In my opinion, RPMGlobal Holdings Ltd (ASX: RUL) is a hidden ASX small-cap share worthy of your attention.

I first recommended RPMGlobal to our Rask Invest members

back in April 2019 at a price of around $0.59 per share.

Before I get into the specifics of why we like — and still own — RPM, it’s worth noting a few things:

- Investing in small-cap shares, like RPM, can be risky. Please keep that in mind when it comes to position sizing. For example, I initially opened a 2% position, but that has since grown thanks to a second purchase and share price growth. Small caps also require a higher level of research before you invest. You must also have thick skin and consider how you will cope with high levels of volatility.

- This investment idea is provided for general information purposes. It’s not personal financial advice. Please check with your financial adviser if you’re confused about what this means or what your needs, risk profile and goals are. If you don’t have a financial adviser, I know one who refunds all commissions back to their clients. You can email me.

RPMGlobal (RUL): My small-cap ASX stock pitch

Tune in now: iTunes – Spotify – Castbox – YouTube

If you haven’t already tuned in to my latest podcast, please consider clicking any of the links above as I recently detailed my investment process and the thesis for buying RPMGlobal shares. You can click this link to subscribe for free to our latest stock videos on YouTube.

My investment process

My/our investment process is unashamedly simple and has been covered in great depth as part of our Value Investor Program. Our overarching investment philosophy is that every good investor is a value investor because we are all trying to buy assets (which grow and pay dividends) for less than they are worth.

At Rask, we like to think of ourselves as ultra-long-term investors who buy shares in companies that are often ‘too extreme’ (for lack of a better phrase) for stereotypical “value investors”. The companies we buy must tick these boxes:

- They sit within our circle of competence. As Warren Buffett would say, we’re not looking to chase stocks into industries or areas we have no business investing. We’re seeking intellectual one-foot hurdles and invest with conviction when a company is deep within our domain of expertise (e.g. software, technology, health-tech, fintech, financials).

- We only invest alongside company management if we believe they have integrity, energy, and talent. Finding CEOs and boards with “skin in the game” is not enough. You want to invest with managers at the intersection of the three factors above. If they have those three traits, they’ll likely be owners of stock in the company they run.

- The company must have a competitive advantage/moats. There are different types of “moats”, each varying in strength and durability. Broadly, moats can be bucketed as follows:

- Network effects

- Regulatory & licensing

- Location & efficient scale

- Scalability & stickiness (mission-critical, business-to-business technical distribution, etc.)

- Brands. As an aside, nowadays, I think consumer brands are not nearly as durable as they once were because information discovery — think e.g. Amazon reviews — happens much quicker than in the past. We also have strong consumer protections, which take care of purchasing risk (e.g. Aldi return policies).

- The company must have a large, valuable and growing total addressable market (TAM). If you’re hunting for multi-baggers, companies capable of growing viciously over many years, you almost always must find a company with long-term growth potential in an emerging or large addressable market (TAMs). I think a rising tide can lift many boats, so investing where the wind is blowing be provide some downside protection if you back the wrong horse.

- Finally, the shares must be reasonably valued. As I say, we believe there’s no such thing as a value investor. However, there are a lot of people and market participants who know the price of everything but the value of nothing. I spend 95% of my time reading, thinking and learning about businesses and probably 5% of my time goes into modeling. I believe spending more than a day modelling the types of companies I buy is a massive misallocation of our research time — especially for an initial investment decision. That said, we’ll happily buy ‘cheap and good stocks’.

