The Fortescue Metals Group Ltd (ASX: FMG) share price has experienced huge gains year-to-date and today announced another project approval. Can FMG shares keep climbing higher?

Headquartered in Perth, Fortescue is the fourth largest iron-ore producer in the world, up there with the likes of BHP Billiton Ltd (ASX: BHP) and Rio Tinto Ltd (ASX: RIO). They are now the lowest cost provider of iron ore to China and they continue to expand their operations into Japan, South Korea and India.

FMG’s Announcement

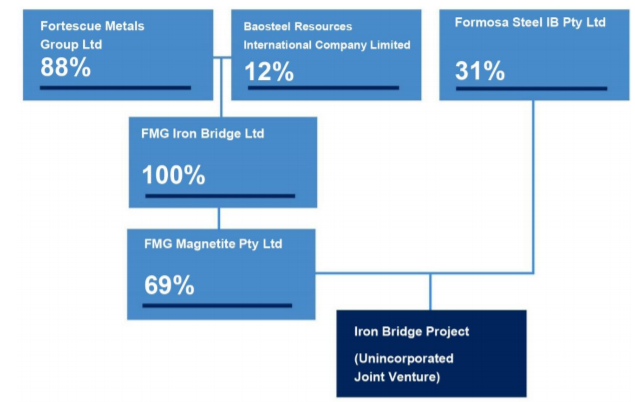

Fortescue announced approval this morning for the Iron Bridge Magnetite Project. It is a US$2.6 billion ore processing project undertaken by subsidiary FMG Magnetite Pty Ltd and joint venture partner Formosa Steel IB Pty Ltd. The approval is for Stage 2 of the project, following a $500 million investment in Stage 1 which validated key equipment and production processes.

For a simple view of how much Fortescue actually owns in this deal, see the diagram below which they included in their announcement.

Of the $2.6 billion, FMG Iron Bridge Ltd will contribute $2.1 billion, funded by project debt and contributions from respective shareholders.

Recent Performance

The Fortescue share price has shot up 82% in three months and nearly 93% in the last six months. This leaves the shares at an all-time high of over $7.40. Although the half-year report in February was positive and sent the share price higher, it seems like the shares have been unstoppable.

The guidance provided in the report was for little-to-no growth in 2019 in total shipments, and costs per wet metric tonne were expected to be around the same, if not slightly higher.

It seems like the only way the share price can continue to climb is if low-grade iron ore prices continue appreciating. This is why I would be cautious about rushing into Fortescue shares. It is a price-taker and the share price will be subject to iron ore prices, something the company has no control over.

This is also reflected in their dividend history, which has shown dividends up and down over the last few years. However, there does seem to be a long-term trend in increasing dividends, and the current dividend yield is 4.36%.

Buy, Hold or Sell

There are obvious reasons as to why the Fortescue share price has increased, but it has increased at a rate that should be worrying to some investors.

I think now might be the time to question whether these shares are overvalued. In terms of dividend income, it offers a decent yield and over the long-term they may continue to increase it, but there are other options that might be more stable (e.g. not resources companies), like the three companies in the free report below…

[ls_content_block id=”18457″ para=”paragraphs”]

Disclaimer: At the time of writing, Max does not own shares in any of the companies mentioned.