Chris Brycki from Stockspot, puts some perspective around the recent sell-off and what it means to investors over the long run.

With the panic currently impacting the share market it is worthwhile to take a step back and provide a historical perspective.

Fear always lurks behind large falls in the share market. Fear is created by uncertainty and humans naturally react by panic moves such as buying truckloads of toilet paper or dumping shares.

Coronavirus has stoked the fear that people will not be able to travel or go to work, meaning that companies will be limited in their ability to produce goods and services. Herding behaviour has amplified the effect of the underlying pandemic.

A historical perspective

Coronavirus is not the first disease to break out around the world.

There was the flu epidemic in 1918, the AIDS epidemic in the 1980’s, SARS in 2003, Swine Flu in 2009 and the Zika Virus in 2016.

Throughout history there have also been periodic outbreaks of financial panic.

On Black Monday in 1987 fear and panic caused the US share market to fall 22.6% in just one day. Even today there is no clear explanation of its cause but it recovered all the losses within 2 years and is today over 1,000% higher.

Impact of Coronavirus

It’s too early to know what the long term impacts of Coronavirus are for Australia or the world economy.

The news may get worse before it gets better as the mortality increases and governments bring into place measures to contain the virus. On the other hand, confidence could bounce back if infection rates start to fall and governments and central banks take swift action.

Which happens first?

Nobody knows!

That’s why markets are hard to beat, even for investment professionals. That’s why “active” investors who try and trade in and out of markets based on their insights tend to do worse than “index” investors who buy the broad market index and do nothing. Indexing even does better in down markets.

Our advice during market volatility is always to stay invested and do nothing. Moving to cash or a lower-risk strategy are both forms of market timing that are more likely to harm your long-term returns like they do for active investors.

Important points to consider

Market bumps are normal: You should expect a couple of temporary 5-10% falls in the share market every year.

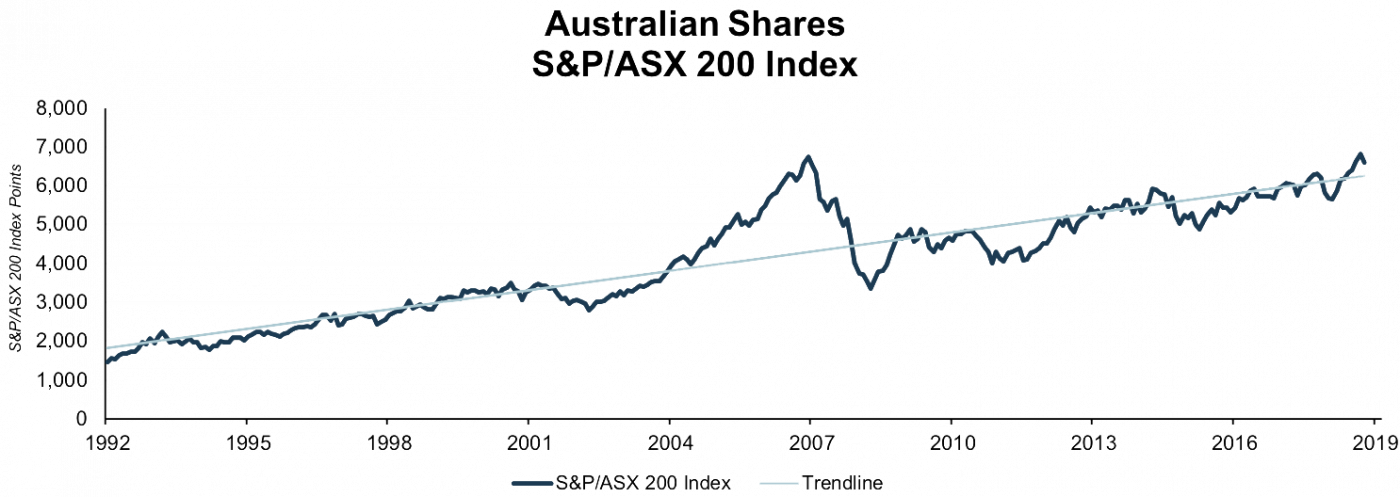

Market falls of 20%+ are less common but still happen about 6 times every 30 years, including most recently 2008, 2011, 2015 and 2020. Over the long run, Australian shares have returned around 9-10% p.a. which has included these dips along the way.

Market falls are nothing to be concerned about and provided you’re well diversified (the next point), you will be well protected from most of the fall so you can stay calm and keep investing.

Diversification cushions your returns: While markets are uncertain around the potential impact of Coronavirus, defensive assets like Australian bonds and gold have been powering ahead. We hold these assets for exactly this reason, because they rise when share markets are shaky.

Owning bonds (+8.7%) and gold (+38.4%) over the last year has meant the Stockspot portfolios have fared much better than the share market.

Should you change your investment strategy in response to Coronavirus?

