It has been widely discussed over the last year that SMSF investors are concerned about possible changes to the treatment of franking credits. Many LICs have been popular with the SMSF investing community in recent years due to their ability to deliver consistent fully franked dividends.

More than a year has passed since the Labor Party made the public aware of potential changes to how franking credits could be used. Yet it appears trading in popular LICs has been affected more in recent months as the election nears.

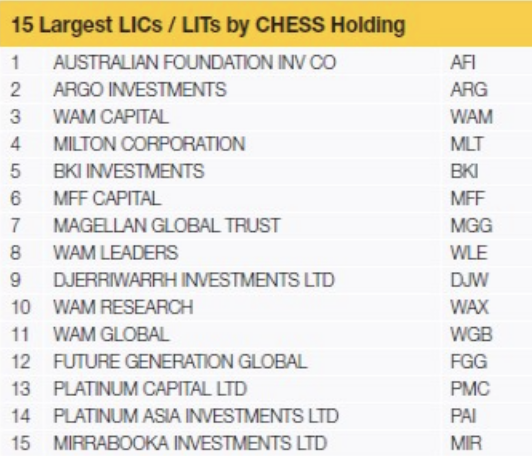

What Are Some Of The Popular LICs?

CommSec provided some data from last year that gives us an insight into what LICs are the most popular for SMSFs. Certainly, the top five from the table below are very well known for their consistent fully franked dividend stream over many years.

Given equity markets have been so strong this year, it has been a rather lacklustre 2019 in terms of total shareholder return for this top five.

Discounts To NTA Have Widened In 2019.

A big part of this lacklustre performance is due to the shares trading at a larger discount to NTA. Here are some of the approximate shifts I have observed over the first four months of 2019, however, there is some guesswork as we are still awaiting the NTA’s for April. I will just assume the below portfolios perform relatively in line with the ASX 200 (INDEX: XJO) for that month.

| (Discount) / Premium Dec 2018 | (Discount) / Premium Dec 2019 | |

| Australian Foundation Investment | +5% | (-2%) |

| Argo Investment | +3% | (-4%) |

| WAM Capital | +23% | +12% |

| Milton | (-2%) | (-6%) |

| BKI | 0% | (-6%) |

It is quite interesting to note that in 2019, the above shares have become roughly 5-10% cheaper purely from movements in the discount / premium to NTA.

Is This An Opportunity?

I suspect we may be reaching a point soon where these discounts stabilise, but I don’t see them making a major recovery in the medium term. The uncertainty over the treatment of franking seems to be having a clear impact on sentiment, yet I believe other factors are also at play.

Doubts Over Ability To Beat The Benchmark

The five LICs above have experienced some difficult times with relative performance versus the benchmark over the past few years. Sentiment may, therefore, take some time to improve. Perhaps some of the older LICs such as AFI and Argo have become so large that outperformance is a lot harder to achieve compared to previous decades. The LICs carry a lot of unrealised capital gains in the portfolio that create quite a dilemma when investors need to consider whether to sell stocks.

In the case of WAM, it also carries the burden of still trading at a premium to NTA. I wrote about some of the risks of buying LICs at large premiums to NTA here. Aside from that, some investors may be cautious about how Labor’s franking proposal may affect the WAM investment structure.

Were SMSF Investors Exiting After The Last Dividend Before The Election?

There does appear to be some signs of panic about LICs that pay high dividends. The implications of proposed changes to the treatment of franking credits are weighing on investors’ minds. I have noticed the trading become heavier in some LICs just after the recent ex-dividend dates, WAM being a good example.

This is interesting to observe given we still don’t know for certain the election result, and that any proposed changes to franking may well be watered down. Perhaps the discounts have widened enough in the short term.

Summary

Although the widening of discounts to NTA in the LIC sector is tempting, I am in no rush to buy just yet. Many will blame this trend on the upcoming election, and I certainly think that is having a significant impact. However, another key factor is that there are plenty of LICs that haven’t fared very well compared to their benchmarks in recent years. Further to this, we have also seen a tremendous increase in the supply of LICs in the last five years. Ultimately, I think the market is appropriately reflecting these facts.

[ls_content_block id=”14948″ para=”paragraphs”]

Disclaimer: At the time of publishing, Steve Green does not own shares in Australian Foundation Investment Company, Argo Investments, Wilson Asset Management, Milton Corporation, or BKI Investment Company Limited.