This story on Pacific Green Technologies (OTC: PGTK) comes from EGP Capital’s February 2020 letter to clients/investors.

I became aware of the Pacific Green Technologies (OTC: PGTK) business in mid-2017. One of your fellow unitholders was especially enamoured of the potential of the technology they were developing. PGTK was primarily focused on developing exhaust gas scrubbers for maritime applications.

Their scrubbing technology was apparently world-class and would undercut their competitors pricing, while still generating strong profit margins for the company. Because we’re discussing a US business in this article, all dollar figures used will be US$ unless otherwise marked.

In late 2017, when I first looked at the accounts, like so many businesses developing a potentially commercially valuable technology, not only were they not yet profitable, they weren’t even generating revenues and were chewing through about $3m per annum in research and development and staffing costs. During 2017, the share price ranged from $0.60 to $0.90 per share, valuing the business at $25m-$38m.

Come 2018, with still only very modest revenues, and growing costs saw the company generated losses exceeding $3m, but the commerciality of the technology was becoming apparent as they began to win some work. The share price started the year at $0.80 and ended at $2.60 (valuing the business at $34.5m-$112m) as investors started to bet the company would become viable.

It was over the course of 2019 that I started to really take notice of the business as they repeatedly grew their forward revenue book. It was this announcement (.PDF), the 10Q for the September 2019 quarter that really proved what the business was capable of being under full operational conditions, the business generated $62.7m of revenue and $25.1m of gross profit and $13.6m of net profit and cash reserves of $13m. The stock traded in a price ranging from $1.60 to $4.25 (valuing the business at $73.6m-$195.5m) as investors started to more fully understand the potential of the business, despite the lack of liquidity.

With the business showing the potential to earn profits of $54m per annum (if they could annualise their

September 2019 quarter), any price sub $200m would seem to be remarkably cheap, particularly in light of the enormous addressable market (more on that below). The key question to ask as an investor was whether the revenues were likely to be one-off or repeatable and whether the technological advantages enabling the revenues was likely to be defensible.

Is the Revenue Repeatable?

The first thing to understand are the markets PGTK are targeting. The business has four divisions:

- PacificGreen Marine Technologies

- PacificGreen Air Technologies

- PacificGreen Solar Technologies &

- PacificGreen Water Technologies

For a relatively small company, PGTK clearly has big ambitions. But at present, the majority of the work is coming via the PacificGreen “ENVI-Marine” system, as there has been a recent change in the emissions standards for shipping, referred to as IMO (International Maritime Organization) 2020, whereby those ships using the cheaper “Heavy Fuel Oil/Bunker Fuel”, must “scrub” the sulphur and particulate matter out of the emissions, or alternatively use the more expensive low-sulphur fuels.

Depending on the price differential between these fuel types and a variety of other ship-specific factors, the payback for a PGTK “ENVI-Marine” scrubber can be between 5-18 months. These indicate the business has a highly commercial product. There are approximately 55-60,000 ships circling the world to move our containers of goods, oil, gas and other cargoes. Of this circa 60,000 ships, it is estimated just 4,000 have scrubbers installed, enabling them to use the cheaper bunker fuel.

Not all ships will end up having a scrubber placed, some ships nearing the end of their useful lives will probably just use the more expensive fuel until they’re scrapped. With that said, the scale of the future opportunity is enormous.

The average scrubber manufacture, supply and installation evidently costs about $2.4m (of which PGTK generates $1.4m-$1.6m for the scrubber and $800k-1m in installation costs, which PGTK does sometimes). If we assume something in the order of 12-14,000 (about 1/4) of the current fleet of ships end up with a scrubber, then the future revenue opportunity is something in the order of $30b+. If PGTK can just capture 5% of this opportunity over the next 5 years, they can underwrite at least 5 years of the earning potential I describe below in the “How profitable can PGTK be” section.

