If you think it’s time to start putting money to work in great companies, you’re not alone. Here’s why I’ve got Microsoft Corp (NASDAQ: MSFT), Adobe Inc (NASDAQ: ADBE) and Morningstar Inc (NASDAQ: MORN) on my COVID-19 watchlist.

Why investing in global stocks just works

The average Australian investor has a severe case of “home country bias” which sees too many of us keep the overwhelming majority of our money invested locally. The problem is 98% of the world’s companies are not Australian. We can’t invest directly in companies like Microsoft (MSFT), Adobe (ADBE) or Morningstar (MORN) on the ASX.

Going one step further, I’d be willing the bet the three most important products or services in your life today were not developed by Australian companies. Think iPhones, computers, televisions, medicine… some of these things might be made here, but the innovation likely comes from overseas.

The popularity of Australian ETFs, such as Vanguard’s US Total Market Shares ETF (ASX: VTS) and the iShares S&P 500 ETF (ASX: IVV), has made getting overseas exposure as simple as just a few clicks.

I would be happy to use either of these ETFs as part of a “core” exposure to global stock markets.

However, through my brokerage account (I use a big bank share broker) I can buy and sell global stocks in virtually the same way I can trade ASX-listed shares and ETFs. And because I’m dollar-cost averaging and investing in the greatest companies I can find, for 10+ years, it makes sense for me to look past temporary factors such as ‘what’s the Australian dollar doing?’ or the requirement to fill in a W8-BEN tax form every now and then to buy US and global shares.

Think about it this way: instead of buying the 10th or 20th best online design company because of the complexity of investing overseas, anyone can open an international share trading account and buy the world’s best: Adobe.

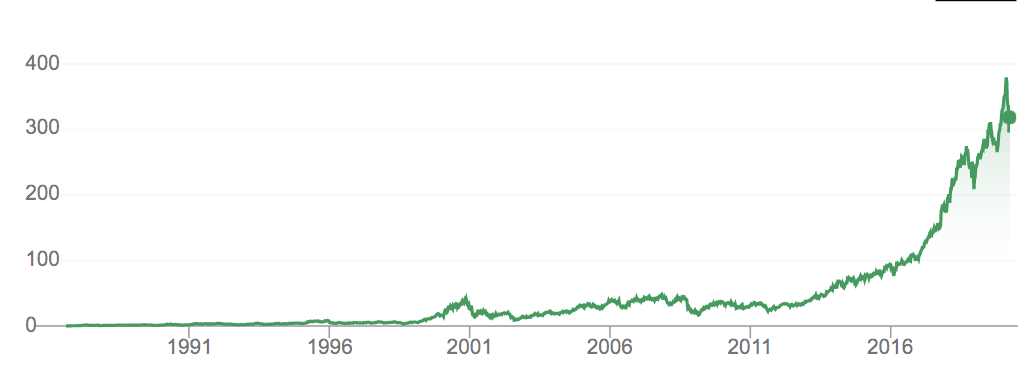

ADBE stock price

Adobe stock is up from 22 cents in the 1990s to over $300 today — but that’s before we include all of its stock splits!

Adobe is the company behind many of the world’s leading design and development tools, such as Photoshop, After Effects, Acrobat and Creative Cloud (its cloud-based products). Adobe is the reason our websites look good and we can create custom animated finance videos like this:

With a long-term management team in place, including a CEO who has been with the company since 1999, Adobe has prepared for the long-term by positioning its tools in the cloud and selling them via subscriptions. Adobe has cash of around $4 billion and no long-term debt, and it’s currently spewing out high amounts of free cash flow.

Another company which has been very successful in taking its business to the cloud is none other than Microsoft.

