The Bubs Australia Ltd (ASX: BUB) share price was trading lower today despite the broader Australian share market trading slightly higher and Bubs’ shares being admitted into the S&P/ASX 300 Index (INDEXASX: XJO).

Bubs Australia Share Price

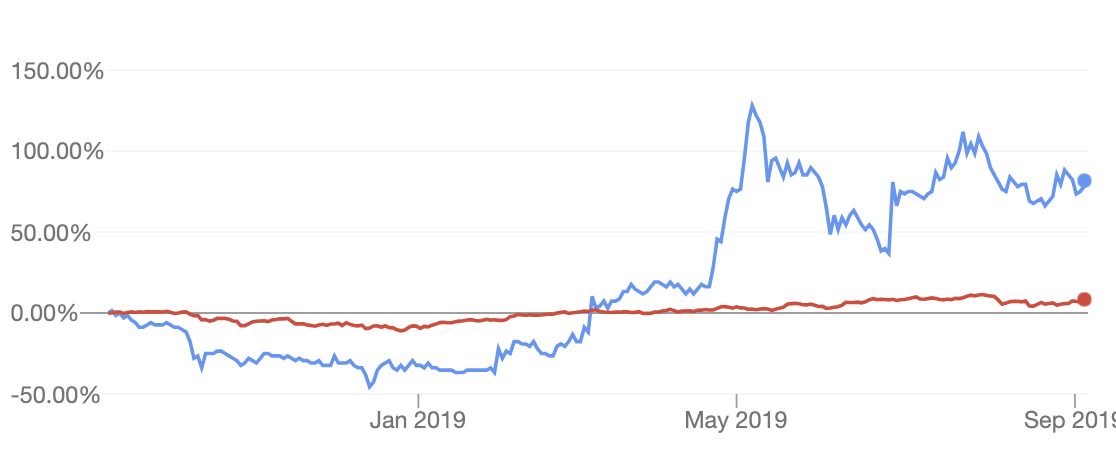

The chart above compares the yearly performance of Bubs Australia shares to the ASX 200 (INDEXASX: XJO). Bubs shares are up 81% year-over-year while the ASX 200 is up 7.6%, both before dividends.

Who Is Bubs Australia?

Bubs was founded in 2006 by Kristy Carr when she found there was a lack of premium organic baby food available for her own bubs. Bubs shares were listed on the ASX in January 2017. Today, Bubs is an infant formula company that is based on goat milk and it also sells organic baby food.

Bubs recently acquired NuLac Foods, Australia’s largest producer of goat milk products, it also guarantees the exclusive supply of local goat milk from Australia’s largest herd of milking goats.

1 Reason To Watch Bubs Australia Shares

Given the strong year-over-year performance of Bubs, the company’s shares will now be included in the ASX 300 index. This is important because it means some high-level investors (e.g. Super funds, managed funds, etc.) may now be able to buy shares for their portfolios.

That’s because there are rules governing which shares can be bought by big funds. Basically, some fund managers will now be able to invest in Bubs shares.

There will also be index funds such as the Vanguard Australian Shares Index Fund ETF (ASX: VAS), which tracks the ASX 300 index, that’ll now include Bubs shares.

More Importantly…

More importantly for long-term investors however is the impressive growth of Bubs as a business.

As Rask Media’s Jaz Harrison reported here, Bubs grew revenue 154% to $47 million in its 2019 financial year and its gross profit margin edged up to an impressive 21% from 14% last year. The following Rask Finance video explains the difference between revenue and profit:

What Now?

Although his analysis is few months old Rask Media’s Will Donnan covered Bubs Australia in great detail in this article, “Why I Bought Bubs Australia Shares“.

If the company can come close to replicating the success of a2 Milk Company Ltd (ASX: A2M) or even Bellamy’s Australia Ltd (ASX: BAL), there could be more long-term growth ahead of Bubs shareholders’ yet. It’s definitely one to watch!

[ls_content_block id=”14947″ para=”paragraphs”]

Disclosure: at the time of publishing, Owen does not have a financial interest in any of the companies mentioned.