The Telstra Corporation Ltd (ASX: TLS) share price was trading 0.5% higher today as new cases of Coronavirus mount up.

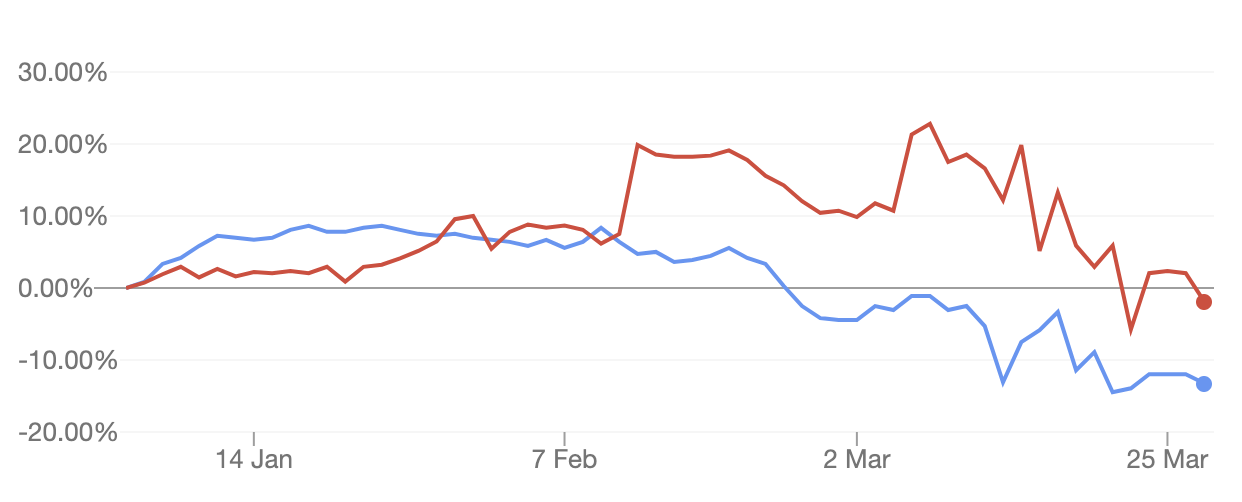

So far this year, the TLS share price is down 13% versus TPG Telecom Ltd (ASX: TPM) (red line) which is down just 2%.

Telstra is our country’s oldest telecommunications business, having built the first telegraph line in 1854. As of 2019, it provided more than 17 million retail mobile services, around 5 million retail fixed voice services (e.g. home phones) and 3.6 million broadband services.

How worried should you be about the Telstra shares?

Earlier this week I recorded the stock market video above and published it here on Rask Australia (and on our YouTube channel). In the video, I explain the exact steps that investment analysts like myself are taking right now, including:

- Balance sheet: a full review, including debt, cash and a thorough working capital analysis

- Cash flow: an analysis of the company’s free cash flow, including reductions for the likely consequences following a recession

- Optionality: this takes time and will require you to consider if the COVID-19 economic downturn will help the company get ahead, like cloud-based software companies, or if it will the hurt valuations (e.g. commercial property and housing stocks)

If you own Telstra shares, I strongly recommend you watch the video above and follow along as we take a look at its key financials below. Please note: I’ll do a brief analysis here, you (or your analyst) can do the rest.

