Flight Centre Travel Group Ltd (ASX: FLT) shares traded 1.7% higher on Monday, with the S&P/ASX200 (ASX: XJO) ending up about 0.5%.

Flight Centre is already one of the world’s largest travel groups but yesterday it announced plans to fast track its growth within the corporate travel sector via a 25 per cent purchase of US-based ‘The Upside Travel Company‘. Flight Centre’s management team commented that they were impressed with “Upside’s best in class technology”.

Interestingly, the company was launched by Jay Walker, who is best known for founding Priceline Group; now known as Booking Holdings (NASDAQ: BKNG). Booking Holdings currently has a Market Capitalisation of about $US 79 Billion, dwarfing Flight Centre’s market capitalisation of just over $4 billion (AUD).

It is possible that Jay Walker may know a thing or two about the future of the online travel industry and how to capitalise on it. Further, it could highlight the potential runway for growth in the Flight Centre’s market capitalisation.

Could the FLT share price lift off?

In my view, Flight Centre shares currently offer good value for long-term investors. In January, I wrote an analysis on Rask Media in which I concluded Flight Centre shares are undervalued.

I believe this week’s announcement strengthens Flight Centre’s position within the global corporate industry and offers the potential to accelerate growth.

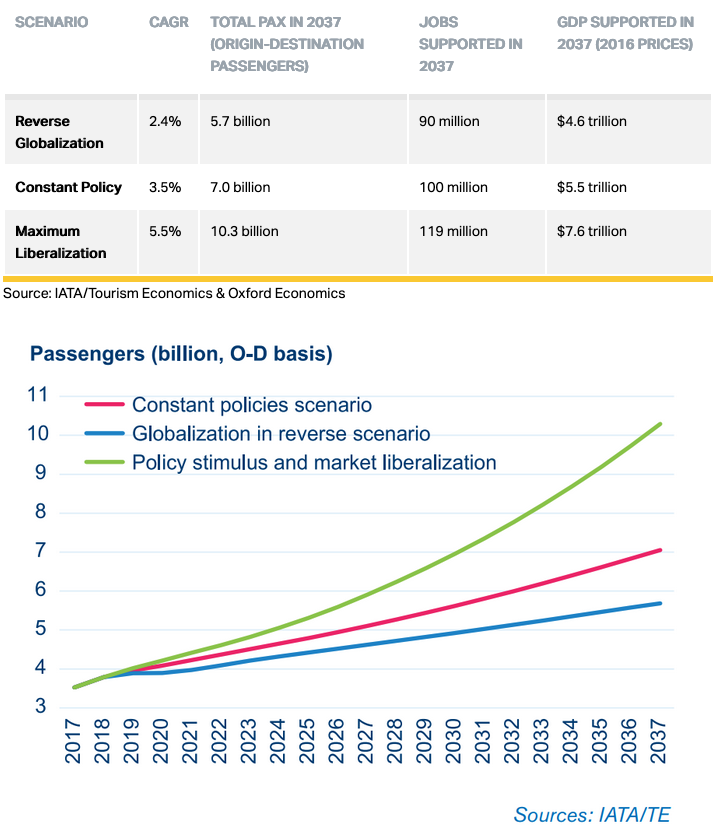

Further supporting long term growth, the International Air Transport Association (IATA) has advised that based upon current trends, airline passenger numbers could double to 8.2 billion by 2037.

As presented graphically above, this forecasts a 3.5% compound annual growth rate (CAGR), resulting in a doubling of tickets sold. This continued growth should provide a strong tailwind for Flight Centre, in my opinion.

If you’re looking for three other proven dividend + growth shares, grab a free copy of our investing report below…

[ls_content_block id=”14945″ para=”paragraphs”]

Disclaimer: At the time of writing, William owns shares in Flight Centre.