Afterpay Touch Group Ltd (ASX: APT) has gone into a trading halt to announce a capital raising and that its founders are selling some shares. How will this affect the share price?

Afterpay Touch is the owner of the popular “buy now, pay later” app. As of early 2019, Afterpay had over 4 million registered users worldwide, making it one of Australia’s true technology success stories.

Afterpay’s Capital Raising

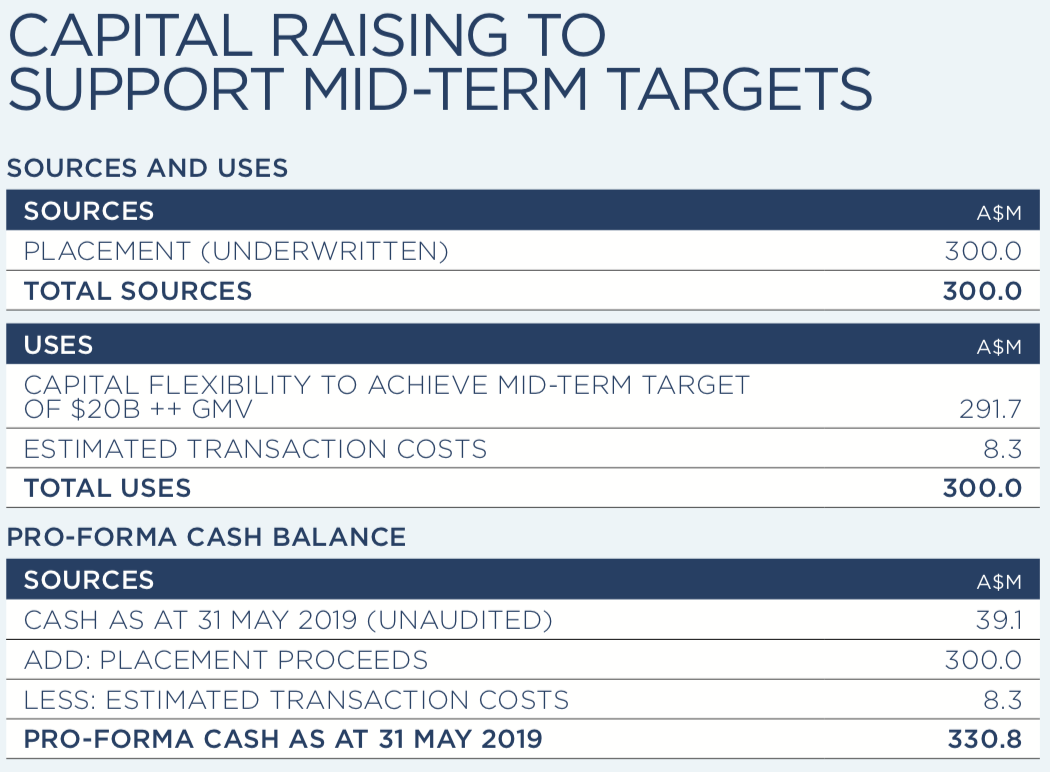

Afterpay has entered into a trading halt so that it can raise a minimum of $300 million in a capital raising to fund its medium-term strategy in Australia, the US and UK.

The buy now, pay later company is issuing a fixed number of shares, around 13.8 million, at an underwritten floor price of $21.75 per new share. The floor price is a 10% discount to the closing price on 7 June 2019.

Regular shareholders can also participate in the share purchase plan (SPP) by purchasing up to $15,000 each. The SPP aims to raise approximately $30 million at a price of either the institutional offer price or the average price of the five days to the closing SPP date, whichever is lower.

Afterpay Founders Selling Shares

Anthony Eisen, Nicholas Molnar and David Hancock have agreed to sell 4.5 million shares to two US investors, Tiger Management and Woodson Capital. The sale shares represents 1.9% of Afterpay’s total shares.

Mr Eisen and Mr Molnar will each remain Afterpay’s largest shareholders with around 20.5 million shares each, representing 8.1% of the issued shares. They have confirmed they won’t sell any more shares for at least 120 days from today.

Anything Else?

Aside from re-iterating some of the numbers quoted in the recent business development announcement, Afterpay said that 10% of all e-commerce in Australia is processed through the Afterpay platform according to the NAB Online Retail Sales Index.

Afterpay also said that more than 95% of gross merchandise volume (GMV) is from returning customers in Australia.

Is Afterpay A Buy?

It’s hard to know where Afterpay will go from here. It isn’t cheap, but the share price has declined materially in recent times, so it could be an opportunistic time to buy.

However, with a lot more competition locally and from large payment giants like MasterCard and PayPal popping up, I’m not interested in buying Afterpay for my portfolio.

For growth I’d rather consider one of the shares in the free report below which seem to have better prospects of delivering yearly profit in the near term.

[ls_content_block id=”18457″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]