Balance sheet

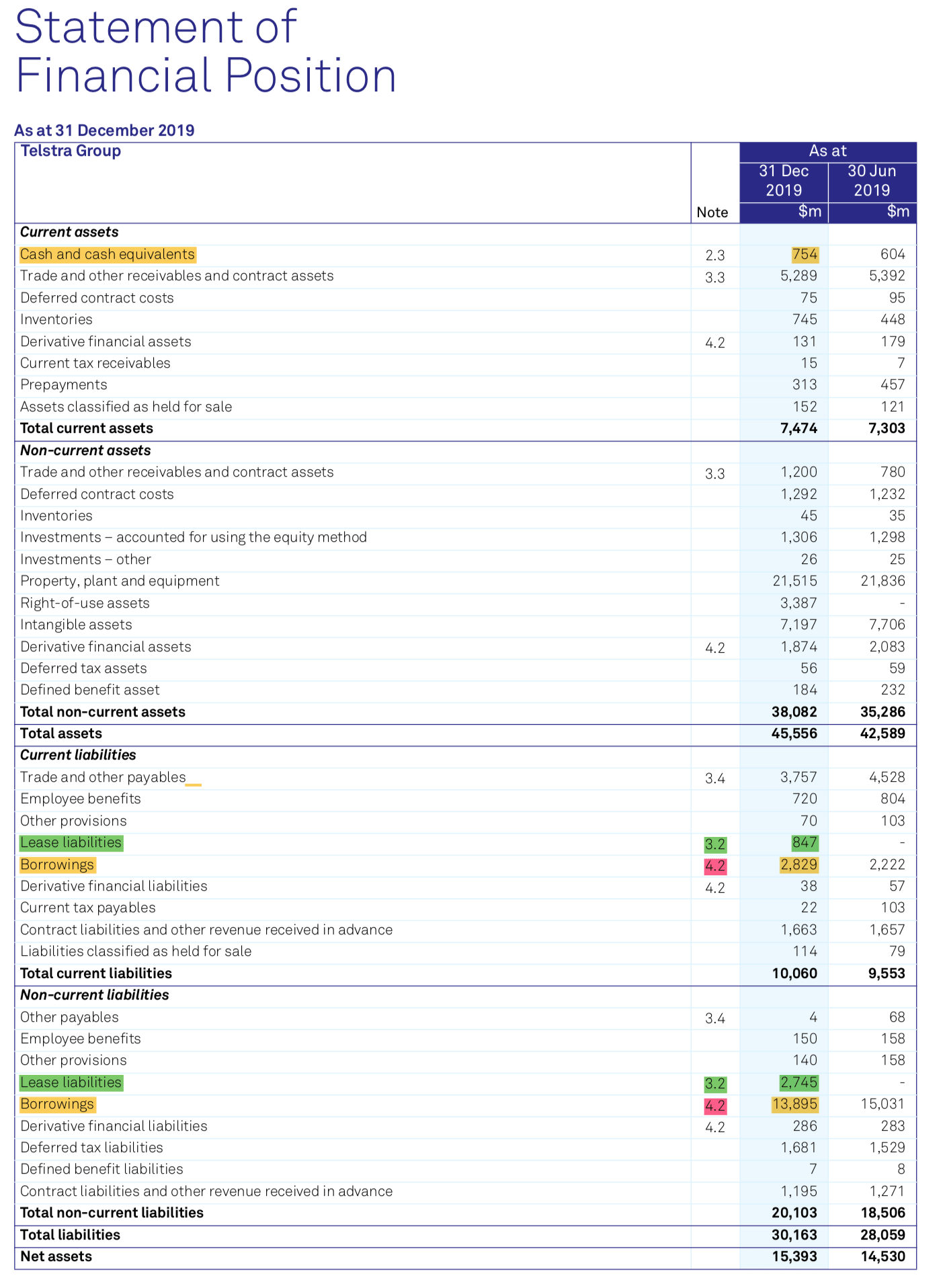

Here’s Telstra’s balance sheet as at 31 December 2019. You can zoom in to see it in closer detail what I’ve highlighted.

From this, we can see Telstra was in a net debt position of ($754 – $2,829 – $13,895) $15,970 million. However, according to the Notes, the company actually had net debt of $17,881 million because it includes leases in the calculation.

This explains why the company paid $483 million in finance costs during the half-year!

Telstra has capacity for another $2,950 million in undrawn debt facilities.

In terms of the maturity of debts and leases, $880 million of leases are due to ‘mature’ in the next year, and the “current” portion of borrowings (from the balance sheet) tells you what’s due to mature sooner rather than later.

Note: I haven’t mentioned the possible currency impacts from having debts in different currencies, or delved into working capital. That’s an article or video in itself.

