The S&P/ASX 200 (INDEXASX: XJO) flew 2.5% higher on Tuesday morning as companies like Computershare Limited (ASX: CPU), Afterpay Ltd (ASX: APT) and ANZ Banking Group (ASX: ANZ) snapped back.

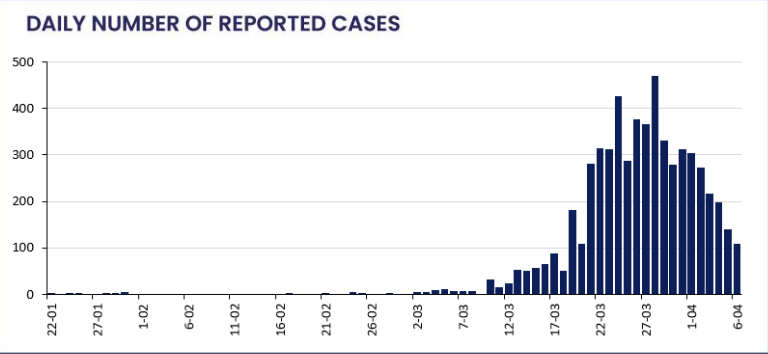

The ASX appears to be bouncing back as the number of Australian confirmed COVID-19 cases begins to show more promise. Remember, the stock market is ‘forward-looking’. So at any one time ‘it’ is trying to predict what comes next for businesses listed on the market.

While it is far too early to let our foot off the containment measures, the number of new cases falling could signal that we are, potentially, getting on top of things.

ASX 200 Movers Today

1. Afterpay Touch Group Ltd – up 6%

Afterpay Touch is the owner of the popular “buy now, pay later” app. As of 2020, Afterpay had over 7.5 million registered users worldwide, making it one of Australia’s true technology success stories.

Afterpay has been one the of most volatile shares on the ASX, falling from over $40 to below $10 and back to $22.

As our lead analyst wrote last month, Afterpay is a tough share to value due to the nature of its business as a short-term lender to consumers. That said, Afterpay accounted for more than 10% of all Australian e-commerce (aka online sales) in 2019. Meaning, it has clear upside potential if it can move past a spike in bad debts.

2. Computershare Ltd

Computershare is best known for its share registry services and employee share plans, but also provides mortgage services. It was founded in Melbourne in 1978 and has now become a global business with over 75 million customer records and 12,000 staff.

This morning, Computershare updated shareholders and the market on the COVID-19 response plan and profit guidance. Computershare said it now expects its “management EPS” (their version of profit per share) to be 20% below the profits achieved in its 2019 financial year. This compares to the previous forecast of a 15% fall.

“We have been implementing a number of measures to reduce operating risks and ensure the delivery of critical projects for our clients globally,” Computershare CEO Stuart Irving said. “The latest interest rate cuts were earlier than we anticipated. Coupled with reduced transactional revenues and foreclosure suspensions, earnings will be impacted.”

All things considered, Irving said there are some green shoots and reasons to be optimistic about the future.

“Whilst some of the transactional volumes are more challenging to predict in this environment, there are a number of opportunities in other parts of the group, and our strategies to build strong businesses with solid long-term growth prospects are intact.”

3. Australia and New Zealand Banking Group

ANZ is a leading Australian and New Zealand banking institution, with a presence throughout the oceanic region. ANZ is one of the Big Four Aussie banks and derives much of its revenue from mortgages, personal loans and credit.

Up 2.7% today, ANZ shares were amongst the financial stocks leading the ASX higher this morning. This is despite news out of New Zealand last week that revealed the Reserve Bank of New Zealand (RBNZ) would require locally incorporated banks to avoid redeeming capital notes (hybrids) and refrain from paying dividends.

The bank said: “ANZ Bank New Zealand Limited (ANZ NZ) has announced that the RBNZ’s decision will prevent it from redeeming its NZ$500 million Capital Notes on 25 May 2020, although it is able to continue to make interest payments on those Capital Notes.”

Recently, major banks were converting hybrids and convertible notes to shares at a time that could ultimately prove to inflict severe damage to the end investors who were told by their adviser or a financial professional (e.g. columnists who write for Australian Financial Review) to invest in them. While it is legal to convert these debt-like investments into shares, our opinion has long been that convertible notes are not suitable for the overwhelming majority of investors.

The bottom line is that it would be reasonable for bank investors to question if their dividends will be cut in light of the COVID-19 outbreak. As our Rask Invest analyst recently wrote, it’s likely dividends will be cut and bad debts will increase in the near term. You can read his article here: “What holders of CBA shares & NAB shares can expect next”

[ls_content_block id=”14947″ para=”paragraphs”]