In speaking with management prior to authoring this report, I asked the question as to whether they thought they would be able to win steady marine work to replace the order book as they complete the existing work. They seem remarkably confident that for at least the next few years, shippers will be scrambling to get large parts of their fleets converted. Inquiry levels so far in 2020 have apparently exceeded all of the 2019 inquiries, all that remains is to turn inquiries into revenue.

The key swing factor here is likely to be the spread between the fuel prices, with the gap presumably narrowing over time as demand for bunker fuel is increased by the addition of a substantial expansion in ships capable of legally running the fuel. I estimate the shipping revenues will have at least a few years to run and if PGTK can continue to capture an expanding portion of this market, it comfortably underwrites the current valuation.

The Competitive Environment

PGTK’s key competitors are mostly operating out of Northern Europe/Scandinavia.

Yara International are a Norwegian business capitalised at about AU$15b, generating annual revenues of about AU$20.7b and EBITDA of about AU$2.2b per annum.

Alfa Laval is a Swedish business capitalised at about AU$14.5b, generating annual revenues of about AU$7.2b and EBITDA of about AU$1.3b per annum.

Wartsila is a Finnish business, capitalised at nearly AU$10b, generate annual revenues of about AU$8.8b and EBITDA of about AU$1b per annum.

The businesses described above operate with gross margins ranging from 26-44%, meaning the 40% gross profit (see below) PGTK seem to operate at is within the range of industry norms. These large firms obviously operate across a much wider set of technologies/industries than just scrubbers. To get an idea of the breadth of the businesses, have a look at the description of Wartsila’s operations in this link.

Even so, the three competitors named above evidently speak for more than 50% of the global market for scrubbers, with a variety of smaller competitors still much larger than PGTK. It should not be hard for market share gains if the technology is as far ahead of others in the industry as it appears to be. Evidently circa 150 of the 4,000 installed/ordered scrubbers are PGTK units.

This makes it seem quite conservative given the significant competitive advantages of the PGTK technology that only 5% of the opportunity over the next 5-7 years. The business should be multiples of its current size if it can just maintain the current share of marine scrubbers. This ignores the very substantial market opportunity PGTK have outside of their core marine business.

How profitable can PGTK be?

The latest investor presentation from PGTK released after the December 2019 10Q’s release indicates PGTK has an order backlog at present of $212m. If we were to assume they were able to deliver that entire backlog this year (which having spoken to management they are capable of doing, but the timing of delivery is often out of their hands – more on this below), then the business is capable of earning a “Gross Profit” of approximately $85m (GP margin has been 40.0% & 39.7% from the last two quarterlies).

The below the line expenses have been $11.6m & $12.6m from the last two quarterlies. If we assume they will run at $12.5m per quarter, then $50m of non-COGS expenses seems a reasonable estimate. This would place the current profit potential of the business at around $35m per year, which is remarkably high for a business capitalised at $103m at the $2.20 per share closing price for February.

