Scentre Group (ASX: SGP) shares currently trade at a historical 5.37% dividend yield, 27.8% franked. Could Scentre Group shares be a buy for the dividend?

About Scentre Group

Scentre Group owns and operates 41 Westfield shopping centres in Australia and New Zealand, with Scentre’s interest valued at $39.1 billion. Many of the shopping centres are owned in partnership with property investment institutions. According to Scentre Group, more than 535 million visits were made to its centres in 2018.

The Positives

Scentre Group, in its Westfield shopping centres, has a range of large clients that provide very stable lease income and are on long leases. This stability and their low vacancy rates give Scentre Group a competitive advantage.

Over the last few months, Scentre Group shares have looked somewhat volatile, but over the longer term, the shares tend to perform similarly to the overall market.

According to Yahoo!Finance, Scentre Group shares have a three-year beta of around 0.65, meaning Scentre Group shares were actually less volatile than the market over the last three years.

The dividend yield offered by Scentre Group is significantly higher than competitors such as Dexus Property Group (ASX: DXS) and Mirvac Group

(ASX: MGR), although the dividends are not fully franked. The video below explains franking credits in more detail.

Valuation

There are many ways that a company like Scentre Group could be valued, but one method is a dividend valuation.

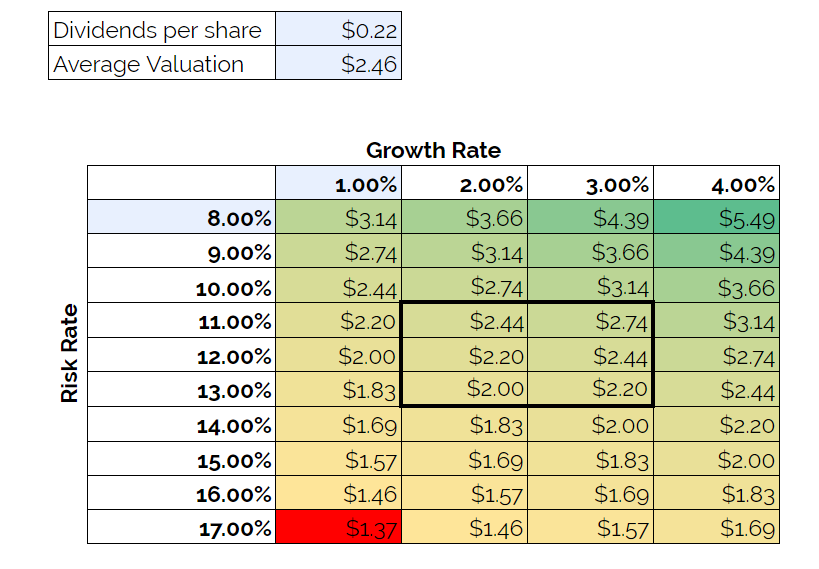

Scentre Group paid total dividends of $0.2195 last year and they have recently been growing their dividend at about 2% per year. Using this information, we can come up with a value for the company by dividing the dividend by what we call the risk rate subtracted by the growth rate.

The table below shows the result of that calculation, which gives an average value for Scentre Group shares of around $2.46.

While this suggests Scentre Group shares are overvalued, I would say that this is only a very rough calculation and based on other measurements Scentre Group seems reasonably valued compared to companies like Dexus and Mirvac.

Summary

Ratios suggest a reasonable valuation while a dividend model suggests that Scentre Group shares are overvalued. I think it’s a company worth considering, but I’d be completing a more thorough valuation before investing.

For now, I’ll stick to the companies mentioned in the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of writing, Max does not own shares in any of the companies mentioned.