ANZ (ASX: ANZ) has released its FY19 report to the ASX, is the ANZ share share price a buy?

ANZ is a leading Australian and New Zealand banking institution, with a presence throughout the oceanic region. ANZ is one of the Big Four Aussie banks and derives much of its revenue from mortgages, personal loans and credit.

What Did ANZ Report In The FY19 Result?

ANZ reported that its cash profit (with the businesses it continues to operate) was flat at $6.47 billion. Net profit before credit impairments and tax was also flat at $9.96 billion.

One measure of profit that did see growth was continuing cash profit per share (EPS), it grew by 2% to 227.6 cents.

Meanwhile, statutory net profit fell by 7% to $5.95 billion.

ANZ Balance Sheet

ANZ reported that its gross loans and advances (GLA) increased 2% to $618.8 billion, showing that the credit environment is slow and tough for the major bank right now.

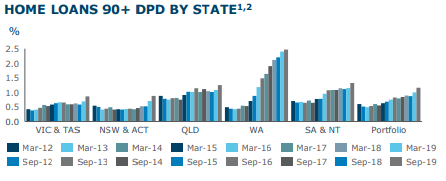

Total credit impairment charges as a % of average GLA increased from 0.12% to 0.13%. ANZ continues to see a rise in home loans that are over 90 days overdue in all states, which can be seen on this graph:

Customer deposits grew by 5% to $511.8 billion despite the low interest rates.

The big four ASX bank said that its Common Equity Tier 1 Ratio (CET1) was stable at 11.4%, meaning it is still ‘unquestionably strong’ according to APRA’s requirements.

ANZ Dividend

The ANZ Board declared a final dividend of 80 cents per share, bringing the full year dividend to $1.60 per share, the same as last year.

However, shareholders will see an income cut with a reduction of the franking amount to 70% rather than 100%.

ANZ Profit Measures

The headline cash profit may have been flat, but other profitability measures declined.

Return on equity (ROE) dropped 0.1% to 10.9%, return on average assets fell 0.04% to 0.68%

The net interest margin (NIM) – which is the difference between the cost of ANZ’s funding versus the interest rate it lends to borrowers – was 1.8% at the end of the first half, but the ‘underlying’ NIM was 1.75% at the end of the second half and the actual NIM was 1.72%. Profit margins are shrinking.

One of the main things that ANZ is doing to combat this is reducing its staff numbers, which were down 2% over the year to 39,060 full time equivalents.

Is The ANZ Share Price A Buy?

For ANZ to keep cash profit stable and grow cash EPS in this environment is a decent effort with Royal Commission customer remediation ongoing.

But ANZ CEO Shayne Elliot said that the bank expects challenging trading conditions to continue for the “foreseeable future”. Record low interest rates and intense competition will continue to impact profitability.

Retirees might be attracted to ANZ for dividends, but I don’t think there’s going to be much profit growth or share price growth. For reliable dividends I’d rather buy the shares in the free report below instead.

[ls_content_block id=”14945″ para=”paragraphs”]

[ls_content_block id=”18380″ para=”paragraphs”]