Searching for needles in a haystack

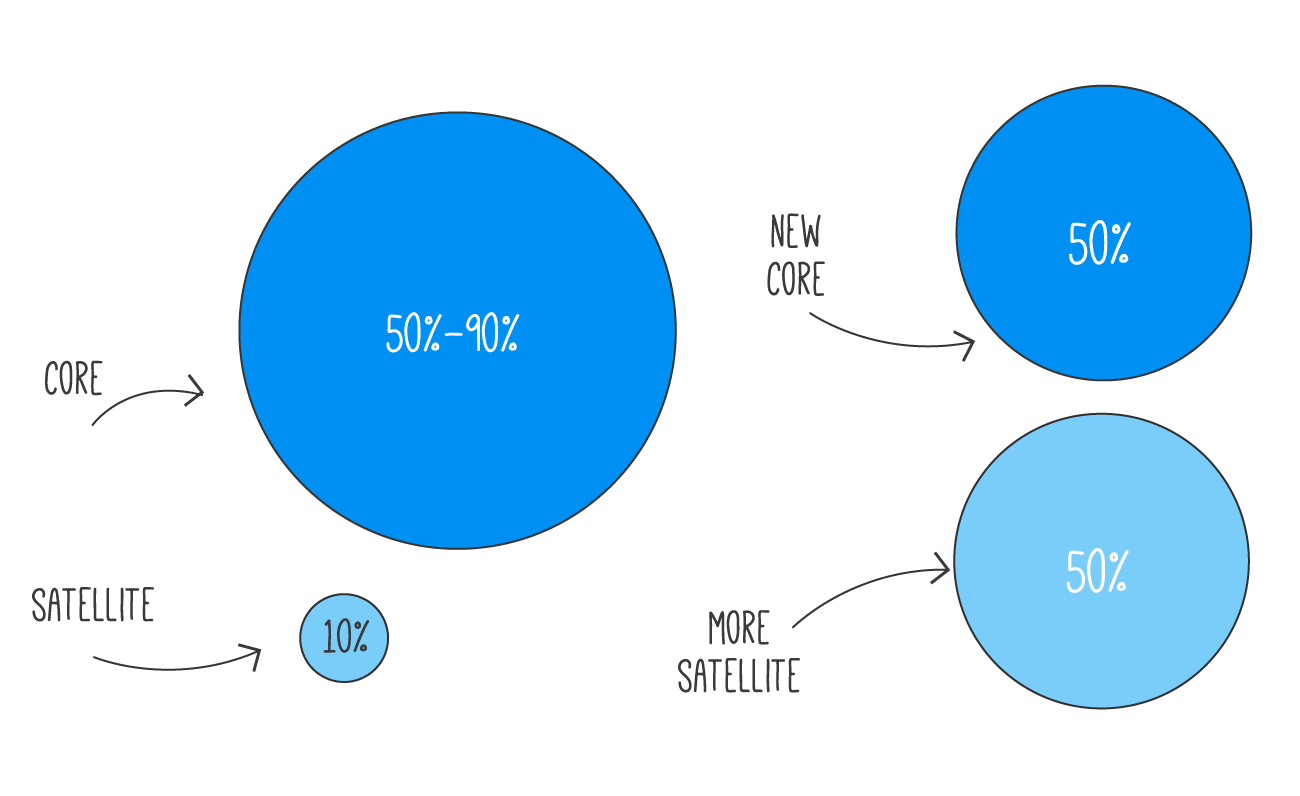

We combine our individual stock exposures, like RPMGlobal, with low-cost core exposures to markets, which will include low-cost ETFs, managed funds, cash (e.g. term deposits) and unlisted assets (e.g. property). New investors would be wise to start investing by building up their core exposure. Then, over a typical 5-year investing apprenticeship (by trial and fire), a newer investor can begin to increase their allocations to more active positioning, as shown below:

We invest actively in individual shares because studies show just 4% of stocks on the sharemarket account for all outperformance. Some people say individual stock investing is like “finding a needle in a haystack”. We agree.

We invest actively in individual shares because studies show just 4% of stocks on the sharemarket account for all outperformance. Some people say individual stock investing is like “finding a needle in a haystack”. We agree.

However, instead of going completely passive, our take is that if you find a needle in a haystack: never throw it back into the stack!

If you find a company capable of compounding viciously over many, many years don’t sell it too soon. Never sell a stock investment for a non-investment reason (e.g. “the share price has risen too fast” or “I’m worried I could lose money”).

Our analysis of RPM Global

The following analysis walks you through our analysis of RPMGlobal. Although I published the research over a year ago to our members, when the shares were well below their current price, I’ve updated the material and to this day RPMGlobal remains an active Buy idea inside Rask Invest.

I hope you enjoy it!

“During the Gold Rush, most would-be miners lost money, but people who sold them picks, shovels, tents and blue-jeans (Levi Strauss) made a nice profit.” – Peter Lynch

As all Rask Invest members will know we/I am not the biggest fan of resource businesses because they are more often than not price takers. Moreover, early-stage resource businesses can have terrible economics.

Just imagine the cost and risks involved in exploration, planning, financing, design… the list goes on. Then, it often takes years before a mine is off (or in!) the ground. But the risks don’t end there. Commodity prices can swiftly drop below the cost to produce one tonne, ounce or gram of whatever it is that you’re selling.

While essential to society — and it can be extremely profitable at times — mining is a very tough business.

