The Serko Ltd (ASX: SKO) share price traded 15% lower today before skidding into a pause in ASX trading. Over the past month, shares of Serko are down 21%. For comparison, the S&P/ASX 200 (INDEXASX: XJO) is down just 1% in the same time.

Serko Pause V Trading Halt

Pauses in trading are similar to the common trading halt and are often put in place by an exchange (e.g. ASX) to ensure that the market is ‘fully informed’ about material news or events. The video above explains trading halts.

Who Is Serko?

Serko is a New Zealand software company founded in 2004. Serko listed on the New Zealand stock exchange in 2014 and on the ASX in 2018.

Serko’s travel management software is used by blue-chip Travel Management Companies or TMCs which use their software to book corporate/business travel for large clients.

Serko also offers a growing expense management technology platform which is also sold through TMCs to help companies keep on top of their financial reporting and record-keeping.

Update: Serko Trading Halt

Shortly after we published this article, Serko shares moved into a trading halt upon their own request. Specifically, the company requested a trading halt as it is:

“…at an advanced stage of finalising a material transaction that includes a proposed capital raising and requests that trading in its securities be halted to ensure an orderly market while the terms of the transaction are finalised.”

Meaning, I think it’s likely when Serko shares wake from their trade on Friday, October 25th, that the company will have detailed its plans to make an acquisition and sell more shares to investors.

Serko’s Suspicious Trading

I’ve been investing long enough to know that this form of trading activity right before a material news update should be a major red flag for the ASX, ASIC and Kiwi regulators.