Why Customers Choose Pacific Green

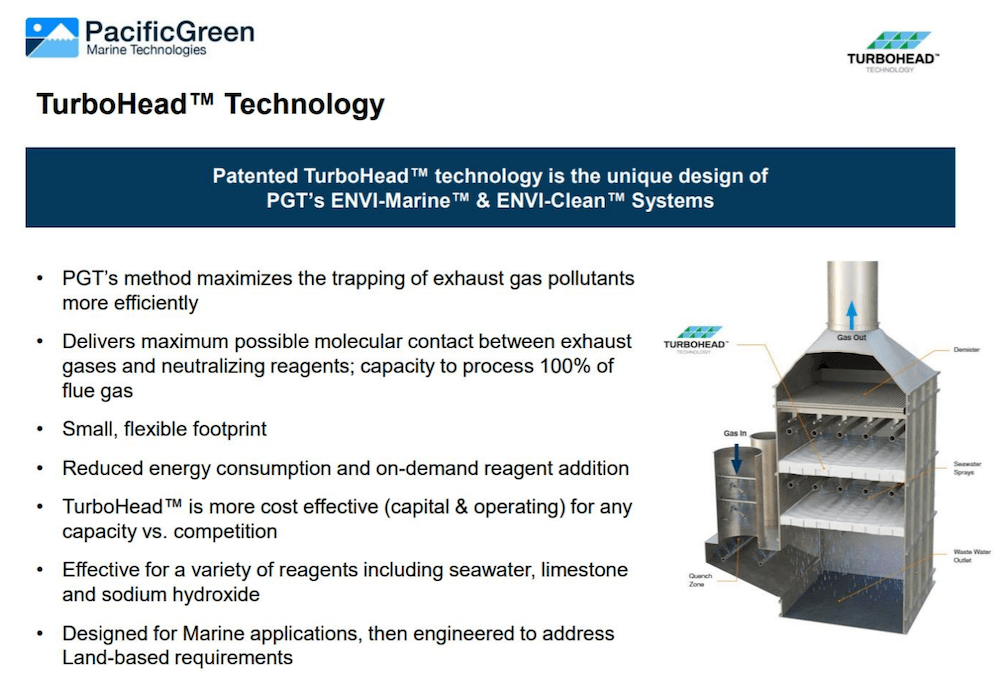

Rather than me try (and probably fail) to explain the technology, instead, see the below page from a company presentation:

Key advantages in layman’s terms is the lower operational height of the PGTK scrubber, and the smaller footprint, there is also a very useful short video on the Pacific Green website that explains the tech. The PGTK scrubber is cheaper on both CAPEX and OPEX, if the market is rational, PGTK will surely grow its market share in the future.

The second big advantage PGTK have is their long-curated working relationship with PowerChina – Power Construction Corporation of China, Ltd (601669.SS). PowerChina is a roughly AU$15b capitalised business generating >AU$70b of revenue per annum with more than 200,000 employees.

The relationship with PowerChina enables PGTK to scale rapidly without placing a working capital strain on the PGTK business. PowerChina match the terms PGTK give their customers, effectively allowing PGTK free access to PowerChina’s enormous balance sheet, and an almost unlimited ability to scale should they be able to win increased levels of work. This enables PGTK to develop positive cash balances throughout the client delivery program.

The amount of time a ship spends out of commission having scrubbers retrofitted is also incredibly important to the ship-owner. Recent reports of a Turkish shipyard taking 149 days to complete a scrubber installation will have potential customers reviewing PGTK’s offering very favourably. They apparently take 30-40 days for the entire retrofit including dry dock, whereas most competitors are in excess of 60 days.

From deposit to commissioning, PGTK generally take less than 6 months, compared to 8-13 months for competitors. These are meaningful differences and unless the competition can close some of the gaps in CAPEX, OPEX and installation times, the most likely outcome would have to be an ever-increasing proportion of the work being won by PGTK.

Post-Shipping Opportunities

PGTK have capability in concentrated solar power (parabolic trough and molten salt) and desalination, but the primary near-term opportunity that excites me is the “Land-based Flue Gas Desulphurisation (FGD) System”, which enables the removal of sulphur dioxide from boiler exhaust. China has an installed base of coal-fired power now exceeding 1,000 terawatts and about 3,500 plants (and is still building new plants). This is an incredibly large number, and we will have all seen pictures of the incredible pollution smogs that occasionally descend on Chinese cities under certain weather conditions.

Like all countries as they become wealthier, citizens become much more attuned to environmental matters once their more basic needs are met. The Chinese Communist Party (CCP) has shown an increasing willingness to deal with environmental issues over the past few years and the scale of the opportunity in land-based desulphurisation is many times larger than the IMO 2020 opportunity PGTK is currently enjoying. Outside of China, India also have 166,000 MWe of coal fired power plants requiring compliance retrofits. This Indian retrofit opportunity is estimated to exceed $8b and is dwarfed by the Chinese opportunity.

The average age of Chinese coal fired power plants is about 11 years. The design life for these plants is 40-50 years. To give a contrast, the average age of Australia’s 23GW of coal fired power is about 29 years, therefore much closer to the end of its useful life, making replacing, rather than retrofitting to improve the environmental output a much more realistic option. The US fleet of coal plants is closer to 40 years of age, making it even easier for them to replace that power with current technologies.

