Is it time to buy at the current Australia and New Zealand Banking Group (ASX: ANZ) share price?

ANZ is a leading Australian and New Zealand banking institution, with a presence throughout the oceanic region. ANZ is one of the Big Four Aussie banks and derives much of its revenue from mortgages, personal loans and credit.

Is The ANZ Share Price A Buy?

A lot of investors seem to think that the big banks like ANZ suddenly have a better near term future. However, the ANZ share price has fallen back almost 5% from the initial excitement after the election.

On the one hand it looks as though credit growth may come back somewhat with APRA lowering its interest rate buffer, the RBA seemingly on course to lower interest rates and the government offering to help first home buyers purchase a property if they don’t have enough of a deposit to avoid paying mortgage lenders’ insurance (LMI).

Will this save Australian house prices? We’ll have to see.

But things are not plain sailing for the big four banks of National Australia Bank Ltd (ASX: NAB), Westpac Banking Corp (ASX: WBC) and Commonwealth Bank of Australia

(ASX: CBA).

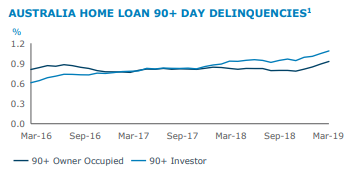

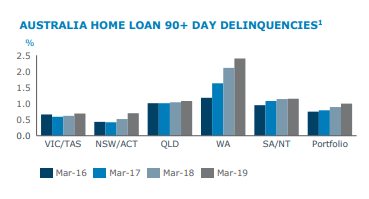

ANZ may have bucked the trend by delivering solid continuing cash profit per share (EPS) growth of 5%, but it is displaying the same problem Australian mortgages as the other banks.

All regions are showing a negative trend and I can’t see people’s ability to repay their loan changing under the same circumstances as before the election.

Is It Time To Buy ANZ Shares?

Regardless of what first home buyers are doing for ANZ, it’s possible to see that ANZ may suffer from rising bad debts, which I think means it is worth avoiding investing in ANZ shares for now.

I would much rather buy shares of one of the ASX businesses in the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]