What happens when the Australian sharemarket hits the skids after months of smooth sailing (as it did this week) and the internet makes it easy to publish viral research?

Reading the headlines this week it seems to me that more and more we’re seeing companies come under fire from explosive short-selling reports.

This week, Rural Funds Group (ASX: RFF) and Treasury Wine Estates (ASX: TWE) shareholders witnessed short reports produced against their companies.

The Good

If you want to see what a well-researched short report can do to companies with questionable management and accounting practices, just look at the Glaucus report on Blue Sky or the Viceroy

report on South Africa’s Steinhoff. Shares in these two companies have fallen on their face, wiping billions from investors’ wallets and lining the pockets of short-sellers who saw it coming.

For part-time or DIY investors who don’t have the time or skills to understand unusual or creative accounting, this is what most of us fear. We’ll question ourselves, “what do they know that I don’t?”. After all, they’ve done the research, right?

I was fortunate enough to sit down with Viceroy Research’s Gabe Bernarde to talk about short selling as part of the Australian Investors Podcast series. In the following video, Gabe explains the process of short selling:

The quick definition is that short sellers make money when a share price falls. Typically, the best outcome is that a short seller makes a 100% return.

In my opinion, good short sellers are a net positive for the market because they keep a lid on irrational share prices and can play a part in stopping promotional management from building a house of cards that can inevitably destroy the financial lives of unwitting shareholders.

The Bad

If you’ve ever got stuck into the financial statements of a company on the ASX or globally you’ll know it’s no easy task untangling the assumptions made by management to arrive at their figures.

You can take it from me — someone who runs a business and invests in many others — there will always be something ‘creative’ going on behind the scenes. Whether it’s selective reporting of sales figures, aggressive assumptions for asset values or something else more complex.

Tip: grab a (strong) coffee and take half an hour to read the ‘notes to the financial statements’ in a company’s annual report. Be critical of what you read. And as one of the world’s highest-paid female TV personalities, Judge Judy, might say, “If it doesn’t make sense, it’s usually not true”.

Now I can’t say for sure what will happen next with Rural Funds Group shares but I’m sceptical (skeptical?) the shares are worth zero dollars — which is what the short seller alleged.

The Ugly

The worst short-sellers are opportunistic, misleading and deceptive ‘researchers’ who fabricate “alternative facts”. These people are entitled to their opinion, as we all are, but they should also be entitled to be hit with the fat book of the law if they do the wrong thing.

Unfortunately, it’s very hard for part-time investors to know who to trust.

For Treasury Wines (ASX: TWE), the Australian wine producer and global distributor, it seems the short report against it has fallen on deaf ears with management acknowledging the report in an ASX update but then disregarding the issues as misleading.

Your Defence Against Short Reports

I believe investors’ best defence against short reports is the work we do before we buy shares in a company.

As you’ll know if you have taken our free investing courses, we here at Rask Invest only ever buy shares in companies we can understand. It’s a commonsense approach filtering shares.

Basically, we believe investors should buy shares of companies within their ‘circle of competence’ to lower the chances of making a mistake.

After years of researching and talking to Australia’s leading investors, I don’t think it’s any surprise that the best investors are really good as saying “no”.

What I mean is they know that there are tens of thousands of ways to invest money yet just a handful of shares is all that’s needed to make great returns.

What’s more, most people who understand compound interest will tell you it’s far harder to make money once it’s lost. That’s why Buffett’s first rule of investing is “don’t lose money”. His second rule is “don’t forget rule number one”.

For me, a simple way I think any Aussie investor can avoid losing money is to stick to buying great companies — not ‘cheap’ stocks.

You can do that with the help of a checklist.

For example, for Rask Invest, I’ve recognised that my worst investment mistakes have come from buying shares that I thought were cheap — or from selling great shares too soon.

