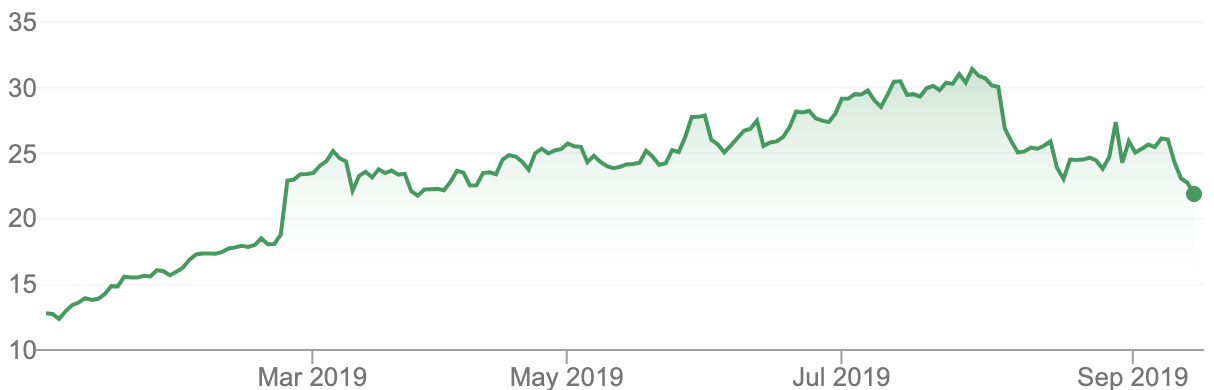

The Appen Ltd (ASX: APX) share price

was trading more than 4% lower this morning. Over the past month, Appen shares have fallen 18.1% while the S&P/ASX 200 (INDEXASX: XJO) has risen 4.02%.

Appen provides data for machine learning and artificial intelligence. Basically, it provides and improves data for the development of artificial intelligence and machine learning products. With more than 20 years of experience in over 130 countries, Appen has firmly established itself as a global leader in this space.

What Happened?

Appen did not release any news to the market today, but shares have been falling since its first-half FY19 results were released on August 29th. Going back further, shares were already falling for the month leading up to the report and the peak was at the end of July.

The share price decline appears to just be a readjustment to the very lofty valuation Appen was given. In less than a year, its share price went from a low of $9.60 to a high of $32, an increase of around 233%. Clearly this valuation was not sustainable.

Despite a promising half-year report showing revenue growth of 60% and profit growth of 33%, shares are now trading at less than $21. While it may look like a buying opportunity, the price-earnings (P/E) ratio is still over 50 times and I’m not convinced the share price has finished its decline.

My Take

I’m not a buyer at today’s price, but it appears as though the Appen share price has been swept away by negative sentiment and hit harder than other growth shares.

This could create a buying opportunity for what is a high-growth, high-quality business. If Appen wasn’t already on your watchlist, now might be a good time to take notice.

For other high-growth shares, have a look at the free report below.

[ls_content_block id=”14947″ para=”paragraphs”]

Disclosure: At the time of writing, Max does not own shares in any of the companies mentioned.