The S&P/ASX 200 (ASX: XJO) finished the trading day at 6216.2 points, 2.81% lower, on Friday.

Leading the ASX 200 down were shares of airlines, including Qantas Airways Limited (ASX: QAN), Air New Zealand Limited (ASX: AIZ) and Virgin Australia Holdings Ltd (ASX: VAH).

Featured Video: Matt Joass, Maven Funds

If you’re looking for interviews with some of Australia’s most sophisticated investors, start your day with The Australian Investors Podcast. It’s free to subscribe on iTunes, Spotify or Android.

ASX 200 Recap – airlines led fall

On the Australian share market Friday, gold mining stocks Newcrest Mining Ltd (ASX: NCM), Northern Star Resources Ltd (ASX: NST) and Evolution Ltd (ASX: EVN) bucked the trend and pushed higher. Here’s how they fared:

- NCM – up 1.9%

- NST – up 3.5%

- EVN – up 3.3%

The positive momentum behind gold shares comes amid further concerns over the Coronavirus. More negative sentiment towards the virus caused the Dow Jones to fall sharply overnight.

As Marcus Padley wrote on Rask Media earlier today, “the computers have well and truly taken over the asylum. The ‘Buyden’ bounce has turned into the ‘Sellden’ fall.” Click here to keep reading.

While gold miners can be the flavor of the month when uncertainty looms, it’s been airline stocks which have felt the brunt of the market’s concerns over the Coronavirus.

Today, Qantas, Virgin Australia and Air Zealand weighed heavily on the ASX:

- QAN – down 8%

- VAH – down 17%

- AIZ – down 5%

Last month, Air Zealand released its financial results to the ASX and also issued a statement citing the expected impact of the Coronavirus on its full-year 2020 outlook.

At the time, the company said: “The airline’s revenue outlook for the remainder of the year is expected to be adversely impacted as a result of softer demand for travel to and from Asian destinations.”

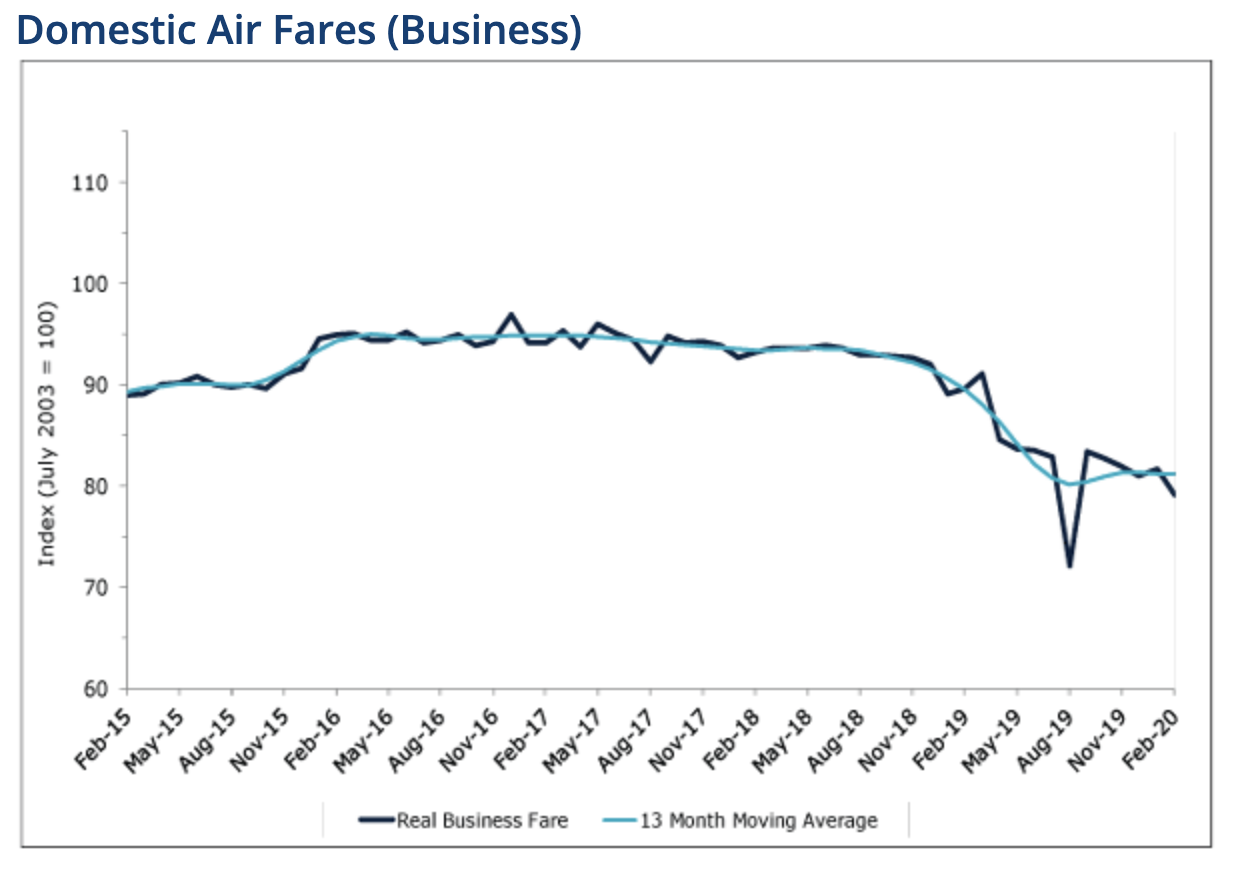

While the data is not completely up-to-date, the Australian Government’s Bureau of Infrastructure, Transport, Regional Development and Communications (BITRE) website shows the value of domestic business airfares had fallen in February, though not materially as some might have expected.

Aside from business travel, fares increased modestly for travel in restricted economy classes and for ‘best discount’ travel.

On February 20th, Sydney Airport Holdings Ltd (ASX: SYD), the owner of Australia’s most frequented international airport, reported a 0.7% decline in international passenger numbers for January, year over year.

However, Sydney Airport CEO Geoff Culbert said at the time: “We expect traffic to be more significantly impacted in February as a consequence of the coronavirus.”

Of course it’s not only airlines that are feeling the pinch of souring consumer sentiment. While shoppers were rushing into supermarkets to buy toilet paper in a frenzy, other consumer-facing companies have not been as lucky.

Vitamins business Blackmores Ltd (ASX: BKL) said it expected supply challenges in the form of a two-to-three month setback for its products.

Here are today’s top stories:

- Why this fund manager just invested in his 1st overseas company

- Central banks are destroying risk free returns

The ASX 200 index closed Friday at 6,216 points.

[ls_content_block id=”14947″ para=”paragraphs”]