The Afterpay Touch Group Ltd (ASX: APT) share price rocketed 8% today after releasing its eagerly awaited 2019 financial year report.

You can read all the nitty-gritty details in this article, “FY19 Report – Afterpay Touch”, by Rask Media’s Jaz Harrison.

The Afterpay Result

On face value, Afterpay’s results appear extremely impressive:

- Total retailer sales: $5.2 billion, up 140%

- Number of users: 4.6 million customers, up 130%

- Number of retailers/merchants: 32,300, up 101%

- Revenue: $251 million, up 115%

As you can see, Afterpay is growing rapidly, with just about every key operational metric (and revenue) rising at triple-digits year-over-year.

First-Mover Advantage

Afterpay’s virality is well and truly in full swing. As Rask Invest analyst Cathryn Goh wrote earlier this month:

“Afterpay has become a lifestyle in its viral growth phase, with its brand name even being used as a verb. The term “just Afterpay it” is constantly thrown around, much like how we “Uber” somewhere or “Photoshop” something.”

Ask yourself:

- Have you “Googled” something recently?

- Or did you “Bing” it?

Needless to say, being a ‘first-mover’ in a consumer-focused industry is a huge advantage for companies — not to mention it can be extremely profitable for early investors.

The Afterpay Model

Afterpay’s business model, management team, total addressable market (TAM) and overseas earnings tick many of our boxes at Rask Invest, even though we still don’t own it for the Rask Invest model portfolio… yet…

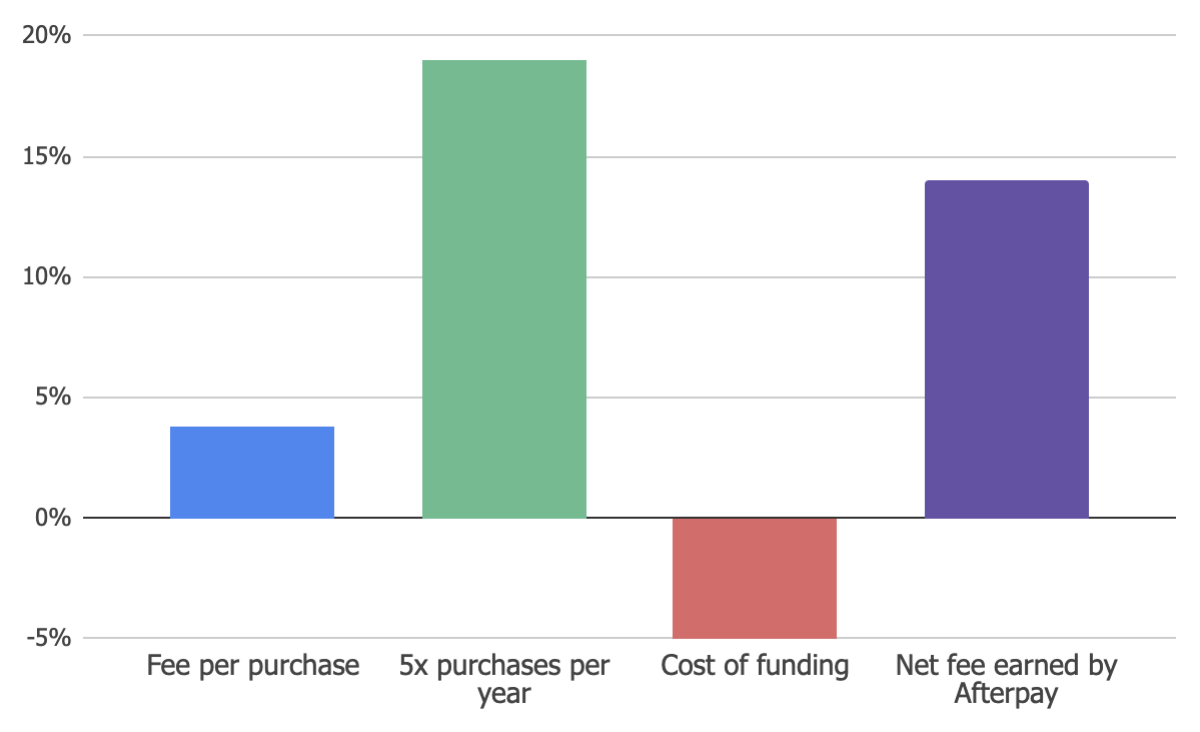

Using the chart above we’ve provided a very basic overview of how Afterpay works.

