Yesterday the Reserve Bank of Australia (RBA) cut rates to 0.25%, following the US Federal Reserve, who has thrown the kitchen sink at the markets – cutting interest rates to zero (0 to 0.25%) and announced $700 billion in money printing.

Market sentiment and individual opinions about the market are bi-polar at the moment. Someone told me at the weekend (after the 13% bounce on Friday) that they are going “all in”. One of our SMA clients (very happy with our service) has withdrawn their money because they now want to take on the investment role themselves and aggressively buy.

We have thought very hard about whether this Fed move is going to create a stock market low and whether we should start buying today. No is the answer. There are a few things holding us back:

- What have the central banks seen that we haven’t?

- Coronavirus has been the catalyst to finally take us to zero interest rates.

- No interest rate is a disaster for a lot of retirees as the risk-free return goes to zero and the real return goes more deeply negative. They are already losing money in cash.

- Negative interest rates are next and that’s a disaster for anyone with capital.

- The next step is money printing again and we still haven’t paid the price for the post-GFC decade of money printing yet.

- We are risking deflation, ingrained deflation.

- The Central Banks are now out of policy weapons. Nothing left. The economy will now turn to politicians and fiscal policy for salvation and as Japan taught us in the 1990’s and 2000’s, fiscal policy is like throwing snowballs at hell, it will achieve nothing meaningful beyond budget deficit blow out and regular political change as government after government continuously fail to turn the economy.

- There is heightened economic uncertainty at the moment.

- There are a host of profit downgrades related to coronavirus that have not been quantified yet (have we had any at all?) – they are coming. Earnings expectations are in flux.

- The social impact of things like the US being shutdown have only just begun. The US is preparing for lockdown. Supermarket shelves are being stripped. If you think we have a problem with loo paper, gun shops in the US have seen queues around the corner as Americans stockpile guns and ammo. Ohio and Illinois have closed all bars and restaurants. It is taking six hours to get your bags and three hours to get through screening into the US airports. Trump has tweeted “Its Terrific” and “very good news”. It’s not. The Fed can do what they like but this is going to get worse before it gets better. We have not seen the social end game yet so it’s unlikely to be the stock market end game either.

- The biggest one day rallies in the market come during a bear market. We just saw a 13% rally in the ASX 200 (ASX: XJO) from bottom to top (on Friday March 13th). That’s not a trend change, it’s a bounce in a very volatile market.

Our decision still is to STAY OUT. That’s our assessment of the current risk reward equation. Standing on the shore has a better risk reward than sailing in the storm. But you need to decide for yourself, because the reality is, we’re guessing, everyone is. If this is the bottom and you call it, you guessed. We’re guessing it’s not the bottom.

The opportunity

This is certainly a buying opportunity. Big corrections are almost never bigger than 50%. We have seen an over 30% correction from top to bottom so far. – the odds are:

- In a year’s time we will have forgotten COVID-19.

- The economic rebound when it comes will be quick.

- The stock market rebound will precede the economic rebound and will be even quicker.

- All we will remember is a market that dropped and popped.

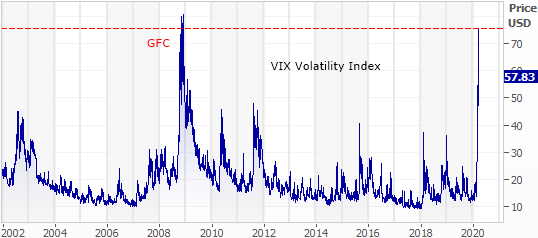

- Here is the VIX Volatility index – we are back to GFC levels. If you are supposed to buy when others are fearful…we must be getting closer.

- The only game in town now is to time the buying.

- There is unlikely to be a clear ‘moment’. It’s unrealistic to think you can spot that.

- We will almost certainly progressively buy as the risk reward ratio improves rather than go “All in” on one day.

While it might take a while to see a bounce

The main variable is the depth of the GDP impact and the corporate damage, and how long it lasts. Until that is envisaged by investors the markets will not bottom. If we knew the size and timing of the economic impact exactly the market would price it in and bottom.

The problem is that for the following reasons the impact is likely to be prolonged not momentary.

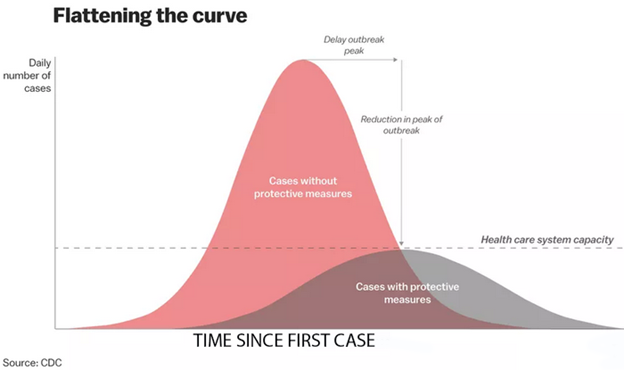

This is the central chart, and its not good news for a quick recovery. This is from the CDC (Centre for Disease Control) and its on the media everywhere – it’s the “Flatten the curve” chart.

From the stock market point of view, if the primary focus of the Government becomes the capacity of the healthcare system to cope then to hell with the economy, it is the rate of spread of the disease that matters (not the economy) and the Government can do something about that and it involves taking some economic damage, early, now, and its beginning. We can expect Australia (and the US and Europe) to go into lockdown pretty quickly and remain there until the coast is clear.

Economic Summary

- The Government will focus on the rate of spread, not the economy.

- The economic impact is secondary and not a priority.

- To slow the spread government will advise lockdown periods for individuals/schools/sports/gatherings/businesses. They have just called a State of Emergency in Victoria.

Our conclusion is that the duration of the economic impact will be long, not short.

There is a long long way to go in this story. We, like you, watched that bounce in the Australian and US markets on Friday the 13th March. We like you watched stocks jump 20% to 35% in two hours, and we like you have kicked ourselves for missing the opportunity. And we like you started thinking about buying (we are in 62% cash in our Growth SMA).

But we shouldn’t. Missing that quick rally is all that’s prompting us to even think about buying. Its FOMO not logic. Everything else says don’t. We are still in this storm.

That rip up on Friday was not the bottom, it was some fund manager somewhere who decided, maybe in Sydney, or maybe in a skyscraper in New York (Fidelity), to buy some SPI Futures in big size. We don’t know why, but my guess is that they too, were guessing, as Twiggy Forrest was guessing when he bought Fortescue (ASX: FMG) shares this week (never follow emotional billionaires making gestures), and as we are guessing and as you are guessing.

On the financial front we should take the same tack as the medical advice at the moment – too cautious is better than reckless.

Meanwhile the FOMC cutting rates to zero and printing money is a scary development. These people have more informed advice than us, they can see what we are in for more clearly than we can and the FOMC, the RBA and the Australian Government are clearly seeing something we haven’t yet.

Optimism today might look really silly in a month or two when you, and those futures traders who caused last Friday’s bounce, are sitting at home sharing a bowl of rice with their kids whilst the stock market is shut.

Plenty of clickbait Cowboys will call the bottom every day. We’ll call the turning point in the newsletter when we think it’s time. Maybe after the avalanche of coronavirus earnings downgrades, we haven’t even begun to absorb yet.

***

I’m Marcus Padley, the author of the Marcus Today stock market newsletter. To sign up for our free 14-day trial and access our ASX share research and commentary, please click here. There’s no obligation and no credit card required. Just come in and take a look.