For once it seems the Altium Limited (ASX: ALU) share price is trading lower today than the broader ASX 200 (INDEXASX: XJO), which is up 0.4% as I write this.

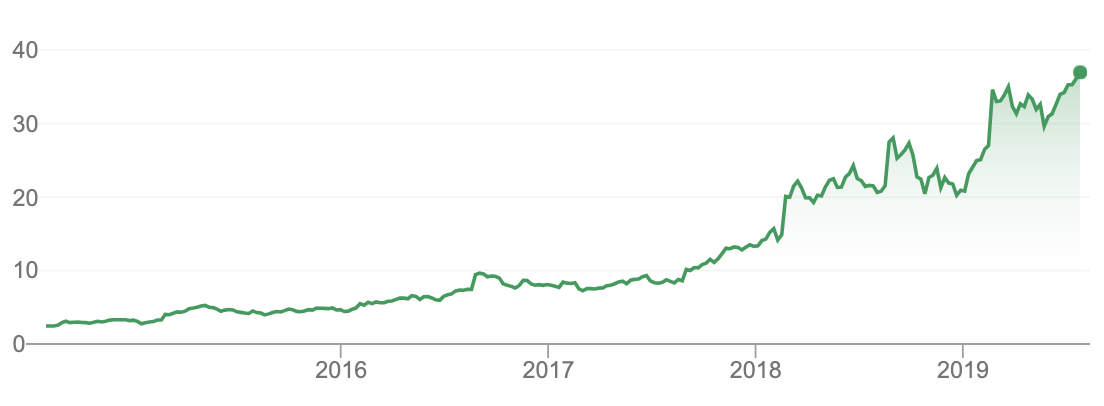

Indeed, for those of us who don’t own Altium shares and have watched it rocket higher, it’s all too easy to feel envious looking at a chart like this:

Altium Share Price

However, as the legendary thinker and investor Charlie Munger says, envy is the only one of the seven deadly sins we should ignore because we’ll get no pleasure from it.

What Altium Does

Altium is an Australian multinational software business that was founded in 1985. It now has offices globally in places like San Diego, New York, Boston, Munich, Shanghai, Tokyo and Sydney. Its software focuses on electronics design systems for 3D PCB design and embedded system development.

Altium’s services include Altium Designer, Altium Vault, CircuitStudio, CircuitMaker, TASKING and Octopart. Basically, its software is increasingly used by engineers and manufacturing firms to design, create and (more recently) source parts/components and manufacture.

Here are two reasons I’d keep holding my Altium shares (if I owned any) in 2019 and beyond:

1. Stickiness

Altium’s software is very ‘sticky’ which is another way of saying its customers are very unlikely to give it up.

Even in the worst recession, engineers, designers and manufacturing facilities will need to pay the relatively small fee to use keep designing with Altium software — and keep their blueprints.

2. Growth

Altium shares look overvalued at today’s prices — I’d be keen on them if they were priced closer to $20.

However, the company should continue to see growth in its core business because the industry is growing and Altium appears to be snatching market share away from the likes of key rivals, Siemens and Cadence Systems.

As it pushes towards 100,000 subscribers Altium will, in effect, be locking in years of recurring revenue for every subscriber added.

What Now?

When Altium reports results, expected on August 19th, keep an eye out for any comment on market share growth, subscriber numbers, growth in Altium Designer and Altium 365 – the company’s new cloud-based platform which brings designers, engineers and the manufacturing teams together in one platform.

My colleague and fellow Rask Investment Analyst Cathryn Goh provided a much deeper analysis of Altium shares in this brilliant article, “Altium – Cashing In On The Internet Of things”.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing Owen does not own shares of any company mentioned in this report/article.