As you can see, we could assume Afterpay makes around 3.8% from every purchase/transaction by offering short term “credit” or capital to the retailer (covering the consumer’s purchase). The customer is extended this credit for an average of, say, seven weeks.

The beautiful thing is this capital can be recycled back into the business to fund other customer purchases.

With an average repayment cycle of seven weeks, conservatively we can say Afterpay could recycle the capital/credit at least five times per year. That means Afterpay can ‘make’ 3.85% x 5 or around 19% per year (p.a.).

Again, if we assume that the capital Afterpay ‘lends’ to retailers costs 5% per year (funded by its bank loans, internal cash reserves and/or by issuing new shares to shareholders), the margin for Afterpay over a year might be 14% (19% – 5%).

As I say, that’s a very basic overview and it’s worth noting the 14% doesn’t take into account the net transaction loss (~0.5% of sales) from consumers who don’t pay the money back. It also doesn’t cover Afterpay’s costs, expenses like marketing, labour, tax and many more real things which Afterpay’s management has to balance as it grows.

Terrific Economics?

The ‘economics’ inside Afterpay are truly terrific.

Conversely, we think the risk to Afterpay’s business model lies in the transaction losses it will incur throughout the credit cycle. Then there’s technological disruption and the biggest question revolves around margin compression once Afterpay, Splitit (ASX: SPT), Klarna and Affirm become mature businesses. Will retailers still be willing to pay 3.8% to Afterpay if Klarna offers the service for less?

The pleasing counterpoint to these risks is the growth Afterpay could experience outside of its core merchants/lending business.

At Rask Invest we think the ‘optionality’ in referral fees for merchants, advertising, analytics on customers and cross-promotions will become more important over time.

Afterpay – The Short Of The Century?

Short selling is the ‘art’ of making money when a stock price drops. Our Rask Finance video below explains short selling:

Bottom line: short-sellers need to be right about a company (e.g. it’s a bad company) and get the timing right (because it costs money to short sell). This is different to long-term investors who can get the timing wrong and still be right over the long run.

If like me, you believe that short term share prices are unpredictable, then short selling is probably something you can do without…

Getting back to Afterpay though and one of the easiest targets for short-sellers are shares that look extremely expensive.

A short seller might say things like “look at its price-earnings ratio, it can’t stay like that forever!” or “it’s risen 200%, trees don’t grow to the sky”.

These are the same arguments being made about Afterpay and on first glance, Afterpay shares look very expensive. The company is worth $7 billion right now yet it doesn’t make a profit.

Indeed, Afterpay doesn’t look like a ‘cheap stock’. However, when we consider 16% of the Australian purchasing population already use Afterpay — and it accounts for more than 10% of total online sales in Australia (a growing market) — I think it’s reasonable for an investor to think it could grow very strongly for many years.

Buy, Hold, Sell Or… Short?

Ultimately, for me, there’s a lot of risk to buying Afterpay shares at today’s prices. However, there’s arguably more opportunity in the form of new features, users and overseas growth that justify a higher-than-average valuation.

Given that we haven’t found anything significantly untoward with Afterpay and shorting is not something we recommend at Rask Invest, I won’t be going short Afterpay shares anytime soon.

Instead, we’ll be creating a new valuation model to determine a fair valuation range for Afterpay shares — as always, our Rask Invest members will be the first to know what we think.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of writing, Owen owns shares of Alphabet Inc, the parent company of Google. Rask Invest analyst Cathryn Goh owns shares in Afterpay.