There will likely be many tens of billions of dollars spent on retrofitting older coal fired power stations (not to mention cement plants, waste incinerators and steelworks). Such a retrofit program would go a long way to eliminating the smog hazard these plants currently present, whilst enabling them to see out their economic lives.

Doubtless many Chinese plants will be retired younger than the plants of the developed nations, but if we assume they see 30 years of service, there is 19 years of improved environmental output to be gained by using PGTK’s technologies. The relationship with PowerChina positioned alongside the technological superiority of the PGTK products should mean the company is the presumptive front-runner to the process of improving the environmental friendliness of the current fleet of China’s coal fired power plants. That is to say nothing of the enormous opportunity outside of China.

What is PGTK Worth?

The easiest way to think about a business such as this is to imagine you were the owner of the entire business and someone offered to buy it from you. The value to a private owner is not necessarily likely to be achieved in a public market (sometimes listed businesses trade well short of private valuations, sometimes well beyond), but it gives a useful starting point.

If I owned 100% of PGTK and someone offered me $10 per share in a takeover, I would very likely turn them down. This is a business that under its current construction (it is debt-free and modestly net-cash) is comfortably capable of earning $30-50m pre-tax. Such a business, once it has a few such years under its belt, is highly unlikely to be valued below $500m, which is 5 times the current share price. We think the undervaluation is material and very likely to be corrected in the next year or two.

There is one other relatively imminent potential catalyst to rectify the obvious undervaluation at present of PGTK stock. The business will shortly uplist to the NASDAQ exchange, which will make transacting in the stock much easier for many potential buyers, including some institutions that have mandates that preclude them from buying OTC stock.

The one risk with this uplisting is that the business feels compelled to undertake a significant M&A transaction as part of the process. This might be something they would consider as without additional stock being available for better price discovery, the uplisting itself will likely not assist liquidity that much, management and insiders own 45% of the stock and have clearly been disinclined to sell at the prevailing low valuation, a change of exchange doesn’t change this factor without the issuance of additional equity.

The risk, of course, is that the business purchased was meaningfully inferior to the operations already owned, with the secondary concern being that given the obvious and demonstrable undervaluation of PGTK shares, if a transaction of meaningful scale was undertaken at the present valuation, it would likely be highly dilutive to the current PGTK shareholders. The 45% insider ownership provides strong protection against such an outcome, but investment bankers with their spreadsheets can be a persuasive lot.

We fall on the side of heavy insider ownership being likely protection against a poor outcome as described above. Also, as at 31 December 2019, PGTK also carried $16m of company cash on the balance sheet, and was highly cash-generative, so the need for a meaningful raising of capital is also lowered by this fact.

How about the Coronavirus?

It is worth noting the fall in revenues from the September quarter of $62.7m to the December quarter of $37.5m. Shipping rates spiked in the December quarter, and like all good profit-seeking capitalists, the shippers deferred installations to chase the improved pricing conditions. Shipping rates fell back to earth in January, which would likely provide a tailwind for PGTK quarterly revenues as shippers used the weak market to bring forward retrofits. Coronavirus changes that, we must understand how long/damaging the effect will be.

The Chinese shipyards PGTK use to undertake their installations closed down as usual for the Chinese New Year holiday period. What is different this year is they didn’t reopen as normal as part of the CCP’s coronavirus containment efforts. Apparently shipyards began reopening in the last week of February, but it stands to reason the revenue for the March 2020 quarter will be weaker than it should have otherwise been.

None of this really alters the long-term valuation case for PGTK. In fact, the likely continued weakness in shipping rates from a global economic slowdown caused by coronavirus and attempts to contain it could perversely assist PGTK as the predisposition for ship owners to conduct retrofits is likely enhanced by the combination of reduced shipping rates and the need to improve the economics of their fleets by enabling their ships to operate using the cheaper bunker fuel.

[ls_content_block id=”27512″ para=”paragraphs”]