MFF Capital Investments Ltd (ASX: MFF) has been around since 2006 while Magellan Global Trust (ASX: MGG) hit the exchange in 2017 with a huge IPO.

Magellan is one of the best fund managers in Australia, specialising in global shares/equities. After being founded in 2006, Magellan’s investment performance has been excellent. It is therefore not surprising that both of these listed managed investments are amongst the most popular held by SMSFs.

MGG is a Listed Investment Trust (LIT) rather than a Listed Investment Company (LIC), but it is not simply a matter of that being the only difference. Let’s take a closer look at the two…

LIC Versus LIT Structure

The LIC structure can make it easier for the fund manager to smooth out its dividends over time. LITs, on the other hand, are required to distribute their profits each year to unitholders.

MFF has always been a very low dividend payer under the LIC structure. Magellan’s management style is to seek out global companies with very good growth prospects. They have often stuck with excellent companies and have held them a long time. That has meant they have quite a substantial build-up of unrealised gains in their portfolio. This can result in lower franking credit balances building up and less of a need to pay out higher dividends.

MGG under the LIT structure has recognised that many retail investors would prefer to receive more in the way of regular dividends. It targets to reach a 4% yield each year. Achieving this sustainably over the long term naturally relies on their performance.

Where Do They Trade Versus Their NTA?

MFF’s trading history dates back to 2006 and like many LICs, there can be long periods where it trades at significantly different levels to the NTA. Newer investors may be surprised that MFF traded at a significant discount to its NTA for a long time after it launched.

After some excellent investing performance that quickly changed. We even saw a very large premium to NTA develop in 2015. Now it trades approximately between its pre-tax and post-tax measures.

MGG’s history only dates back to October 2017. It tends to trade quite close to its NTA and doesn’t have the extent of large unrealised gains in the portfolio. It has performed very well though even in its relatively short life so far of under two years.

Fees

The arrangement with MFF is a little unusual, but quite attractive compared to many rivals. In recent years the base fee has consisted of $4 million a year. Performance fees of $1 million kicked in for 2018 when the total shareholder return exceeds 10% for the year. These figures may sound large to some. However when we consider that the portfolio is over $1.5 billion you get a very competitive management expense ratio overall.

MGG isn’t as efficient from a fee perspective as they charge a 1.35% base fee and a 10% performance fee for returns above their benchmark.

Who Is Managing The Investments?

Chris Mackay and Hamish Douglass are the founders of Magellan Financial Group Ltd (ASX: MFG). Mackay manages MFF in quite a separate manner to how MGG is run by Douglass. MFF does, however, have an agreement where it pays for research services from the Magellan Group. That means we see a large number of individual stock holdings that overlap in both portfolios.

What Are Their Investments?

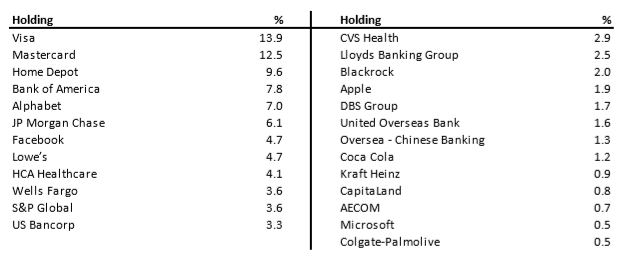

Although many stocks held in both portfolios are similar, there are still significant differences between the portfolios. MFF has a more concentrated portfolio, with the top ten holdings accounting for almost 75% of the portfolio in recent times. By contrast, MGG lists its top ten holdings as representing around 58% of its portfolio.

Refer below to get a sense of how both invest. Firstly MFF:

Here’s MGG’s key holdings:

Currency Hedging & Cash Held

MFF has employed very little active currency hedging in recent times and generally remained fully invested.

MGG currently has around 55% of its position hedged to AUD and is sitting on a cash weighting of about 12%.

Which One Would I Buy?

I would perhaps give the nod to MFF as I prefer the fee structure and that it is not doing much in the way of currency hedging right now. However, I am uncertain as to how to weigh up where it trades versus the pre and post-tax NTAs. There is a large gap between the measures which is unusual compared with most global LICs on the market.

The answer may come down to an investor’s individual preferences regarding appetite for yield, concentrated portfolios and currency hedging.

[ls_content_block id=”14948″ para=”paragraphs”]

Disclosure: At the time of publishing, Steve Green does not own shares in MFF Capital Investments Limited, Magellan Global Trust or Magellan Financial Group Ltd.