Shares in payments disruptor Afterpay Touch Group Ltd (ASX: APT) have surged back towards their recent record high following the completion of a hugely successful institutional capital raise — for which the business tapped the market for an extra $317.2 million. That takes gains for the past 12-months to a whopping 208%.

There’s no doubt that things are going well for the business — the fact that institutional investors were happy to gobble up a bucket-load of new shares at the top end of the indicative range is testament to that! (Combined with the retail component, shares on issue will increase by approximately 6.3%.)

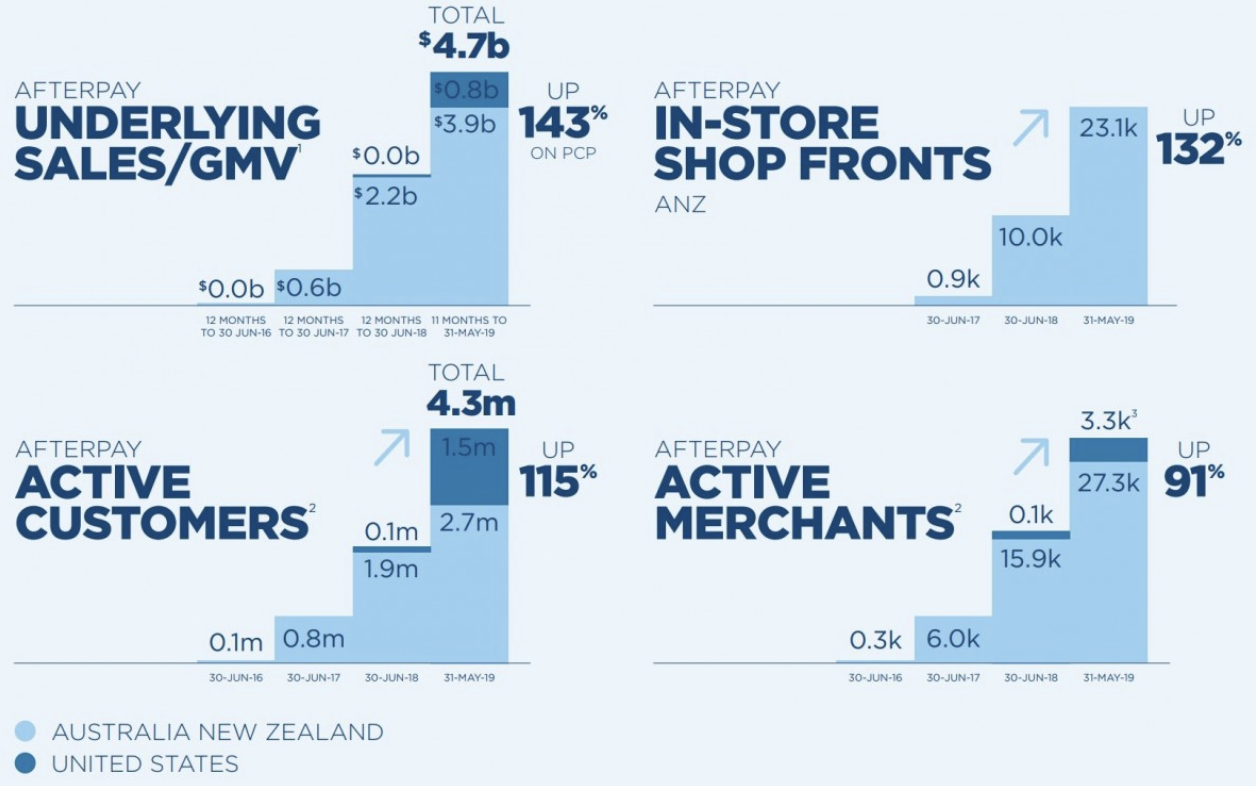

It’s also fair to say that the underlying financials, and their unrelenting growth, lend a lot of credence to the bullish sentiment. After all, underlying sales (GMV) have grown 143% in the past 11 months, the US continues to show great traction and early signs are very encouraging in the UK.

Source: Afterpay Investor Presentation June 2019

Nevertheless, to quote the great Charlie Munger:

“…no matter how wonderful it is, it’s not worth an infinite price. We have to have a price that makes sense and gives a margin of safety considering the normal vicissitudes of life.”

– Charlie Munger, Vice Chairman of Berkshire Hathaway

Are Shares Too Expensive?

Accounting for all the share options on issue (all of which are ‘in the money’), and adding in those likely to be issued under the share purchase plan, the current market capitalisation of Afterpay sits a shade under $7 billion. $6,991 million to be precise.

Assuming Afterpay hits $5 billion in underlying sales for FY2019, and that they maintain their Net Transaction Margin (NTM) of 2.3%, that puts shares on a Price to sales (P/S) ratio of around 60. That’s certainly up there, but this is a business that is growing exceptionally fast.

If we assume Afterpay hits its 2022 target of $20 billion in GMV, net sales will be around $400 million three years hence. Assuming the business can contain costs, we’re looking at a net profit of around $180 million at that time. If this is achieved, given the traction, it isn’t much of an extra leap to assume that the growth outlook will also remain strong at that point. Under this scenario, Afterpay shares could easily sustain a PE of around 35.

There’s a lot of (unavoidable) thumb sucking there, but when you follow it through you have a business trading at around $23 per share in 2022. With the current market price around $26, that’s not such a great proposition.

Still, this is a business with a huge addressable market and one that has a history of beating expectations. Although our previous assumptions were far from timid, let’s ratchet things up a notch.

Let’s assume Afterpay smashes through its lofty targets and achieves $25 billion in GMV by 2022. With similar margin and cost assumptions, we now have a forecast net profit of ~$250 million. Let’s also assume that market sentiment remains strong and give shares a PE of 40. That’s a target price of ~$37, or an annual compound return from today’s price of about 12%.

The Bottom Line

Investing in growth stocks is a tricky business.

All of the great success stories from history seemed expensive in their early days. A failure to account for sustained and aggressive growth, and a reliance on traditional value metrics have led to plenty of missed opportunities.

Nevertheless, it pays to remember that the Amazons of this world are the exception, rather than the rule.

Estimations of value are fraught with danger at the best of times (“garbage in, garbage out” as they say), but with fast growing companies it’s even trickier. But although it’s wrong for investors to hang their hat on a single valuation, there’s great worth in going through the exercise.

While we can never know exactly how fast Afterpay will grow sales in the coming years, let alone what multiple the market will ascribe to its shares, what we can say for certain is this:

To generate acceptable returns from here, investors need to see extremely strong and enduring top-line growth, coupled with tight

cost management.

As we’ve demonstrated, even if Afterpay achieves its ambitious targets and trades on ‘typical’ growth multiples, the return outlook isn’t great over the medium term. Given the market is already factoring in plenty of success, the pace of growth, and its duration, need to be even greater for those to argue for good value.

It’s certainly possible. Indeed, if Afterpay becomes the dominant global platform for buy-now, pay-later services shares are likely worth a lot more than the current market price (although success is never a straight line, so expect plenty of volatility along the way).

Investors just need to be clear on their expectations, and have the fortitude to stick to their convictions.

Ranked #2 on Strawman, Afterpay certainly enjoys the backing of plenty of our members. But with shares now above the community’s consensus valuation, the investment case is becoming more difficult to sustain…

Disclaimer: The author may hold positions in the stocks mentioned in this publication, at the time of writing. The information contained in the publication and the links shared are general in nature and does not take into account your personal situation. You should consider whether the information is appropriate to your needs, and where appropriate, seek professional advice from a financial adviser. For errors that warrant correction please contact the editor at [email protected].