Are industry super funds like AustralianSuper and Hostplus still a no-brainer for Australians? Jamie Nemtsas explains.

At this point, daily Australian sharemarket volatility exceeding 5% has become accepted, in fact bond yields are now exhibiting more volatility than shares. One if our biggest concerns actually relates to those who aren’t clients of Wattle Partners, in particular those who don’t have access to professional financial advice at this very difficult time.

Whilst we aren’t blaming the Royal Commission, it has come at an incredibly difficult time for retirees and investors in general. Thousands of advisers are leaving the industry or dealing with additional compliance at a time when they should be 100% focused on guiding clients through this volatile environment. We decided to call Australian Super this week to enquire on our small investment in their balanced fund, which has fallen over 25% in the last three weeks.

After spending several minutes on hold, we were informed that they were no longer able to process changes to investment options over the phone and guided all investors towards their mobile application or website. This is a little concerning given many of their members are 70+ years old and in our experience may struggle in dealing with this type of technology.

We have been inundated with calls and emails from readers of our newsletter who have decided that they need to ‘protect’ what they have left by moving their entire investment options back to cash; at what is most likely to the worst such time to do so.

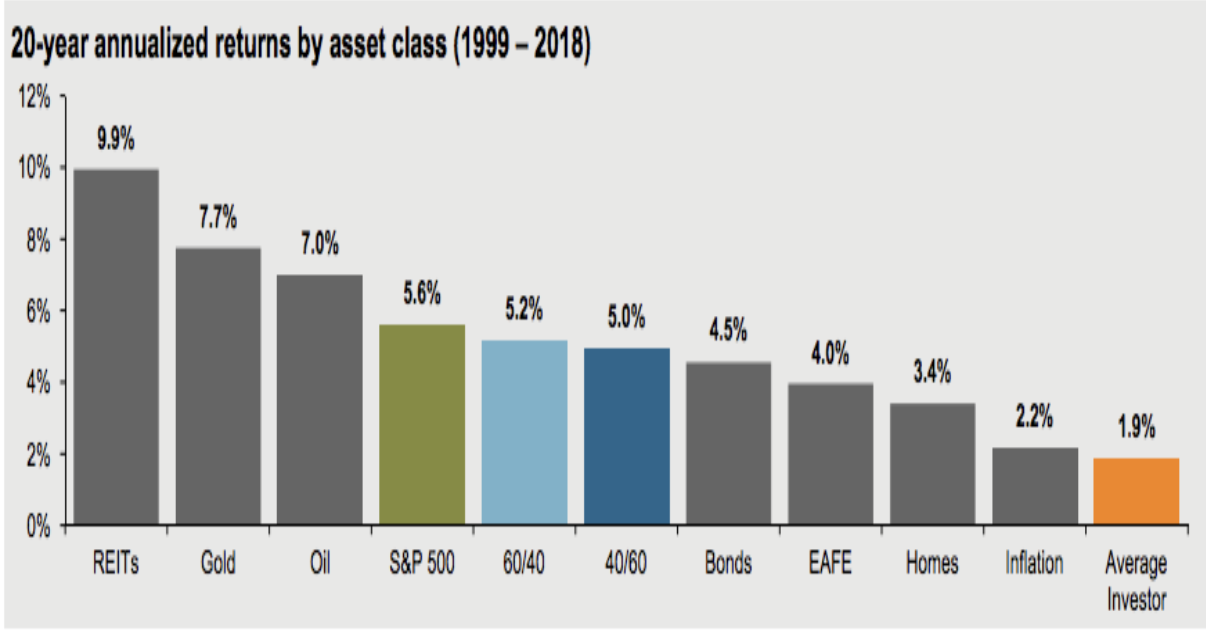

The chart below from JP Morgan evidences the risk of making this decision, in that it explains why the average investor consistently underperforms the funds and assets they invest; this is solely because they tend to change strategy at the top and bottom of the market. The chart plots each asset class from left to right, with the average investor on the far right, with a return of just 1.9% per annum over 20 years.

