Wisetech Global Limited (ASX: WTC) was founded in 1994 in Sydney, Australia and today is a cloud-based logistics software company connecting over 12,000 logistics organizations across 130 countries.

With 40 offices in Australasia, Europe and the Americas the company operates worldwide. CargoWise One, its flagship product, provides an end-to-end logistics solution and helps establish an integral link in the global supply chain and is the market leader. With a customer attrition rate of less than 1% leading to a recurring revenue of 99%, it is growing at a very fast pace as the legacy software is replaced by the latest SaaS platform.

What do the numbers look like?

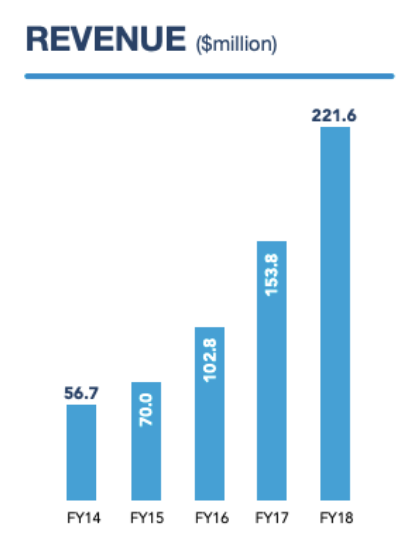

With a market cap of $7.3 billion and rising more than 138% in a year, it seems to be doing really good. With revenues constantly growing over the last 5 years with an impressive jump of 44% vs FY17 and EBITDA up 45% compared to FY17.

The company reinvests 34% of its revenue and 51% of its staff into product development and innovation, which is reassuring for long term growth.

Source: Annual Report 2018

Comparables

The company doesn’t have a direct logistics software competitor on the ASX which provides a similar product. But few other notable players in the software space are Altium Limited (ASX: ALU) and Technology One (ASX: TNE).

Altium Limited (formerly known as Protel until 2001) is a public software company. Their flagship product is in native 3D Printed Circuit Board (PCB) Computer Aided Design. Annual revenues clock in at $US140 million. Altium employs over 600 people and has 50 partners worldwide.

Technology One founded by Adrian Di Marco in 1987. Today it is a software company employing 1200 people in around 40 offices worldwide. They provide various payment and inventory solutions to logistics firms worldwide. FY18 net profit came in at $66.5 million.

Management

Richard White founded WiseTech Global in 1994 and has been CEO and an Executive Director since then. With over 30 years of experience in software development, embedded systems and business management, Richard also has over 20 years of freight/logistics industry experience. Prior to founding WiseTech Global, he was the founder and managing director of Real Tech Systems Integration (a provider of computer consulting and systems integration services) and founder and CEO of Clear Group (distributor of computer-related equipment).

Richard holds a Master of Business in Information Technology from UTS. He is a major shareholder of the company.

Is it Good Value?

Reading so far some of you might have already made up your mind to buy the stock but wait, not so fast.

Even though the data may suggest it’s a very good company to invest in there might be a chance it is overvalued. So let’s see what the numbers say.

| Earnings | P/E Ratio | P/B Ratio | P/E Growth | |

| Company | 2.54 | 137.20 | 19.70 | 3.71 |

| Market | 0.65 | 14.70 | 1.20 | 1.12 |

| Sector | 1.79 | 25.40 | 2.34 | 1.22 |

From the above table we can see that P/E ratio is extremely high compared to the market and P/E Growth also suggests the same. Also, if we compare the P/E ratio to the average growth rate of the last 5 years, which comes out to be around 41%, it suggests WiseTech shares might still be overvalued.

Final View

In conclusion, to me this is a typical example of a sexy ASX share that everyone is onto — and that makes me cringe a little. Even though the company is showing positive signs and growing quickly, it might be tough for the company to achieve the high growth rates implied by its current valuation.

If you’re looking for other rapid-growth ASX shares like WiseTech get our free report below.

[ls_content_block id=”14947″ para=”paragraphs”]

At the time of publishing, Shoumik does not have a financial interest in any of the companies mentioned.