Tesla Inc. (NASDAQ: TSLA) is one of the largest manufacturers of electric vehicles (EVs) in the world. The company is led by CEO and largest shareholder Elon Musk.

Q1 2019 Results

Tesla delivered approximately 63,000 vehicles in the first quarter of 2019, 110% more than the comparable quarter last year, but 31% less than last quarter.

However, the net result was a reported loss of US$702 million. Tesla’s cash balance was down to just $2.2 billion after burning through $1.5 billion over the prior three months.

Last week an email from Elon surfaced (verified by Reuters) telling Tesla’s employees that the company has about 10 months to achieve break-even and therefore all expenses will be heavily reviewed. Since the release of this email, the market has punished Tesla shares, sending them about 10% lower.

Autonomous Advantage?

Tesla recently held an Autonomy Day, where the company announced that their new chip will allow ‘full self-driving’. To achieve this, the chip will process and interpret data transmitted from the onboard cameras, sensors and radar.

In the presentation, Tesla boldly claimed this technology will allow it to launch a driver-less taxi service in 2020. Of course this is assuming regulators give it the all clear.

Research released by Intel suggests that products and services made possible by autonomous driving technologies represents a US$7 trillion opportunity.

Tesla has competition in the self-driving space, most notably from Waymo (formerly called the Google self-driving project) , a subsidiary of Alphabet Inc.

(NASDAQ: GOOGL). Waymo has offered a self-driving taxi service in the Phoenix area since December 2018.

Waymo’s approach to self driving differs from Tesla’s as their vehicles incorporate LiDAR (Light Detection and Ranging) sensors. In Tesla’s Autonomy Day presentation, Elon said “anyone relying on LiDAR is doomed” and that they are “expensive sensors that are unnecessary”.

Time will tell as to which approach, if either, prevails.

The Demand For Electric Vehicles

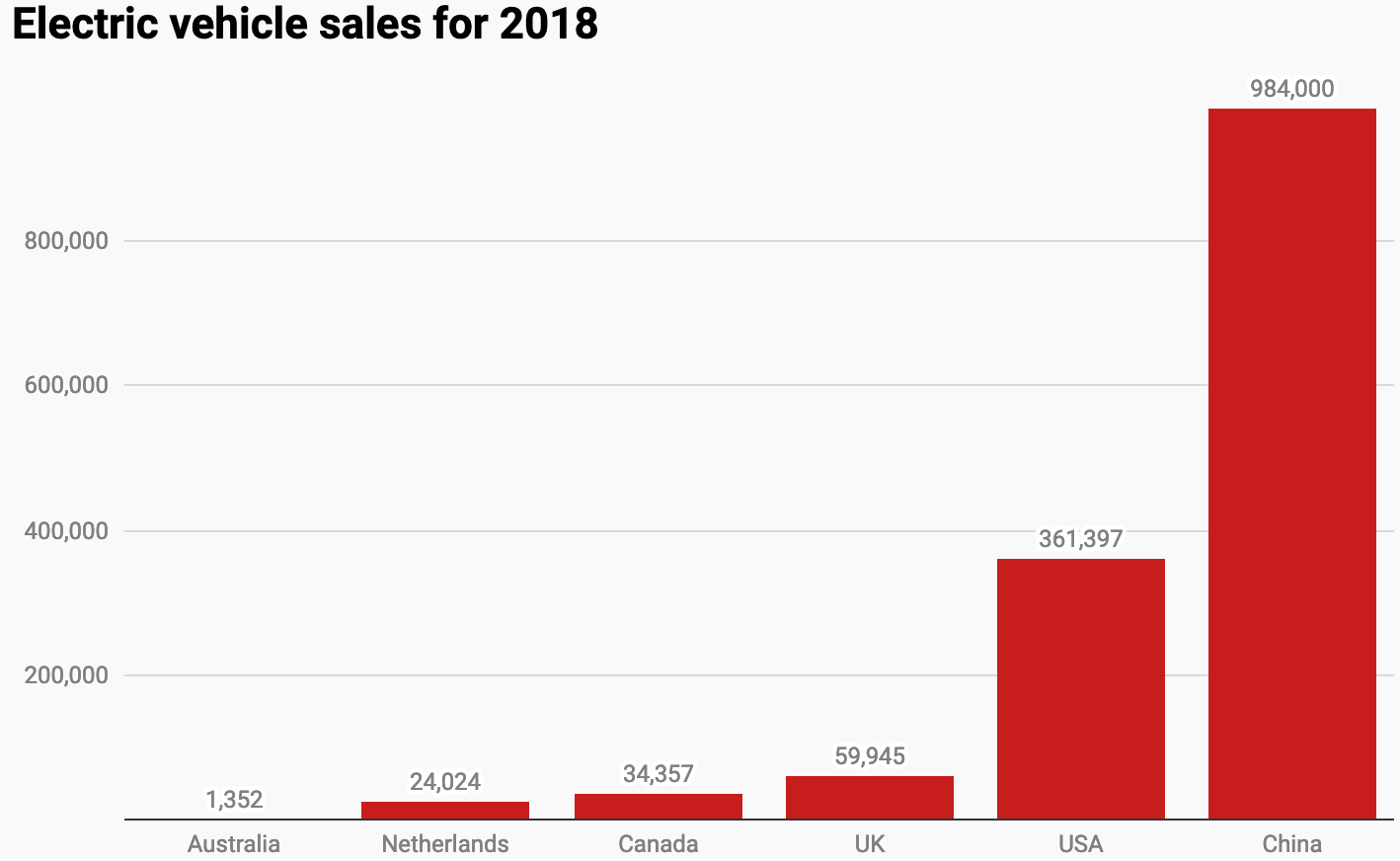

The demand for EVs is growing around the world, with China being the largest auto market on earth. EV sales almost reached 1 million vehicles in 2018 as sourced from ABC News Australia below.

To capitalise on this huge opportunity, Tesla is building its third ‘Gigafactory’ in Shanghai, China which will begin producing its Model 3 variant as soon as this year. Tesla has advised the cost of Gigafactory 3 will be around US$2 billion.

Competition Is Coming

Tesla was responsible for about 68% of U.S. EV sales in 2018. However, competition is set to rise, which has been broadcasted by a raft of announcements from competing auto manufacturers. Here are just a few.

The Volkswagen Group (FRA: VOW) plans to increase production of EVs, invest more than €30 billion in the development of EVs by 2023, and has set a goal for EVs to comprise more than 40% of the group’s fleet by 2030. Volkswagen began testing its own self-driving vehicles this year in Hamburg, Germany.

The Ford Motor Company (NYSE: F) has announced plans to spend US$11 billion to build a range of EVs by 2022. It has also made an investment of US$500 million in EV startup Rivian. Amazon has also backed Rivian with a $700 million dollar investment in February this year.

Mercedes-Benz, subsidiary of automotive giant Daimler AG

(FRA: DAI), has also unveiled plans to invest over €10 billion in EV production.

Is It A Buy?

With a current market cap of about US$36 billion and no current profit, it’s clear that expectations of a bright future with huge future profits are embedded into Tesla’s current share price.

Although I am a fan of Tesla vehicles and wish I could afford one, it is clear the company is facing growing competition in both the production of EVs and the development of self-driving technologies.

From this stand-point, I don’t think Tesla shares are a buy right now.

For some more proven Australian share ideas, check out the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclaimer: at the time of writing, William does not own any shares in companies mentioned.