This leads us to a secondary concern regarding the industry fund sector, which we believe may be driving the huge amounts of volatility being experienced in Australia and around the world. It’s important to disclose that we are proponents of the traditional balanced fund approach for many younger, smaller balance investors, as we understand they are built for accumulating capital, not drawing it down and carry an inherently higher risk investment philosophy.

What concerns us most, is the many retirees and pensioners who move to Australian Super chasing their returns (which interesting still only show up to 30 June 2019 on their website), but are now in a position without any access to advice and having seen a substantial drop in the value of their life savings.

We have attempted to summarise our various concerns succinctly in the following sections:

- Lack of transparency: We have consistently queried the transparency and reporting capabilities of the likes of Australian Super, based on our long-held concerns that their strong returns were being delivered by taking substantially higher risk than many of their older members expected. In times of volatility, humans value information and knowing exactly what it is that’s driving performance both positively and negatively. Outside of a generic top 10 holdings list or out of date strategic asset allocation table, these funds offer very little transparency at a time of need.

- Liquidity concerns: This and the next issue were highlighted very well by Robert Gottliebsen in today’s Australian, where he opined on the issue facing industry funds that offer same or next day investment option switches to their millions of members. This is of course fine when the underlying assets are liquid, like cash and shares, however, a liquidity issue emerges when as much as 30% of the typical Balanced option is now invested in things like private credit, junk bonds, property, infrastructure and venture capital, which simply cannot be sold. The result has seemingly been many industry funds having to sell down the only liquid portion of their portfolios, Australian and overseas shares, in order to fund investment switches and redemptions; leading to mayhem in investment markets. Interestingly, many funds faced a similar liquidity issue during the GFC, as their model of internalising sharemarket investments meant they were required to fund the cost of hedging their portfolios, which spiked dramatically as the AUD fell.

- Valuation concerns: This was similarly highlighted by Gottliebsen when he suggested that all industry funds should be spending the weekend undertaking a real valuation of their unlisted asset portfolio or risk the potential for legal action from their members in the coming years. His concern, like ours, is that many unlisted assets are likely to be overvalued in this environment, meaning that those redeeming an investment option, maybe leaving a lesser valued asset and disadvantaging those who stayed put. His specific example focused on the concept that there are two office buildings next to each other, one is listed, the other is unlisted; the listed one has fallen 30% in value over the last 12 months, but the unlisted has not moved at all. If you then transfer the unlisted assets to someone else, you are passing on a capital loss to that person.

- Reliance on contributions: This is closely related to our liquidity concerns expressed above, with our issue being that the huge capital flows into industry funds, which total several billion dollars per month in the form of Super Guarantee contributions, have been a primary source of liquidity. This constant flow of cash has meant they are able to invest more into unlisted assets with the knowledge that pension payments will be covered by incoming contributions; but what if this stops. Or what if investors become concerned about the performance of their fund and all rush to withdraw their balance at the same time. Does the sector face a bank run type event that would require them to freeze redemption requests?

- Inability to take targeted action: Another major concern is that investors within these funds have very little scope to make targeted changes to their portfolios. They have very few investment options to choose from and the few options available have vastly different risk profiles. Take for instance Australian Super’s Balanced Option, which has 90% in risky assets, the next closest option, Index Diversified, has a 70% allocation to risky assets. In recent weeks we have been advising clients to consider hedging their overseas shareholdings, introducing allocations to gold bullion or removing long duration bonds, all of which would alter their asset allocation by no more than 5%, but vastly reduce the risk. These small changes are simply not possible via large industry funds.

- Lack of access to advice: Our biggest concern was highlighted in the introduction, being that these funds now have many millions of individual members simply do not have the staff, technology, experience or the licensing to provide professional financial advice at the time of greatest need. They can advise on investment switches but are not able to explain the potential implications, loss of benefits and compounding of losses that will occur.

If we can provide one small piece of advice to investors within industry funds carrying large unlisted asset exposures, it would be to maintain your current ‘market’ exposure, but shift your investments into the Australian shares and International shares investment options. We have serious concerns about the current search for liquidity and its impacts on unlisted, private holdings within Balanced options.

We hope this has provided some unique insight into the sector and one of the many reasons that markets appear to be behaving irrationally during this stressful time.