The Vita Group Limited (ASX: VTG) share price has crashed almost 19% lower this week following changes to its remuneration agreement with strategic partner Telstra Corporation Ltd (ASX: TLS).

What Does Vita Group Do?

Vita Group is a successful retailer that operates across four key business units.

Via its Master License Agreement with Telstra, Vita Group provides information and communication technology (ICT) products and services through its Telstra stores.

Sprout is Australia’s largest single-branded technology accessory provider with products stocked in more than 350 locations across Australia

SQDAthletica is a men’s athletic wear brand with the mantra of “inspiring men to find balance and get fit for life”.

Artisan Aesthetic Clinics offer non-invasive medical aesthetics (NIMA) services such as cosmetic injectables, laser and light-based therapies, body contouring and dermal treatments.

In May, Vita Group announced they had acquired Face Today Mediclinic Cairns. Face Today Mediclinic is the 14th clinic within the fast-growing Artisan Aesthetic Clinic portfolio. Vita Group announced their goal is to grow the portfolio to 70-90 clinics in the coming years.

What Caused The Sell-Off?

The share price of Vita Group has rapidly declined in recent times after announcing changes to its payment structure with its strategic partner, Telstra.

Vita Group advised they had agreed to forego some components of their former remuneration agreement amounting to approximately $12 to 13 million per year going forward. Perhaps equally shocking to the market was this was agreed to in order to secure an extension to Vita’s Master License Tenure to 30 June 2024. It is clear to see who holds the bargaining power in this exchange!

Overall Vita Group said it: “expects to enjoy higher remuneration attached to the sale of devices, including smartphones, tablets, connected devices, wearables, and non-transactional performance metrics. Conversely, Vita expects to see lower remuneration from sales of connections to the Telstra network”.

Vita Group CEO, Maxine Horne projected her optimism, stating: “We have seen many changes to plan construction and channel remuneration, which have been necessary as markets, channels and products evolve. Whilst the FY20 changes are structurally significant, I am confident in the Vita team’s ability to adapt to change.”

“Our team will continue to consult with our customers to understand their needs and provide multi-product solutions.”

Is It A Buy?

On the back of last week’s news, I don’t believe Vita Group shares are a buy right now.

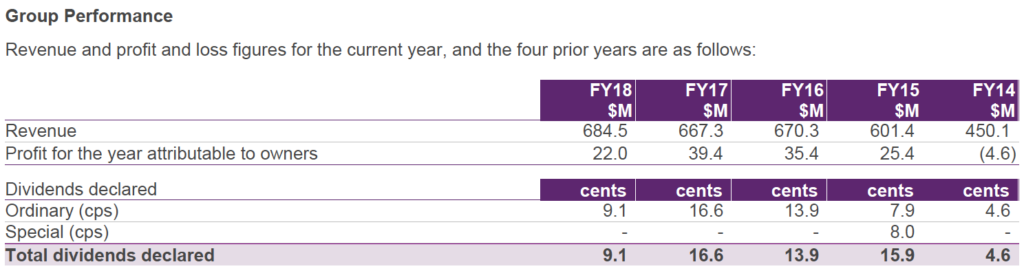

Although the share price has been hammered and provides a ‘tempting’ trailing dividend yield of 6.8%, this may be a realistic reflection of Vita Group’s uncertain future and riskiness. Below is a history of Vita Group’s recent up-and-down dividend history.

In essence, I would prefer to buy shares in a company paying a lower but growing dividend stream.

[ls_content_block id=”14945″ para=”paragraphs”]

At the time of publishing, William does not have a financial interest in any of the companies mentioned.