Is it just me or has the Australian sharemarket or ASX 200 (INDEXASX: XJO) had a dream run in 2019?

As you can see in the following chart, the ASX 200 — Australia’s pre-eminent sharemarket index — is now at 10-year highs:

Please keep in mind that the ASX 200 by itself does not include the positive impact of share dividends paid by Australian companies. Here’s our educational video explaining dividends:

To see the impact of dividends you should use the S&P/ASX 200 Total Return index (INDEXASX: XNT). The decision to include dividends might seem small now but it’s actually quite large when compounded over multiple years.

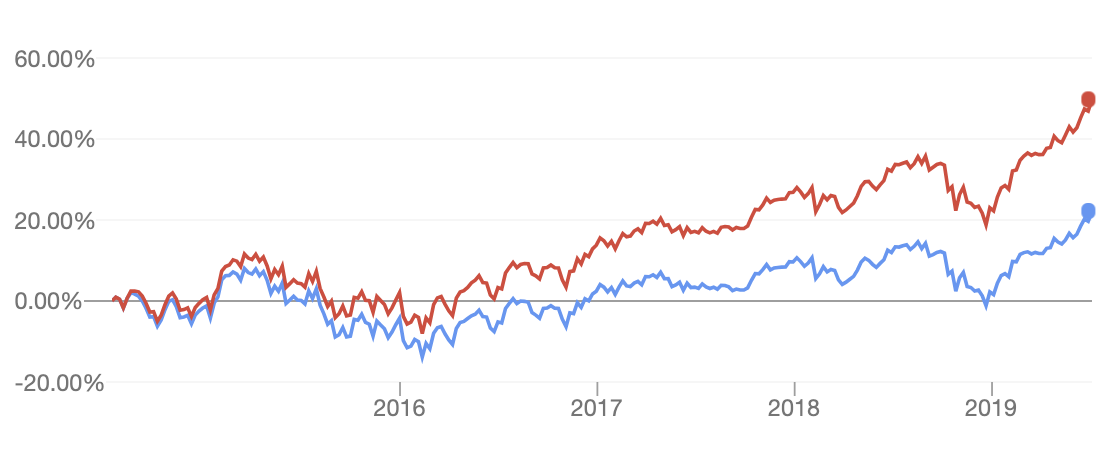

Here’s the normal ASX 200 (blue line) versus the ASX 200 with dividends reinvested (aka total return) (red line) over the past five years:

Needless to say, long-term sharemarket investors who stayed the course have done incredibly well.

Don’t Trust The Talking Heads

I think it’s also worth keeping in mind that the excellent returns above have come at a time when self-titled sharemarket experts and economists were sounding the alarm bells.

Remember the European debt crisis, Brexit, China’s 2014 sharemarket crash, Donald Trump’s presidential race, interest rate decisions from four years ago or the trade war? Yeah, me neither.

At the time they seemed like prudent reasons to sell out of shares, grab the baked beans and shotgun before heading into the bush.

So much for that!

Will The Australian Sharemarket Crash in 2019?

Ask your Uber driver and he or she will probably have a view of the sharemarket. “I heard it’s really expensive” or “shares are risky”.

Here’s the rub: they’ll be wrong.

Take it from me, an investment adviser, founder and interviewer of Australia’s — and some might say some of the world’s — best investors, no-one can predict with certainty what will happen to the sharemarket next.

No-one.

Not even your dentist.

Not even your mate’s uncle’s brother at a BBQ.

And not even — get this — professional investors who earn more than $5 million per year. None of them.

Sure, they might get lucky or make the correct call once. However, I’ve never seen or heard of it happening more than once or twice.

Time To Sell?

So if I’m saying we can’t predict market crashes, what can investors do?

Here are three things every investor needs to know:

- According to a Deutsche Bank study referenced by Tony Robbins in his excellent book Unshakable, share markets have been known to correct on average every 357 days — or around once per year. Meaning, you can expect a pretty vicious sell-off to your share portfolio every year, on average. If you don’t like the sound of that, don’t invest at all. But be warned: you’ll be the one who loses in the long-run.

- According to just above every superannuation fund, the absolute minimum timeframe to invest in shares is five years. I’ll go two further and say the best timeframe is 7+ years. Why? Because shares are unpredictable in the short run because the prices are influenced by emotions. How do I know this? The formula for investing returns is a simple one: dividend yields + profit growth + – the change in valuations (aka investor behaviour). Find the shares of companies that’ll grow strongly and pay dividends and hold on no matter what. Over 7+ years you’ll start to capture the benefit of the businesses attached to the shares you own and sentiment will catch up… eventually.

- Shares have been the highest returning investments over the ultra-long-term. Yes, even better than property, emu eggs, gold, timber, silver and tulips. If you bet on sharemarkets to grow for decades you’re betting on businesses to get better at serving people. And if you’re betting on businesses you’re betting on capitalism. In other words, you’re betting that more profits will flow towards the ideas, entrepreneurs, products and services we use and love.

Now What?

The sharemarket could crash over the next year because simple averages tell us markets crash ‘every x years’. A ten-year-old with a calculator could tell you that.

However, as famed investor Peter Lynch said, more money has been lost waiting for a market crash than in one. Think about it, if an investor is not prepared to invest now — when everything is going well — how will he or she feel when sharemarkets have fallen 30%, 50% or 70% in one year?

With cash set aside for financial emergencies, dollar-cost averaging is still the best way to invest in global and Australian shares for the long-run. Spend less you make and invest the difference. Rain, hail or shine.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: Owen Raszkiewicz does not have a financial interest in any companies mentioned in this article but is actively investing for the long run.