Pushpay Holdings Ltd (ASX: PPH) released its annual report this morning for the year ended 31st March 2019, showing a 40% increase in revenue. Here’s what you need to know.

About Pushpay

Pushpay is a New Zealand-based donation systems and software business for religious, not-for-profits and education providers in the US, Canada, Australia and New Zealand. Pushpay is used by over 7000 churches worldwide including the largest church in the US which has an average weekly attendance of more than 50,000. The average gift is $192.

The 6 Key Points

- Total revenue grew 40% to US$98.4 million

- NPAT increased 181% from a loss of $23.3 million to a profit of $18.8 million

- EBITDAF was $1.6 million, compared to an $18.6 million loss for the previous year

- Cash and cash equivalents fell 22% to $13.9 million

- Total customers grew 5% to 7,649

- CEO and co-founder Chris Heaslip will resign

Customer Growth Doesn’t Tell the Whole Story

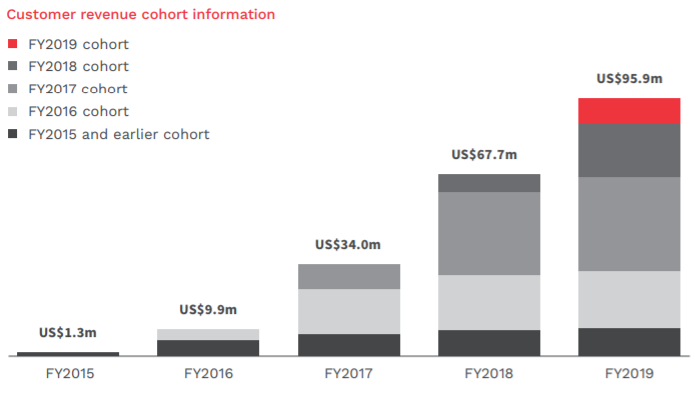

The total number of customers only grew by 5% while revenue grew by 40%. This indicates that revenue from existing customers grew significantly. This is shown in the graph below.

It is also representative of the potential revenue that can be expected from the largest church in the US, which became a customer in October 2018.

Another way of thinking about it is that the largest church represents one customer, but potentially brings 50,000 new users to the platform. This is why Pushpay is so focussed on the largest churches in the US.

One concern though is that once Pushpay has signed up the largest churches, revenue growth could slow significantly unless they can increase existing customer revenue. A 5% increase in total customers is not the most important figure because it doesn’t indicate who the customers are.

Margin Improvements

Another positive announcement was the improvement in Pushpay’s gross margin, which increased from 55% to 60%. Pushpay reported that operating revenue increased 42% while expenses remained stable.

“As a percentage of operating revenue, total operating expenses improved by 28 percentage points, from 93% to 65%”, the report stated.

A deeper dive into the operating expenses shows that general and administration costs were cut by 10% to offset a 13% increase in spending on product design and development. With a team of 104 developers, this bodes well for future innovation and existing customer revenue growth by extending the product offering.

Management Commentary

CEO and Co-founder Chris Heaslip highlighted the strong revenue growth and operating margins as key points.

“Pushpay continued to experience strong revenue growth, expanding operating margins, delivered its first positive EBITDAF result and achieved breakeven on a monthly cash flow basis prior to the end of the calendar year”, he said.

“We continue to focus on future-proofing the business, by refining the strategies that will allow the Company to realise its considerable potential over the long term, while maintaining prudent financial discipline.”

Outlook

Pushpay has provided the following guidance for the year ending 31st March 2020:

- Operating revenue between $122.5 million and $125.5 million

- Gross margin above 63%

- EBITDAF between $17.5 million and $19.5 million

- Total processing volume between $4.6 million and $4.8 billion (up from $4.2 billion)

Pushpay announced that over the long term, it will be targeting over 50% of the medium and large church segments. I believe that with total customer growth relatively low and growth on total processing volume expected to slow, Pushpay will see more growth from expanding product offerings and becoming a full church management system rather than from acquiring new customers.

For other growth share ideas, check out the companies in the free report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of writing, Max does not own shares in any of the companies mentioned.