If you surveyed a room of expert analysts they might say the Westpac Banking Corp (ASX: WBC) share price is worth just $19. If you’re playing along at home, you’d know Westpac shares are currently priced around $27.50.

Meaning, if what those analysts say is right, and Westpac shares trade towards $19, investors could be looking over the edge at a 40% loss. The following video explains how an analyst might value bank shares like Westpac and National Australia Bank Ltd. (ASX: NAB) using dividends:

About Westpac

Westpac Banking Corporation, more commonly known as Westpac, is one of Australia’s ‘Big Four’ banks and a financial-services provider headquartered in Sydney. It is one of Australia’s largest lenders to homeowners, investors, individuals (via credit cards and personal loans) and business.

What Analysts Think of Westpac

According to data from The Wall Street Journal, of the 15 analysts surveyed five analysts have ‘Buy’ ratings on Westpac shares, seven say ‘Hold’, one is ‘Overweight’ and three say ‘Sell’.

What’s interesting to note however is that the average price target or ‘valuation’ of all analysts is $19.65. I can only speculate that the three analysts who have a sell rating are quite negative on Westpac’s prospects.

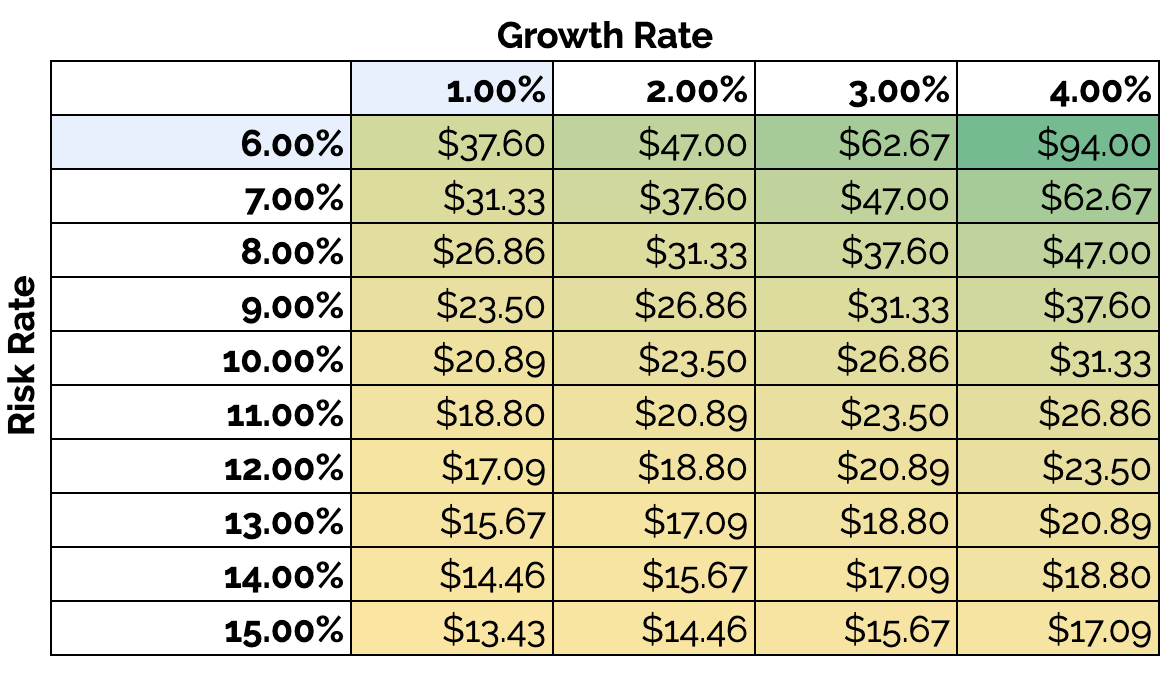

As we’ve done quite a few times here on Rask Media, we can try to ‘reverse engineer’ the $19 valuation using some dividend models (with a sprinkling of imagination — that’s all valuation is, after all).

Given that Westpac’s yearly dividends have been steady at $1.88 over the past five years we’ll use that in our model. This is the most important assumption/crucial we will make.

Westpac Valuation

The usual disclaimers apply: valuation is more intuition than science and garbage-in-garbage-out (GAGO).

Nonetheless, using the table above, which shows the output of our dividend discount model, you can see that to arrive at a valuation of around $19 we might need to apply a risk rate of around 10-13%. For a blue-chip in this interest rate environment, this might seem a little too high. But it is cyclical.

Before we go on, please keep in mind that our first assumption was that Westpac’s dividend of $1.88 is maintained.

Ultimately, my belief is that Westpac might not be able to maintain its dividend for the following reasons:

- We’re late in the credit cycle and bank margins are being squeezed

- The big Australian banks could be about to see their bad debt and non-performing loans spike considerably

- Technology disruption will likely change the way the majority of Aussies bank within the next 10 years (for better or worse)

- House prices don’t grow at double-digit rates every year and can go backwards, as we’re now finding out, and

- In my opinion, Westpac has an ‘uncomfortable’ loan book, with plenty of exposure to trends like investor loans.

Summary

To my mind, arriving at a $19 valuation would require an analyst or investor to be negative on the outlook for Westpac’s net interest margins and/or bad debts. Like anyone else I can’t say for sure how much Westpac shares are worth.

However, going forward I highly doubt Westpac will be able to achieve much — if any — growth in its yearly dividends per share. As I wrote yesterday in my Rask Media article for Commonwealth Bank, there are so many other options to lessen exposure to bank shares while maintaining dividend yield.

I won’t be buying Westpac shares at this price or anytime soon. To see what I would buy, grab a copy of my free investing report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.