I don’t think I’ve ever been this popular.

In the past 48 hours, the Australian sharemarket (ASX) has followed global markets in tumbling downwards. As I write this the ASX 200 (INDEXASX: XJO) index is down 2.1%.

The catalyst, most media outlets are claiming, is the US-China trade tensions.

Indeed, just when the ‘TV experts’ thought talks were coming to an end it became a he-said-Xi-said moment and the result is we have more trade tariffs on imports.

What Happened?

Last week, the USA clamped down on the remaining $300 billion of Chinese goods imported to the US. Now, the Asian superpower halted imports of US agricultural products.

I really don’t see how anyone wins from this. Can’t we just all get along!

For investors in the US, shares of global technology stocks like Apple Inc (NASDAQ: AAPL) — a company I own for the Rask Invest model portfolio — fell 5%. It’s now a $US870 billion company.

Here in Australia, ASX shares of Afterpay (ASX: APT) are down nearly 5%, Altium (ASX: ALU) is down 4% and Pro Medicus (ASX: PME) is — wait for it — down 16%.

I couldn’t tell you the last time a share I owned fell 16% despite no news being released.

Fortunately, thanks to Pro Medicus’ very strong performance (until this week) it is still up more than 200% for Rask Invest and it is one of my largest positions.

To be sure, today’s selloff is hurting more than just the sexy tech stocks. Even the most popular ASX ETFs are feeling the pinch as the market falls. As you’d expect, index fund ETFs are following the market lower.

How Are You Feeling?

Fortunately for our team, it seems most Rask Invest members and indeed our broader Rask community seem to have prepared well for weeks like these.

Our members and readers should be financially prepared.

How?

They’ve been keeping any money that might need to be used in the next three years (e.g. for a holiday, children or retirement) away from the share market. No exceptions.

They’ve also got a healthy cash buffer for emergencies.

And just as important as that the Rask community has prepared psychologically.

Anyone who tunes in regularly for our Australian Finance Podcast or the Australian Investors Podcast will know I sound like a broken record when I say, “the sharemarket corrects on average once every 357 days”.

Meaning, about once per year, on average, the sharemarket might fall 10%.

(Note: there are no hard and fast rules but I consider a ‘correction’ to be a ~10% fall in stock prices)

Stop and think about that statistic for a moment…

One fall every year?

The takeaway is that if you’re indeed a long-term investor — as I am — you better prepare yourself for a few 10% selloffs.

Another oddly refreshing stock market statistic comes from the Tony Robbins’ book Unshakeable which quotes data showing that US markets entered 34 bear markets between 1900 and 2015 (115 years), or about one in every three-and-a-half years.

In more recent times, market crashes or bear markets come about one in every five years.

Using those two ideas and framing it another way, just 20% of market corrections have turned into full-blown market crashes.

If you’re a numbers guy/gal like me, that might bring you some comfort today.

What Happens Next?

Taking stock of the data I believe investors can expect at least one pretty hairy pullback in stocks once every year, on average. Further, around 80% of the time we get hit by correction the selloff might not turn out to be as bad as we expect.

Of course, those are just averages. And we’ve all heard the story of an 8ft man who walked across the river that was 7ft deep, on average.

Ultimately, what happens tomorrow, next week or next year is anyone’s guess.

For example…

Maybe the US-China trade tensions will end in disaster?

Maybe the market will never recover?

Maybe Trump will find another Cambridge Analytica and get re-elected?

Sure, each of these things could happen. But I’m a little more optimistic.

Why It Pays To Be Optimistic

Correct me if I’m wrong but, on average, the world is getting better — not worse — and businesses are solving more problems than ever before. And they’re doing it more profitably than ever before.

If I can throw just one more statistic at you before you close your web browser, please let it be this:

From January 1970 thru 31 May 2019, data from Vanguard shows that Australian and US shares have returned, on average, 9.7% and 11.4% per year, respectively.

Think about it: despite countless wars, terrorist attacks, the Asian crisis, Australian recession, Y2K, the global financial crisis (GFC) and Donald Trump, shares were still the best place to invest.

If you, like me, believe that the world is only getting better and businesses will still be solving problems and politicians will come and go and you have cash to invest — don’t delay.

