The Netflix Inc (NASDAQ: NFLX) stock price has been one of the best performers on US stock exchanges over the past 20 years. So what happens next?

The Era Netflix Left Behind

According to Parrot Analytics Netflix today has a 68% share of the global subscription video-on-demand market, a market that it effectively created. Netflix has 148 million subscribers globally and is responsible for an astonishing 15% of all internet traffic.

In achieving this position of dominance, Netflix saw off feeble competitive responses from Comcast

, ESPN and HBO. It successfully evolved its business model from a DVD mail-order rental company, which contributed to the destruction of Blockbuster Video, to streaming library content from movie and TV studios, to being a major force in the creation of original content.

Netflix spent US$12 billion on content in 2018, around US$10 billion of which was on original programming, and total content spending is expected to rise to about US$15 billion this year, more than seven times what HBO will spend.

In 2018, Netflix won more Emmy nominations than any other network, cable provider or streaming service, ending a 17-year run of dominance by HBO. Just in case you haven’t heard about Netflix, it will spend close to US$3 billion this year just on marketing; that’s more than HBO will spend on programming.

The Era Netflix Has Entered

The business of streaming subscription video is rapidly becoming much more competitive. Fellow FAANGs see streaming video as a service to strengthen their ‘platform’ or ‘ecosystem’. Amazon (NASDAQ: AMZN) has over 100 million Prime subscribers in the US alone and is looking at video as another service to increase the value and ‘stickiness’ of Prime membership.

Amazon Prime Video is expected to spend US$6 billion on content in 2019. Apple (NASDAQ: AAPL), which is increasingly shifting its focus from selling hardware to selling software, services and subscriptions, has budgeted US$2 billion on programming investment this year for Apple TV Plus.

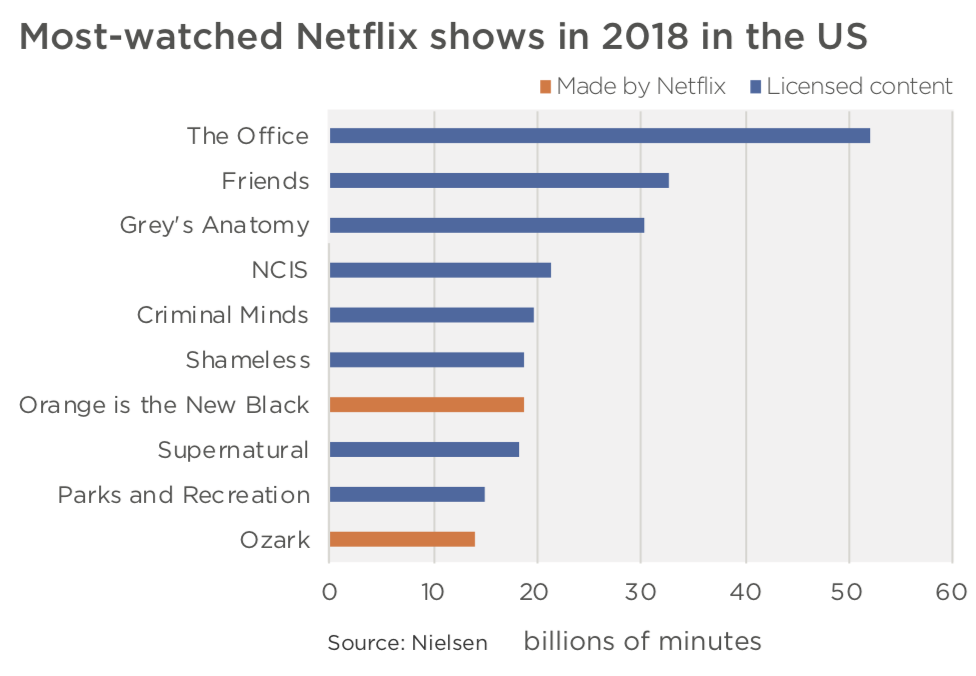

Hulu, now majority-owned by Disney (NYSE: DIS), has 27 million paying subscribers in the US – almost half as many as Netflix has in the same market – and it is adding them at twice the pace of Netflix. Despite its vast spending on original programming, ‘library content’ from other studios accounts for 72% of time spent watching Netflix, according to Nielsen. In fact, all six most popular shows, and eight of the nine most-watched shows on Netflix, are licensed from external studios.

Studios, originally Netflix’s partners as content providers, first saw Netflix as a way to monetise old TV shows and movies (‘Gosh, who would’ve thought these re-runs were worth so much? What else can I license to ya?’). They now see that they’ve helped create a direct competitor and in response have begun to withdraw large amounts of critical content from Netflix. Disney, Time Warner (HBO), NBC Universal and CBS, among others, are all in the process of launching subscription streaming services backed by vast content libraries and enormous programming budgets, and they want to have their content on their own service.

Disney, with its formidable array of characters and movies from Disney Studios, Marvel, Pixar, Lucas Films and Fox Studios, has already pulled all of its content from Netflix. The most popular show on Netflix, The Office, will move to NBCUniversal’s new streaming service in 2021, while the second most-watched show, Friends, is leaving at the end of this year to move to Warner’s new HBO Max.

Maturing Core Market

Netflix already has more subscribers in the US than the entire cable TV industry, and in the UK its subscriber base this year is expected to exceed Sky’s. The rate of penetration growth in developed markets will necessarily slow from here. Netflix may look to compensate for slowing subscriber growth by raising prices, but it’s a risky move when some of its most popular content is leaving or already gone.

[ls_content_block id=”22205″ para=”paragraphs”]