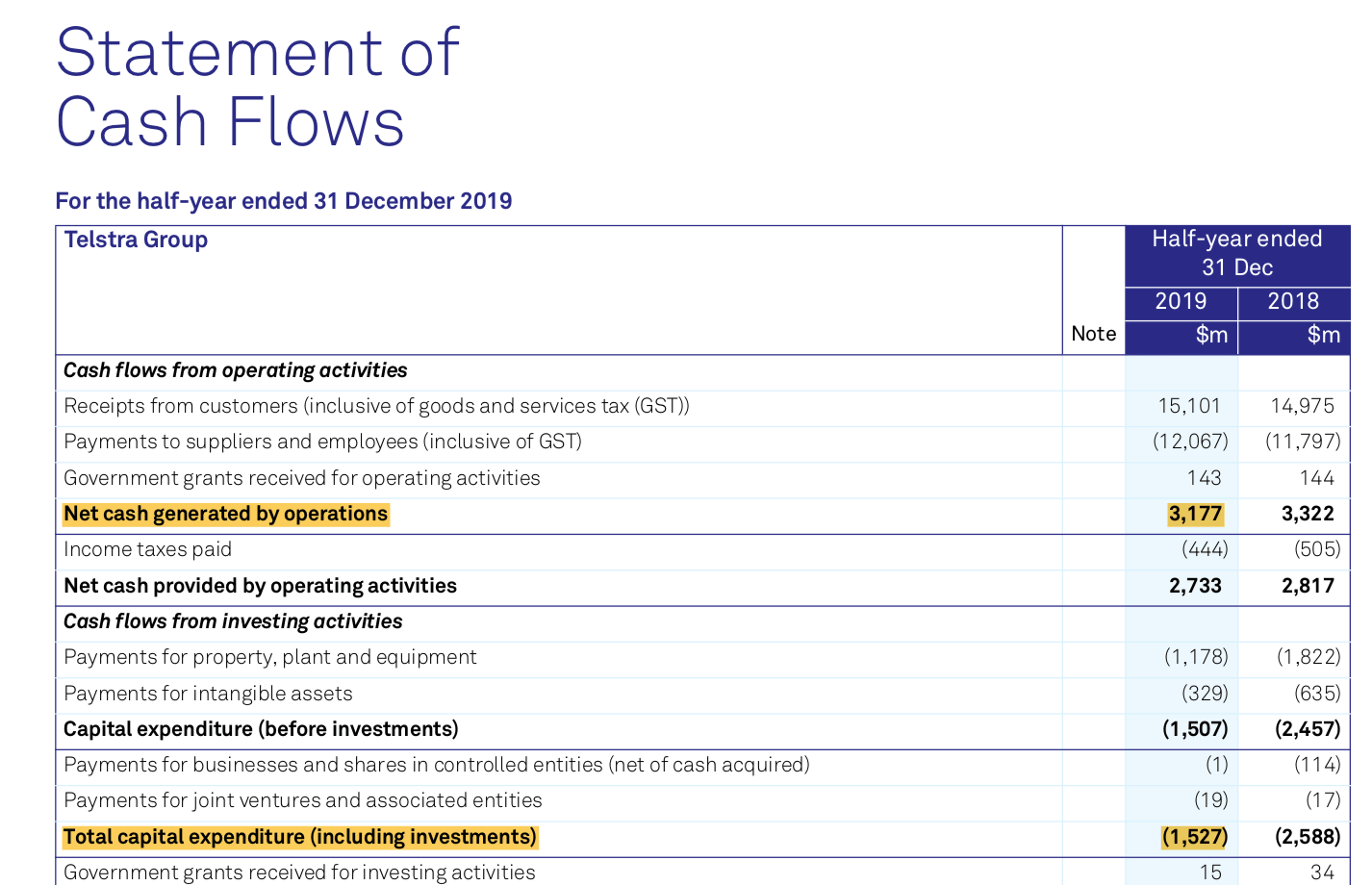

Telstra’s cash flow

While debt adds unnecessary risk to investing (in my opinion), one of the great things about debt and leverage is that your company looks great in good times…

By my numbers Telstra generated $1,650 million of free cash flow during the half year, which is a lot. However, please keep in mind that happened in the past. If you’re looking to value a company in the hope of investing today you likely (but not always) need to make inferences or forecasts of the future.

How will Telstra’s cash flow hold up as the economy enters a recession? I think it’s fair to say it will be affected. It’s just a matter of how far will it drop.

Optionality

Telstra is the mobile network provider of choice and is rolling out superfast 5G mobile towers across the country. The TPG and Hutchison Vodafone Australia (ASX: HTA) alliance, and Optus, are planning to do the same.

With its financial clout, Telstra should be able to use an economic downturn to get ahead of its competitors.

That said, we need to balance the short-term risks of COVID-19 and its high fixed costs against what’s likely to be achieved from rolling out 5G mobile.

While 5G mobile is a great development for consumers and businesses like mine (i.e. those which operate online), a lot of benefits from faster internet will be soaked up by customers… but Telstra has to foot the bill on the 5G rollout.

Verdict: Telstra

The analysis in this article is too shallow for me to tell you exactly whether Telstra is a buy, hold or sell but at least it gives you a sneak peek into what’s required to properly understand the financial risks facing Telstra in the short run. Then, of course, we have to consider how it responds when the world eventually returns to normal and provide a valuation based on cash flow.

Right now, I’m avoiding every company with high amounts of debt and those which are not in a net cash position. Telstra’s fixed costs are way too high for me to have enough confidence that it’s worth devoting more research time to for our Rask Invest members.

If you want to know the names of three companies I would consider buying (or already have!) grab a copy of our free investment report below. You’ll have access to the report when you create a free Rask account.

[ls_content_block id=”14948″ para=”paragraphs”]

Disclosure: At the time of publishing Owen does not have a financial interest in any of companies mentioned.