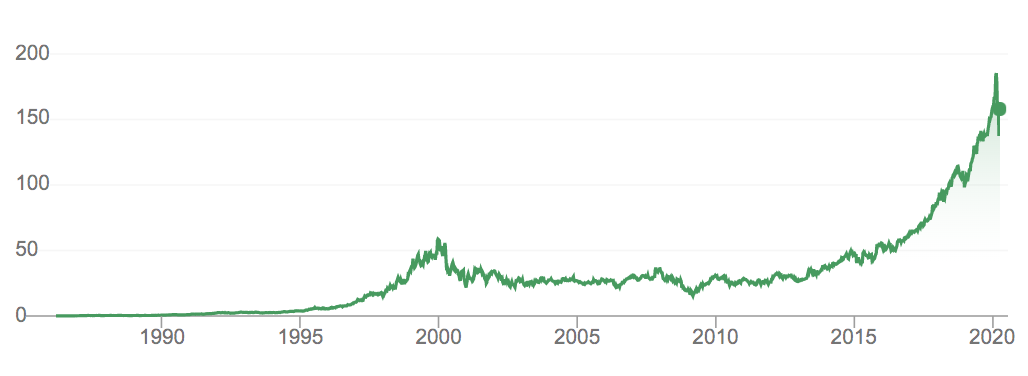

MSFT stock price

As Drew Meredith wrote on Rask Media last week, Microsoft’s very first NASDAQ stockholders would have an average cost of just 9 cents per share, which compares to today’s stock price of $157!

Microsoft makes so much money in so many ways that it’s hard to do them all justice here. The major thrust of the company’s next generation of tools will be found in the cloud and cloud computing. Microsoft 365, Azure, Teams and so many other online-only tools are basically a licence for Microsoft to print money.

Billions of users are already familiar with Office, LinkedIn, Skype and its many brands. However, the real story behind Microsoft’s recent success was the push by CEO Satya Nadella, who took the reigns in 2014, to move all of its sticky software to cloud-based subscriptions (a SaaS style model).

Despite being a trillion-dollar company, Microsoft’s valuation isn’t outrageous, especially when we consider how fast its cloud-based revenue is growing, the stickiness of its customer base, its wide profit margins and annuity-like free cash flow.

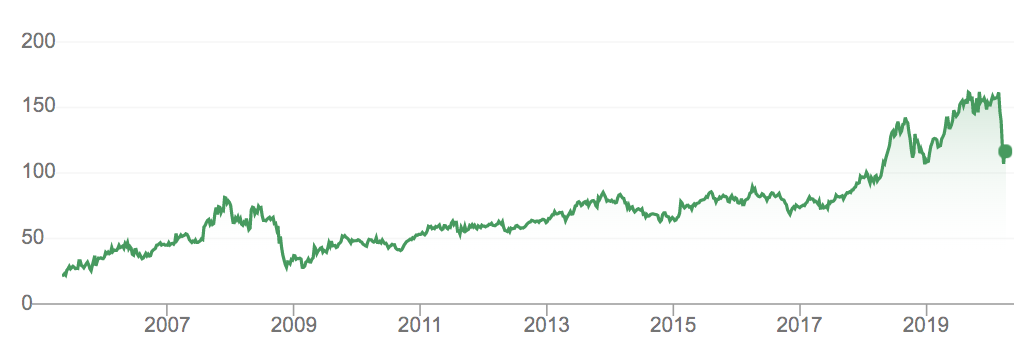

MORN stock price

Morningstar IPO’d its shares in 2005 and they have risen from around $20 to over $100 today.

Morningstar is not like Microsoft or Adobe, and I could have chosen any of the larger Wall Street data providers and research houses — Moody’s Corporation (NYSE: MCO), MSCI Inc (NYSE: MSCI) or Standard & Poor’s (NYSE: SPGI).

Morningstar is a small-cap by global standards, with a market capitalisation of less than $5 billion. Morningstar provides independent research and tools for financial professionals and investors around the world.

What many smaller investors don’t know is that these leading data providers are deeply entrenched in the financial world because advisors, fund managers and analysts rely on them to provide tools that they cannot generate themselves. This allows these companies to reach further into the pockets of professionals and generate good profit margins for shareholders.

Buy, Hold or Sell

Considering the merits of investing globally is a no-brainer for any stock market investor who plans to buy-to-hold some of the world’s best companies for 10 years or more (as I do). These three companies are just examples, ranging from the world’s leading blue chips to a ‘small’ financial data company. I have each of these stocks on my Rask Invest watchlist for our members, and I don’t own any… yet!

If you want to get the names of two stocks I do own and another I’m likely to buy soon, grab a copy of our free investment report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: at the time of publishing Owen does not have a financial or commercial interest in any of companies mentioned… but possibly will buy some soon!