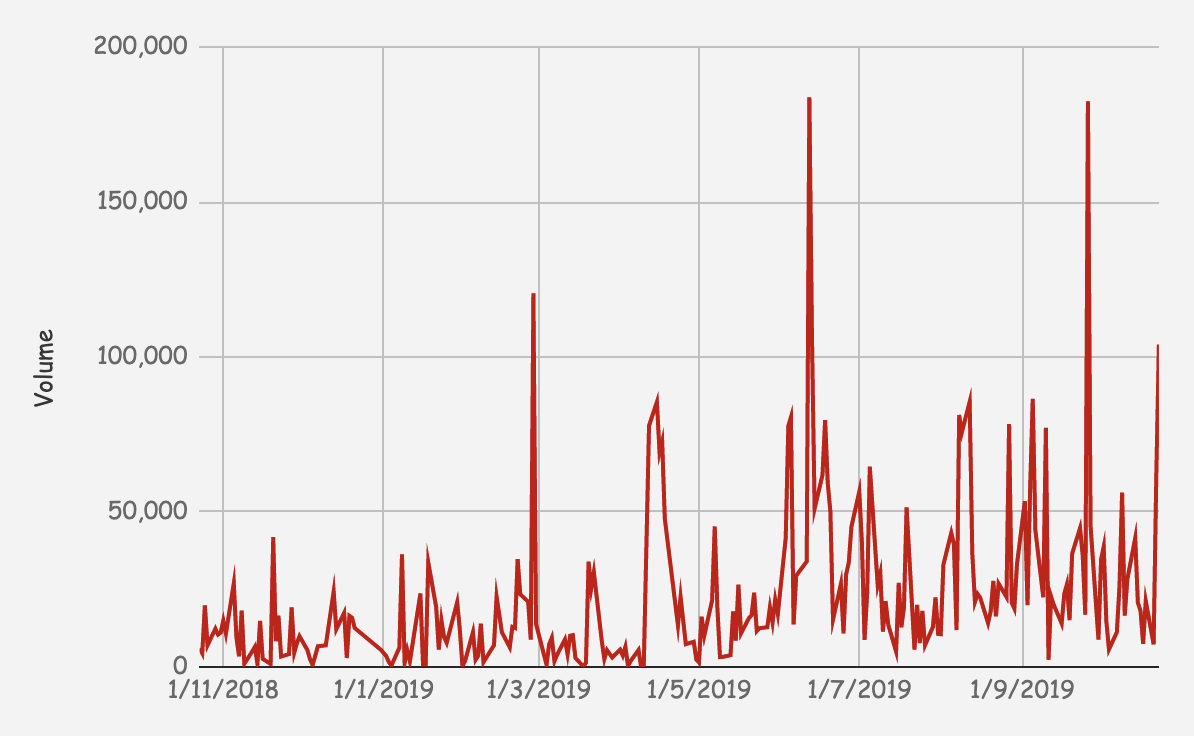

Someone had advanced notice of the news because there was nothing meaningfully unusual (that we could see) other than a modest spike in trading volume this morning.

In other words, in my opinion, someone close to the transaction/deal may have been able to trade on the news before the rest of the market. If it’s true, that’s a big no-no.

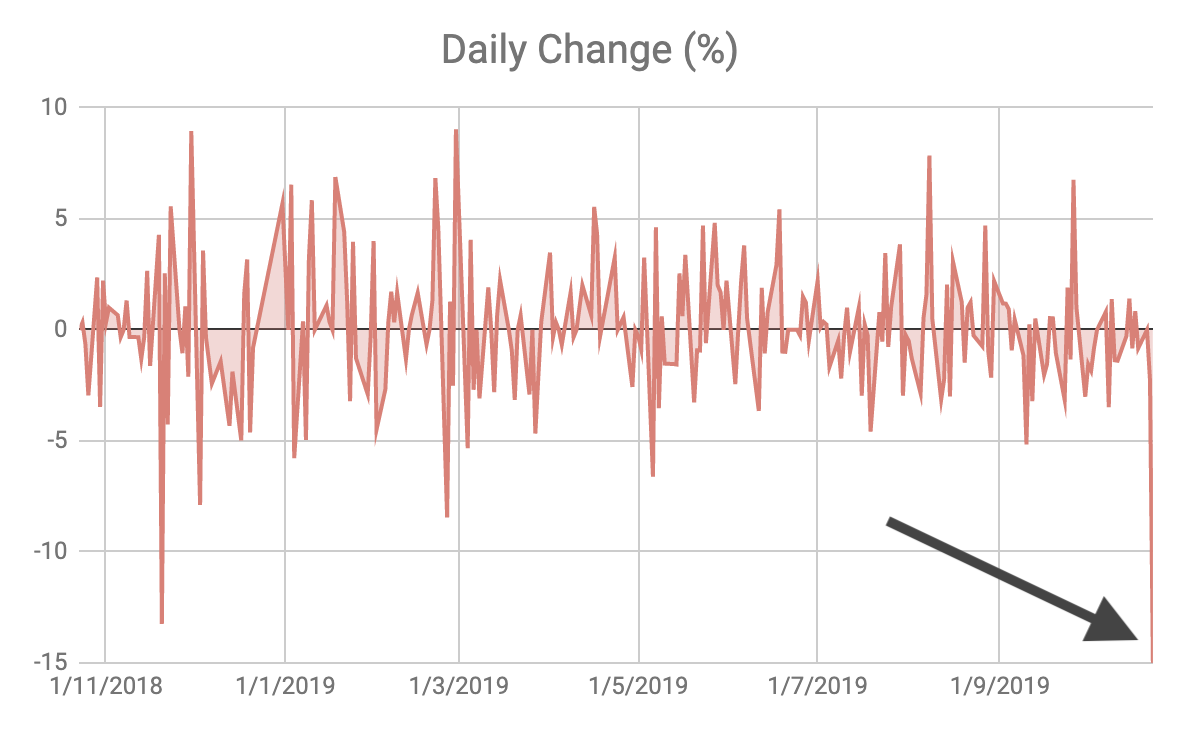

You can see from the volume and daily price changes above that even though ASX volume was high (yet not a record), the negative share price change in around half a day of trading was significant.

What Now?

I hope the ASX and/or ASIC take a look at the trading activity before this announcement and analyse the settlements closely. I would like to think it should be relatively easy to track.

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.