Cimic Group Ltd (ASX: CIM) just announced a $1.3 billion contract extension. With new contracts and the share price down 35% in six months, does Cimic present great value?

About Cimic Group

Cimic Group is an international contractor with operations in telecommunications, engineering, property, mining and environmental services industries. Cimic operates multiple brands such as UGL, CPB Contractors, Thiess, Broad and Sedgman.

Contract Extension

This morning, Cimic announced that its mining services provider, Thiess, has been awarded a six-year contract extension by Coronado Global Resources Inc (ASX: CRN) worth $1.3 billion.

The contract extension covers overburden removal and haulage, mining and run of mine rehandling services, equipment maintenance and pit dewatering at the Curragh Mine in Queensland.

This follows two new contracts awarded to CPB Contractors which were announced last week and are together worth $518 million. With all these new contracts and contract extensions coming in, what are Cimic shares worth?

Valuation

There are several ways to value Cimic shares. You could compare Cimic to other industrials based on metrics like price-earnings (PE) or price-to-book value (PB) ratios, but this is almost like comparing apples and oranges.

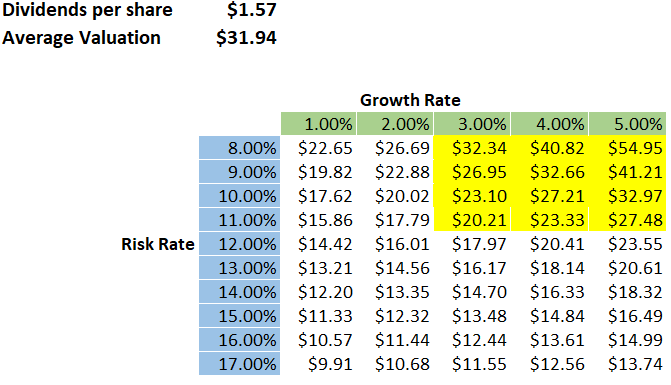

One quick and rough way to value Cimic shares is using a dividend discount model (DDM). I went into much more detail on how to use this model in this article, but the basic overview is this – we take the most recent dividend and divide it by the required rate of return (or risk rate) minus the growth rate. We can do this several times and adjust the figures slightly each time to get an average valuation.

Again, if this isn’t making sense, consider looking at my previous article or watching the video below.

Cimic has paid dividends of $1.57 in 2019, and the dividend growth rate over the last three years has been approximately 17% per year, so it’s fair to say dividends are growing quickly.

I would consider Cimic to have a reasonably low-risk rate because it is a well-established company with very long-term contracts.

Using the dividend of $1.57, we can apply different growth rates and risk rates to get an average valuation.

Using a growth rate of 3%-5% and a risk rate of 8%-11%, Cimic shares might be worth around $31.94, or a little less than the current share price. This may suggest that Cimic shares were overvalued and the recent share price decline was justified.

My Take

This is a very rough valuation and I wouldn’t give it too much weight. However, I do believe Cimic shares were overvalued and are beginning to look more attractive, especially with new long-term contracts flowing in.

If the share price declines a bit further, a buying opportunity may present itself, so I’ll keep Cimic shares on my watchlist for now.

For other companies paying big dividends, have a look at the free report below.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of writing, Max does not own shares in any of the companies mentioned.