Advance Nanotek (ASX: ANO), a manufacturer of nanoparticles for the cosmetic and sunscreen industry, came onto my radar over a year ago. Several high-profile Strawman members had recommended it, offering an articulate and well-reasoned Bull thesis.

At the time, shares were trading at around 50c each.

Not long after, the price started to climb — strongly. By late August shares had more than doubled. Well, I thought, I’ve probably missed the boat. Besides, I can always buy in on a ‘dip’.

Indeed, such a dip was presented, with shares dropping by almost 20% from the high watermark by years’ end. Still, I was too anchored on the earlier price, and speculated (hoped?) that shares could keep falling. It didn’t matter that the Strawman community had posted a consensus valuation that was well above the market price.

And then things really started to take off.

Supported by a series of impressive market updates and financial results, shares doubled again. And then again. And then went up a further 50% from there.

For those keeping score, that’s a more than 1200% return over the past 12 months.

Today, those already eye-watering gains were further boosted after the company reported an “unexpected” 100 tonnes in additional orders from the US. 100 tonnes! And with a recently expanded manufacturing capacity, Advance Nanotek is well-placed to deliver.

Lessons Learned

First, investors should avoid anchoring on past prices. Who cares where the market was at previously; all that matters is what the price will be in the future. So long as shares are being offered for a price that is below a sensible notion of intrinsic value, a rational investor should be prepared to buy. And, according to the Strawman community consensus, that potential has existed for much of the last 12-months.

Second, and related to the first point, existing investors should avoid the temptation to ‘lock-in’ a profit for the sake of it. Undoubtedly, it would have been tempting to take a profit at 50%, and even more so after shares had doubled. At 1000% profit the urge to sell would have been downright irresistible!

And yet shares have climbed a further 20% since then.

Of course, there may be good reason to lighten the load, so to speak, due to considerations around portfolio weighting — it’s probably not wise to have a position that represents 80% of the total! Outside of that, so long as shares represent value, there’s little sense in selling.

In fact, it’s entirely possible for shares to become better value as the price climbs, so long as the underlying fundamentals improve at a faster pace.

Finally, we have to remember that although such gains always look easy in hindsight, they require an immense emotional fortitude to achieve. The path to the so-called “10-bagger” was well illustrated by @RamBhupatiraju on Twitter recently:

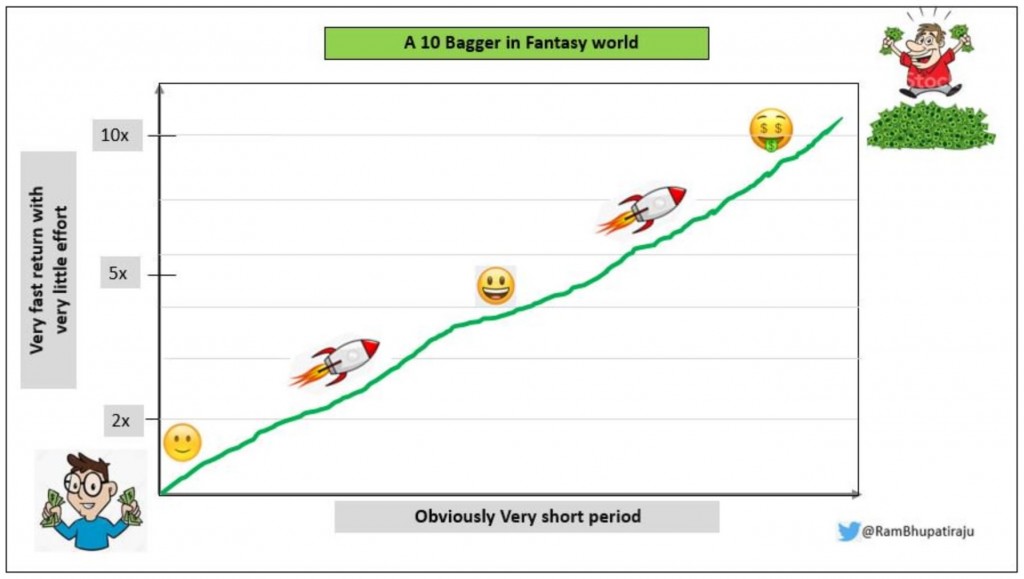

What people think a 10-bagger is like

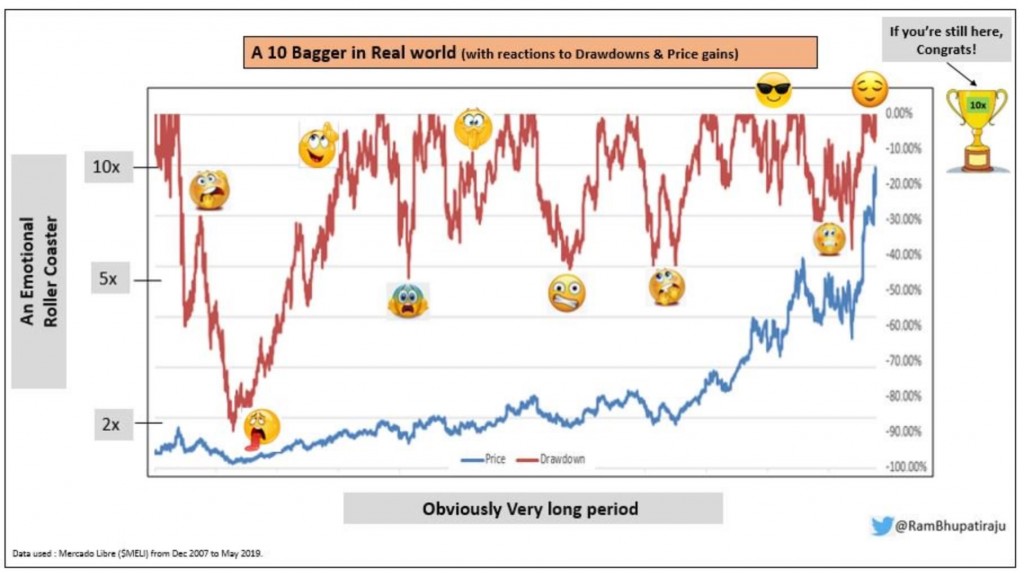

What a 10-bagger really looks like

Although it looks like Advance Nanotek has only moved in one direction, there have been plenty of so-called draw-downs along the way. For example, shares dropped 20% from their previous high in just one week over March!

So, the million dollar question remains; is it NOW too late to buy shares in Advance Nanotek?

Well that, dear investor, is for you to decide. But you can stand on the shoulders of some of Strawman’s investing giants by visiting the Advance Nanotek company report.

Disclaimer: The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].