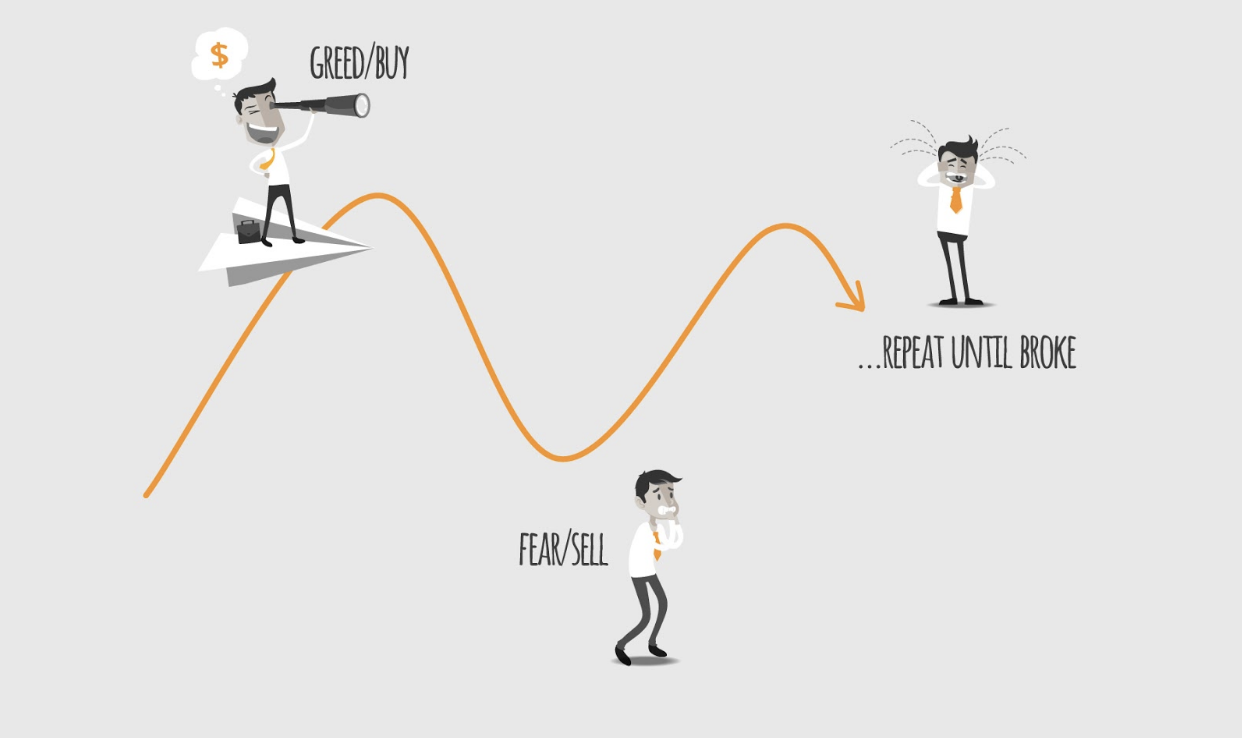

If you let fear rule your investing strategy you’ve already lost.

I don’t know what will happen tomorrow or for the remainder of 2019 or in 2020. I’m not guaranteeing anything.

However, put simply, when you wake up in 10 or 20 years from today I highly doubt you’ll remember what happened in the market today.

Prepare yourself financially and psychologically then make today the day you invest for decades, not days.

Find shares in 15-30 fantastic companies and hold on. It’s exactly what I’m doing for Rask Invest.

Here’s to not being so popular tomorrow!

Owen Raszkiewicz

P.S. According to US stockmarket research from Schwab and S&P, between 1996 and 2015 if you missed the 10 best days of trading the returns from your portfolio would’ve been 4.5% per year. If you had just stayed the course it would have been 8.2% per year.

P.P.S. Rask Invest is our members-only website where we share our best share ideas, updates and ETF research. Click here to learn more about our ETF research ($99 per year) or our Complete membership ($365 per year). Who knows, it could be the best investment you make.

[ls_content_block id=”14942″ para=”paragraphs”]

Disclosure: At the time of writing, Owen owns shares of Apple and Pro Medicus.

Performance returns were taken as of August 6th, 2019. Market data was sourced from various sources and may rely on the author’s calculations. Please note the returns cited are hypothetical as they do not include fees or taxes, they could be wrong and stock prices can move against you. The Rask Group nor its employees and directors can not and will not guarantee an investment’s return.