It might be tempting to sell or move to a lower risk strategy.

Here’s why you should avoid that temptation.

Imagine you were to sell your investments and move to cash.

How would you know when the share market had hit the bottom?

How long would you wait to buy back in when markets start to rise?

How fast would you be able to react if conditions quickly improved?

Even if you got out of the market at the right time, you would probably struggle to get back in at the right time.

Selling out of your investments because you think it could fall further implies you have extra knowledge about the Coronavirus which other investors don’t know.

What you’re probably doing is reacting to the same news headlines everyone else has seen. You’re more likely to end up buying back higher than when you sold if you wait until the uncertainty recedes.

When markets are falling, the key is not to fight your emotional reactions. Instead, channel them into positive strategies and actions that will improve your long-term returns.

1. Keep investing

Regular deposits ensure that you invest at different parts of the market cycle, so you can take advantage of lower prices when markets fall. Dollar cost averaging is a great way to do this.

Automating your investment deposits is the best way to stick to your long-term investment plan and ensure that you avoid the temptation to buy and sell at the wrong times.

Meanwhile, Stockspot’s automated rebalancing will help you buy low and sell high when investments move far from their target portfolio weights. We’re doing this every day for clients!

2. Take a break from monitoring

If you have a tendency to get nervous when your investments go up and down, consider monitoring your portfolios less frequently. This helps prevent your short-term emotions from overpowering the long-term game plan. It’s also important to separate short term market ‘noise’ with the long term trend. Any short term market falls have always been overwhelmed by the long term uptrend.

3. Stay diversified and keep investment costs low

The low-cost diversified ETFs that Stockspot uses gives you access to market returns without paying high fees that eat into your returns. Trying to time the market will lead to higher costs getting in and out as well as tax consequences – both of which harm your returns. It’s why index investing works better in down markets too.

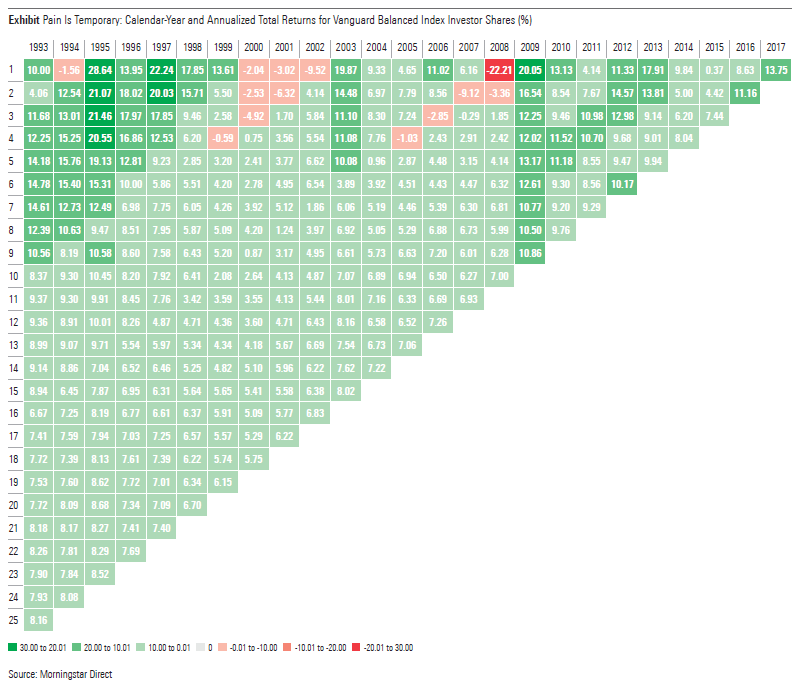

The following chart from Vanguard paints a good long term perspective on market falls. It shows that market drops have always been temporary for long-term investors in a balanced portfolio of index funds (like we use).

Provided you’re investing for more than 4 years (the y axis), investing returns have been positive regardless of when you started investing. This includes if you bought just before the Global Financial Crisis in 2008.

The longer you remain invested, the closer your returns move towards the long term average of 7% to 8% per year.

4. Don’t forget dividends

Even though the value of your portfolio might go up and down over the short term, you’re still earning returns through dividends and distributions. When markets fall, dividends and distributions can be reinvested at a lower price, helping you benefit even more when markets do recover. As interest rates fall in Australia, dividends are becoming more and more attractive.

Our advice on Coronavirus

Rather than react to the latest news headlines around the Coronavirus, stay focussed on what’s within your control and proven to build long term wealth. Stick to your investing plan, stay diversified and let Stockspot automatically rebalance whenever needed to keep your portfolio in line with your goals.

Investing over the long term means not worrying about market movements over the short term. Research consistently shows that buying and holding a broad mix of diversified investments for the long term will put you in a better position than trying to time your entries and exits. Coronavirus won’t change this.

Chris’ article first appeared on the Stockspot blog.