Question: There are fixed rates lower than my current variable rate, should I fix my rate?

Kyle’s Answer:

There seems to be a lot of advertising and discussion around fixed interest rates at the moment with them being very low.

Like most things in finance, interest rates are determined by a market and fixed rates over most periods are currently looking more attractive in comparison to variable rates. This is because the market expects interest rates to go even lower and this is reflected in fixed rates. Meaning, if fixed rates are lower than variable rates now, this is because variable rates are expected to be lower than the initial fixed rate at some point over the term of the fixed rate.

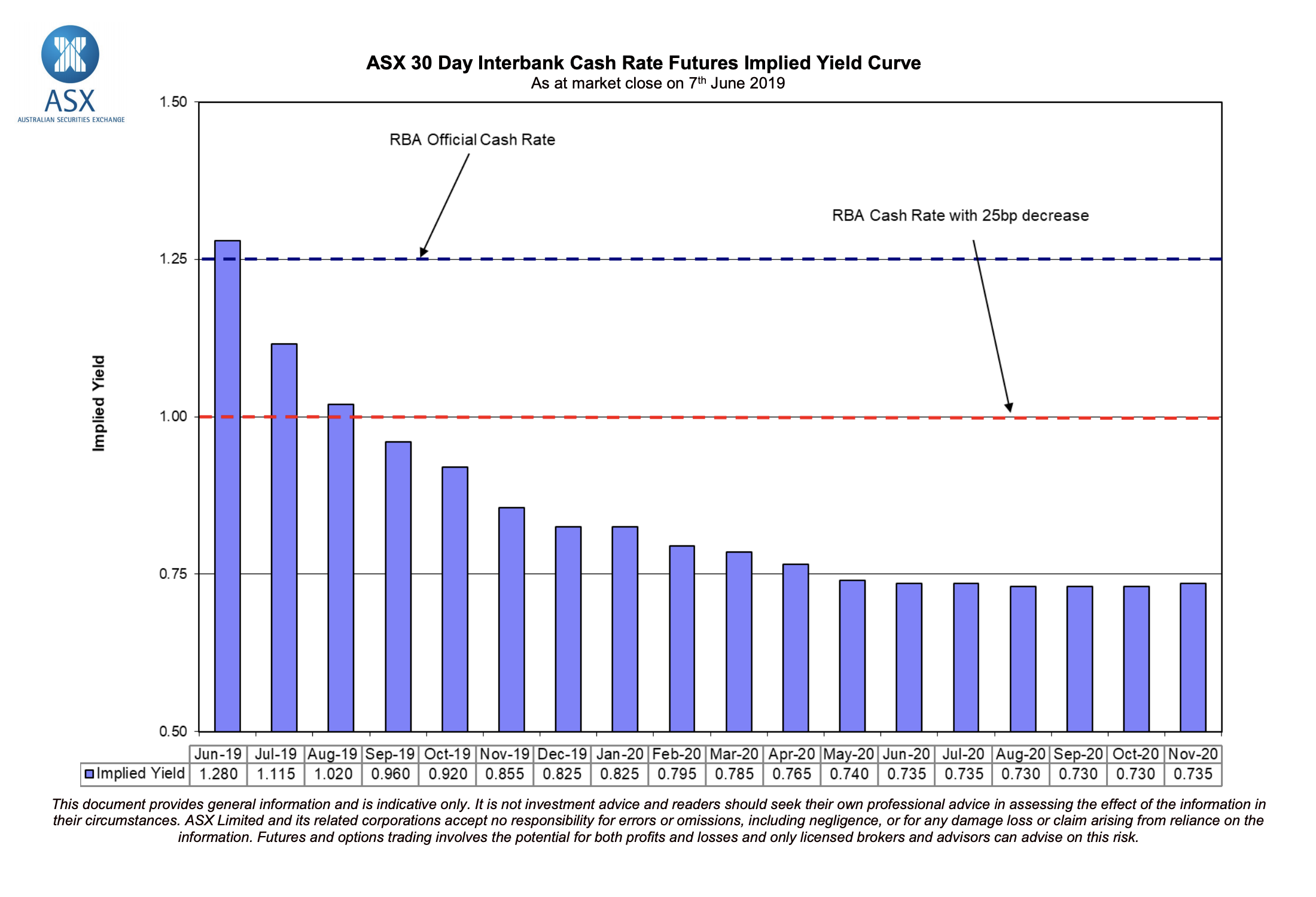

Here’s a graph of where the market expects interest rates to be over the next 18 months or so:

This shows that the market expects interest rates to drop 0.25% by September and believe there will be another cut at some point over the next year.

Why Are Implied Yields Important?

I’m hearing lots of well-intentioned “experts” at the moment saying “don’t fix now, interest rates are going down, so fix your rate then”.

Unfortunately, unless you think interest rates are going to go lower than the market expects there’s unlikely to be much gained from this strategy and you could be worse off if you wait a few months because if the market thinks interest rates won’t go as low, the banks will adjust their fixed rates up accordingly.

So if I don’t have a crystal ball why would I fix my rate?

Like most things, there are pros and cons to fixing your mortgage rate.

Pros:

- Certainty of interest rate and repayments – this could be particularly beneficial if your cash flow is tight over a period e.g. one member of a couple on maternity leave.

- There is the potential you could be better off depending where interest rates go.

Cons:

- You lose flexibility as there likely will be restrictions on making additional repayments or paying the loan down early, offset account restrictions and refinancing restrictions as there likely are break costs if you don’t hold the loan for the term of the fixed period.

- There is the potential you could be worse off depending where interest rates go.

- It’s also possible to hedge your bets and have the best of both worlds by having one portion of your loan fixed and another portion variable.

Another important consideration is the variable rate at the end of the term. Sure, in many instances it’s possible to refinance if the variable rate at the end of the term isn’t ideal. However, this could bring with it costs and if your situation negatively changes (from a lender’s point of view) it could be difficult to refinance.

Lastly, fixed rates bring in another complexity and I find options in this space vary a lot more than variable options so speaking to an expert like a mortgage broker who assesses the options available to you may add significant value.

[ls_content_block id=”18503″ para=”paragraphs”]