Over the last three months, Rio Tinto Limited (ASX: RIO) shares have been on a steady climb to $100 and today they finally cracked triple-digits. Is it justified?

Rio Tinto’s origins date back more than 145 years, but today it is one of the world’s largest aluminium and iron ore producers, with much of its sales revenue coming from its operations in Western Australia. It also owns, fully or partly, mining projects for copper, diamonds, uranium and other minerals.

Why the RIO share price has been rising

When Rio Tinto released their full-year 2018 report a month ago, investors saw that net cash from operating activities had fallen 15% and capital expenditure had increased by 21%. However, net profit increased by 56% and basic earnings per share increased by 62% in the same period.

A lot of the increased profit has come from an increase in iron ore prices. This is one of the big risks with a resources business; they are price-takers. So, even if the share price is worth $100 today, it might not be tomorrow if resource prices fall.

Regardless, let’s put a valuation on it today, just for fun.

Valuation method

There are countless ways to value a company and there’s no one-size-fits-all approach. For a company like Rio Tinto, a dividend model might be the best bet. It’s a large, established company paying reasonably reliable dividends, and the payout ratio is actually over 100%.

In 2018, Rio Tinto paid a full-year dividend of A$4.2173 per share (ignoring special dividends). This represented growth over the previous year of about 6%. Now, this is going to be a really rough valuation, but…

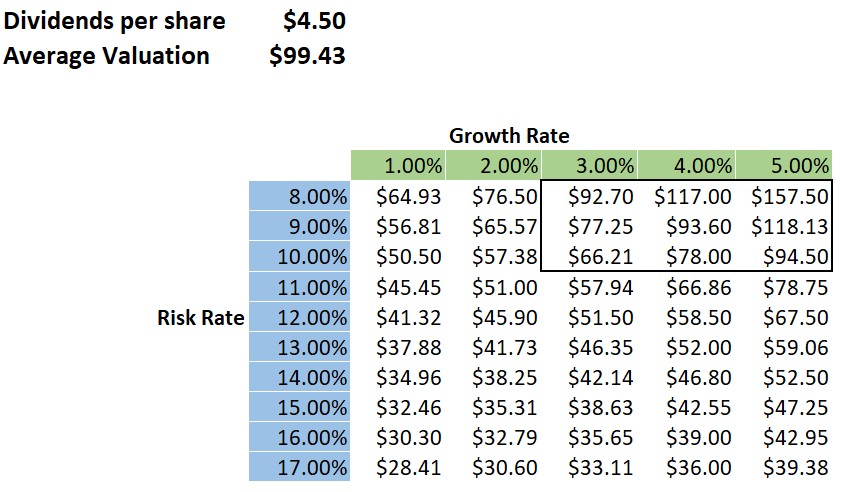

Let’s assume a dividend of $4-$5 per share and a growth rate of 3-5%. Using a dividend valuation model, we take the dividend and divide it by the required rate of return (or risk rate) minus the growth rate. For a well-established company like Rio Tinto, we might consider the risk rate to be 8-10%.

The value

I’ve done this calculation using a dividend of $4.50, growth rates from 3-5% and risk rates from 8-10% and averaged the results.

The average of all these calculations comes to… $99.43. Almost exactly the opening price of the shares today.

Again, this is a very rough valuation and assumes that dividends will grow constantly at the given growth rate. The chances of that happening are low, given that Rio Tinto is a price-taker.

However, the next dividend, due to be paid April 18th, is actually $5.89 per share and the growth rate in 2018 was 6%, so this is a conservative valuation.

With special dividends and ordinary dividends over $5 per share, Rio Tinto could well be worth over $100 using this valuation method. I intentionally used $4.50 as the dividend to account for possible declines in resource prices. It’s almost always better to undervalue a company than to overvalue it.

I think it’s smart to always do your own valuation before investing but it’s also important to recognise that valuations can be wrong and their accuracy depends on the extent of your research and reading. If you’re looking for a step-by-step (and free) valuation education program, click here.

Or, for more information on why Rio Tinto and BHP Group Ltd (ASX: BHP) shares could be set to rise further, check out this Rask Media article.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclaimer: At the time of writing, Max does not own shares in any of the companies mentioned.