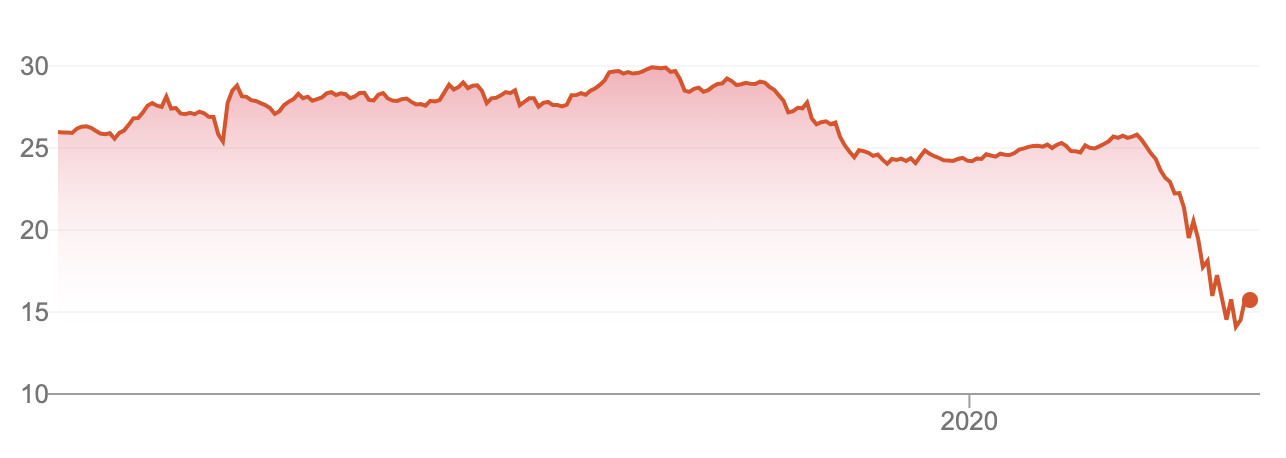

What a month it has been for the Westpac Bank Corp (ASX: WBC) share price and WBC investors right around Australia.

Westpac is down 35% in three months, far outpacing the falls in the S&P/ASX 200 (ASX: XJO), which is down 26%.

Of course, it’s not alone. Australia and Banking Group (ASX: ANZ) and National Australia Bank Ltd (ASX: NAB) are down 33% and 36%, respectively.

Westpac (WBC) share price tumbles

Are Westpac shares worth just $11?

The headwinds facing the big banks are now obvious. That said, the banks have been in similar situations before. Westpac has survived the last 150 years. This period included world wars, recessions, depressions and more.

During the GFC, which was a similar but different type of credit crisis to what we’re experiencing right now, the banks were able to cry foul and emerge from it stronger thanks to huge amounts of government and central bank support. So that’s reassuring.

Despite the optimism, however, there is a price and value for everything. And right now the near-term headwinds make the outcomes of investing in bank stocks very wide indeed. This uncertainty makes valuing Westpac shares very difficult.

According to all of the analysts surveyed by The Wall Street Journal the average WBC share valuation is just $11. However, it’s likely skewed by a few very bearish analysts.

Is it time to sell Westpac shares?

Earlier this week I wrote a very popular in-depth bank article laying out the likely next steps for Australia’s big banks, including for dividend investors and long-term investors like me. Please read my article before taking any action on Westpac shares: “What holders of CBA shares & NAB shares can expect next”

My bottom line is that most analyst price targets and valuations will be wrong. In any case, I’d much rather own shares of capital-light companies with low amounts of leverage to the market cycle and no debt. You might think these ‘golden companies’ are hard to find in Australia but I’ve found a few such stocks in the free investment report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, the author of this article does not have a financial interest in any of the companies mentioned.