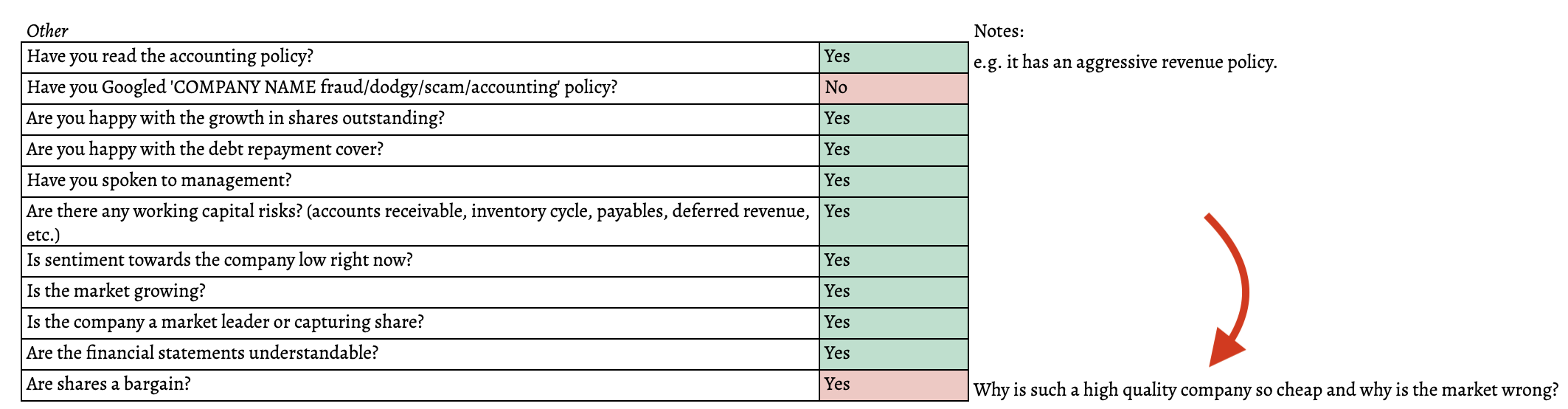

That’s why I recently updated our analysts’ investment checklist to include the final question on this list:

In addition to asking bucketloads of questions about areas where you’ll find the most common management accounting tricks (working capital, inventory, asset valuation and debt covenants) we deeply consider why a stock is so cheap

. Oftentimes, cheap companies stay cheap — or get cheaper.

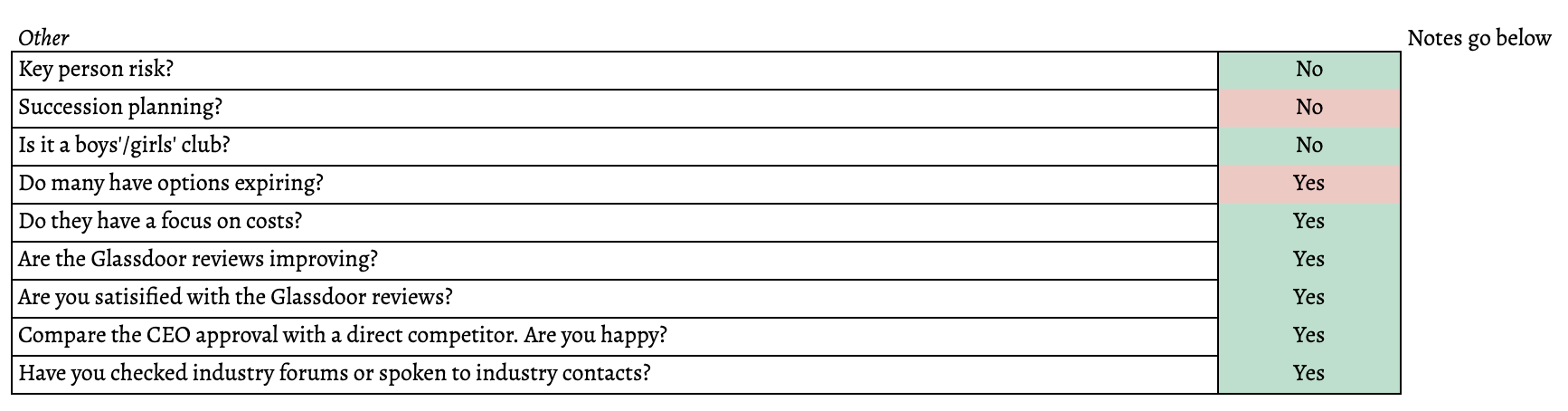

Next, the team and I tend to go well beyond just taking management’s word for things. We’ll search through forums, reach out to industry contacts and do “channel checks”, and ask ourselves (or others) all kinds of questions with regards to the operational, balance sheet or income statement risks that might come back to bite us. Here’s another tidbit:

To be sure, no-one gets every stock pick right. And if you’re investing in the highest quality companies you better be prepared to pay up — or to act when something goes really wrong and the short term performance takes a hit. That’s when you’ll find the best opportunities in the stock market.

Now, you’re probably saying to yourself:

“It’s all well and good for you to do this research, it’s your full-time job and you’re being paid for it!”

That’s true, we are paid a modest subscription fee to produce investment research for our members.

However, if you go to this level of detail in your research it’s easy to see why successful long-term investing is 99% doing nothing.

Indeed, once you do the work and buy shares in a great company the hard part of investing is done because it’s easy to follow along and allow the company to compound your investment for years to come. I’ve found buying cheap stocks is far more stressful.

What To Do Now

If you’re investing for 5, 10 or 20 years — and you want to make good returns — you must prepare yourself to be uncomfortable because even shares in the best companies will take a hit, collapse or get ruined by dodgy management.

The most important thing is you get back on the horse and go again.

Remember, if you buy a stock and it goes to zero you can lose 100% of your money. However, you can make a lot more than 100% of your money in shares of a great company. And therein lies the significant opportunity for true long term investors like us.

If you want to learn more about our investment research service Rask Invest and get immediate access to our #1 share ideas, ETF research and content, simply click here to compare our services. It could be the best investment you make in 2019.

Cheers to our financial futures!

Owen Raszkiewicz

P.S. short selling can pull on the emotional strings and make things tense. Just think, tomorrow is the weekend.

P.P.S. if individual share investing isn’t for you, you should know we also have an ETF research membership service for just $99 per year. Click here to learn more.

[ls_content_block id=”14942″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial or commercial or any interest in any of the companies mentioned.