The Afterpay Touch Group Ltd (ASX: APT) share price has got to be the most talked about thing in Australian investing right now.

Everyone who owns it and even those that don’t want to know how the Afterpay story will play out in 2019 and beyond.

About Afterpay

The ASX-listed ‘Afterpay Touch’ is the owner of Australia’s most popular “buy now, pay later” smartphone app and payment service. As of early 2019, Afterpay had over 3.5 million registered users worldwide, making it one of Australia’s true technology success stories.

Will The Share Price Keep Rising?

No-one knows for certain what will happen today, tomorrow or next month with Afterpay shares. Nobody.

As we wrote in this article, “What Analysts Think Of Afterpay Touch Group Ltd Shares”, even the ‘expert’ investment analysts are just making educated guesses of whether or not the company will hit certain financial targets.

If you want to get up-to-speed on Afterpay, read these articles on Rask Media:

- The Afterpay Share Price Isn’t Slowing Down

- How I Would Value Afterpay Shares

- Afterpay Shares Are Still Extremely Popular

Here are three unconventional but very helpful to get a sense of how Afterpay is performing overseas:

1. Search Trends

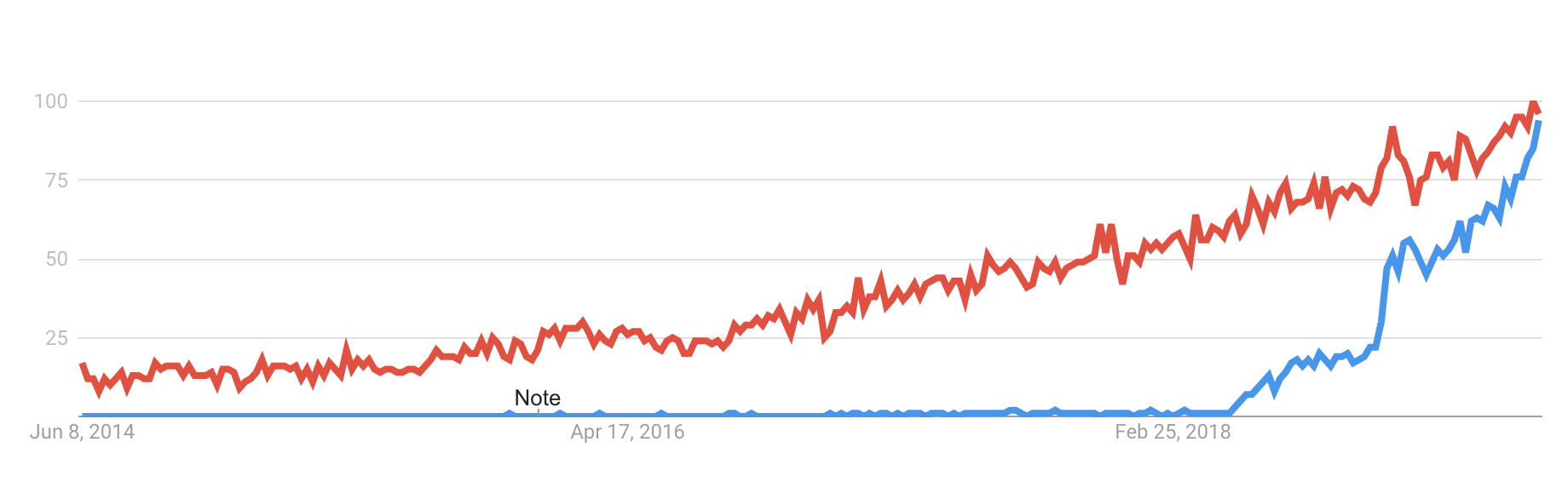

Anyone can use Bing or Google Trends to see how popular it is for people to search for a product or service. The graph above shows the search trends, only in the United States, for Afterpay versus its number-one rival in Affirm. From this one graph, you can clearly see Afterpay’s marketing efforts are resulting in higher online engagement.

2. Culture, Via Glassdoor

Glassdoor is a free employee review website which shows the approval of a company’s CEO and an overall rating for a company’s culture.

In this respect, Affirm gets a 4.5 /5 while the limited number of Afterpay reviews suggest a 3.3/5. It’s probably not enough to be conclusive but it’s worth watching in any case because attracting software development and sales staff are crucial to the ongoing growth in new products and services.

3. Independent Product reviews

As investors, you should be using any and all product review forums to get a sense of what consumers are enjoying and what they’re not.

It’s often not enough to ask yourself or your personal network what they think of a service or product because you’re likely to be biased and your friends likely have similar interests to you. For example, none of my closest friends would go near Afterpay but there are millions using it.

Searching for non-sponsored product review content on forums and blog posts can be handy. But be careful of intimidators — many/most blogs and forums in 2019 have sponsored links or referral programs in place, so their incentive to write a review may not be as independent as you think.

Summary

Ultimately, I wouldn’t be surprised to see Afterpay shares rise from here — especially if we witness its Google Trends continue to smash Affirm out of the water because, to me, that’s a pretty good leading indicator for user numbers.

However, I’m not a buyer of Afterpay shares today. Moreover, as I articulated in some of the articles above, I don’t own shares for a few reasons.

If you’re looking for an ASX technology share I do own — and one that I have a “buy” rating on today — grab a copy of our free investing report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.