Does the Future Generation Global Investment Company (ASX: FGG) LIC provide access to the best fund managers… with zero fees?

Zero Fees, Surely Not?

It’s true. Well, at least, kind of…

The FGG LIC takes a ‘fund of funds’ approach and selects the best fund managers with expertise in global shares that they can find. The fund managers are willing to provide such services at no cost. This also means no performance fees.

Why would they do that?

Instead of paying management fees for the funds and LIC, the LIC donates 1% of the NTA to worthy charitable causes each year. Usually, it is no great burden for the fund managers taking on the extra capacity. In doing this they are happy to know they are supporting some great charities.

It also can’t hurt for the fund manager’s brand awareness to work ‘pro bono’.

Low Expense Ratios

Not only is the (lack of) fees compelling, there are various other service providers within the FGG LIC that provide their services pro bono.

I have observed with other LICs that costs involving directors’ fees and various other administration fees can add up. These fees can amount to a significant additional drag on NTA each year. It is tiny in the context of FGG though, thanks to the generosity of those involved.

Don’t Active Fund Managers Always Underperform?

Below-par performance could be an argument to avoid investing in FGG.

Plenty of studies suggest that on average active managers do underperform their benchmarks. Within many such studies though you will find that a significant reason for the underperformance is the higher fee structures of the fund managers.

With FGG we know around 1% p.a. leaves the fund for a donation and there some other costs. This is far less than a typical global equities fund manager that Australian investors tend to invest with.

FGG is still less than four years old and the underperformance thus far is still relatively small. I would also note the portfolio is structured such that it is more likely to underperform its benchmark in a rising market.

Low Volatility

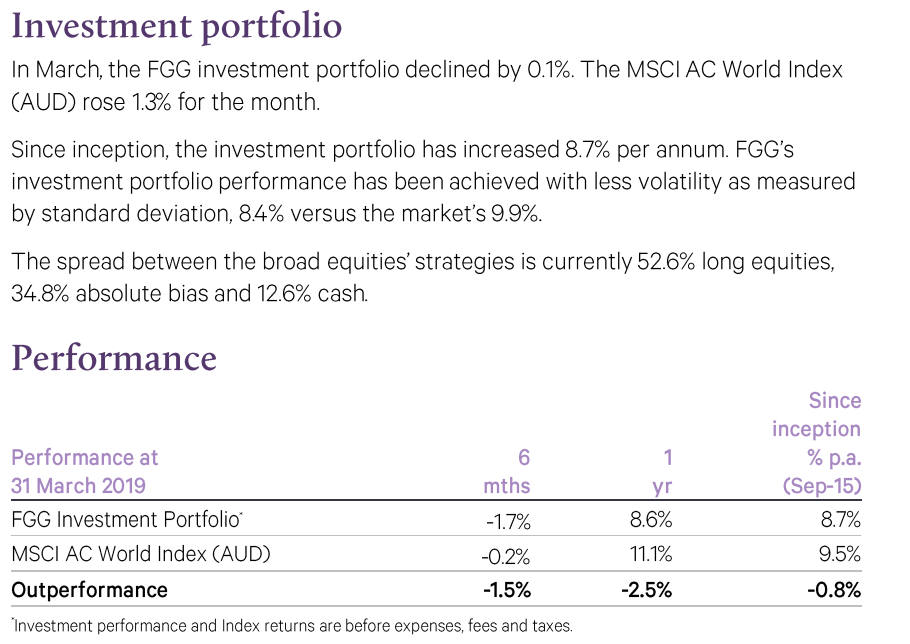

It is made more difficult for FGG to outperform in a rising market since they have significant exposures to absolute return funds and cash. This is evident from their comments regarding the performance table below:

I also note that the FGG LIC has been less volatile than its benchmark. If global share/equities markets were to head into a bear market, I would expect FGG to lose less of its value compared with the indices.

The above portfolio return numbers are before the donation and other expenses are taken out.

Future Performance

I think that over the longer term FGG stands a good chance of at least matching its benchmark.

To get some more perspective on the likelihood of this, one could search the history of the fund managers they are using. There are many examples of them having achieved long term net outperformance. That is with much higher fee structures and of course performance fees, which don’t exist with FGG.

Recent years have been tough for active global fund managers. Returns have been better for those betting more on US markets as a whole, and within that a few concentrated large technology stocks. If this trend reverses, FGG likely stands a better chance of outperforming a passive global equities ETF.

My Conclusion

FGG might be suitable for investors wanting to capture the upside of global sharemarkets but with a little less volatility. The LIC holds approximately 15 separate funds within its portfolio, so I would never expect it to shoot the lights out versus its benchmark. By the same token it should be an investment to sleep well at night. You should expect to capture most of the market’s return in a relatively efficient manner.

If an individual investor is already selecting the same funds as FGG holds directly, then it is even more appropriate to consider the Future Generation investment structure due to the lower fees.

But as always with LICs, I suggest keeping an eye on whether it is trading at a discount or premium to NTA. Given FGG has lagged the performance of its benchmark, I certainly wouldn’t rush out and pay a premium to NTA for this stock.

If you are seeking a high-income investment, note that the dividend yield on FGG shares is quite low. I don’t expect that to change in a meaningful way. Therefore, investors seeking a higher yield could give the domestic version of FGG some consideration. That is, Future Generation Investment Company (ASX: FGX).

And if the investment in FGG doesn’t work out, you can always tell others you went in it for charitable reasons!

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of publishing, Steve Green owns shares in Future Generation Global Investment Company Limited and Future Generation Investment Company Limited.