Fortunately, as Lynch famously said, there are fantastic businesses operating in adjunct industries to mining that can meet all of my requirements for a high-quality investment. RPM Global is the name of the company that receives this tick of approval.

From The Pilbara To Sydney & Then The Clouds

Over 40 years ago (1977), Dr Ian Runge started Runge Associates as an adviser/consultant to mining companies. It didn’t take long for Runge to recognise the future of mining and consulting was not in the digging and drilling but in the modern software and technology used by the miners. A change was underway and Dr Runge didn’t want to get left behind.

In the 2000s, as consumer technology was taking off, Runge knew he needed more capital to make his dream a reality and so the company listed on the ASX.

“Unfortunately, the global financial crisis hit less than 6 months after the IPO, followed just a few years later by the collapse in commodity prices. The timing wasn’t ideal,” he said in announcing his retirement in 2018.

From 2007 to 2012 the GFC created massive headaches for just about every company in Australia. The exception, however, was the resources sector. The likes of BHP, Rio, Fortescue, Shell, BP and Glencore were still investing heavily as they rode the tailwind of China’s infrastructure boom.

The tide turned in 2012, as commodity prices hit the skids and miners went into damage control.

Fortuitously, an innovative and enterprising technology executive named Richard Mathews was on the lookout for a new company to call his own. His bread and butter was enterprise software.

It seems to me that Mathews could see how lucrative but how far behind mining software was from other sectors and the opportunity that was available to the right company.

As a consultant to the mining industry, Runge Limited already had its foot in the door with mining giants. The problem was the Runge consulting/advisory business was profitable and they were very good at what they did. So much so that it took a massive catalyst, the commodity price fall and a huge reduction in employee headcount for a tech executive like Mathews to be heard.

Having been a successful manager at J.D. Edwards (sold into Oracle) and the CEO of Mincom (sold to ABB), Mathews bought a wealth of managerial and technology experience. After taking a stake in Runge and becoming CEO, it was the firm’s marketing and technology efforts that become his unrelenting focus.

In 2012/2013, Mathews set in motion a mission to deliver an ‘off-the-shelf’ ERP system, otherwise known as an ‘Enterprise Resource Planning’ system, for miners. RPM’s mission was to create an open architecture that effectively allowed other pieces of mining software to ‘plug in’ or ‘talk’ to each other.

Managing Complexity

Lots of tech companies talk a big game about ‘managing complexity’ but few actually do it right.

The problem with mining is it’s extremely complex. You have geologists talking to chemical engineers talking to structural engineers talking to truck drivers talking to mechanics talking to accountants, sometimes in different languages and timezones.

RPM knew it needed to partner with the likes of SAP and equipment manufacturers to bring their miners’ systems to life. The way Mathews describes it, is akin to finally enabling data to flow ‘both ways’ throughout a mining project and company.

Automated trucks talking to financial planning software talking to design specialists talking to accounting. Here’s a video of Mathews explaining the benefits of an all-in-one ERP system:

It’s almost impossible to estimate how large the market opportunity is for RPM because, after six years of massive research & development spend, RPM offers mining software across 10 commodity groups (e.g. coal, iron ore, etc.) with different mining methods (e.g. under and above ground).

IMDEX (ASX: IMD

), another ASX mining technology company, estimates the market for mining exploration and development software could be worth as much as $US700 million per year.

Companies such as Rio Tinto have in the past announced $US5 billion ‘productivity’ improvements by increasing their use of technology and analytics. When we attended the Melbourne mining expo (in 2019) we witnessed the thrust behind large miners adopting innovative tech solutions).

In 2017 Rio said, “A total of 29 Komatsu haul trucks will be retrofitted with Autonomous Haulage System (AHS) technology starting next year.” The AHS system was designed by Komatsu and Modular, the latter being a technology partner of RPM.

You’re probably already starting to see the benefit of RPM’s open architecture.

At risk of waffling for too long, I want you to imagine a mine where the trucks drive themselves and get smarter as they move to an automated crushing machine, which loads ore on to an automated train before being loaded on a self-driving cargo ship. Now imagine that this is not the future. It already happens.

Watch this video to get a true sense of what’s going on in mining software:

Financials

I consider RPM Global to be currently near break-even or slightly unprofitable — one reason some investors don’t see it — and while its next two-to-three years are unpredictable, they are likely to be extremely volatile.

However, digging a little deeper beneath the surface in RPM’s financials we can see that its software business is profitable at the operating level and it has grown very quickly, despite transitioning to a subscription licensing model and reinvesting heavily back into R&D.

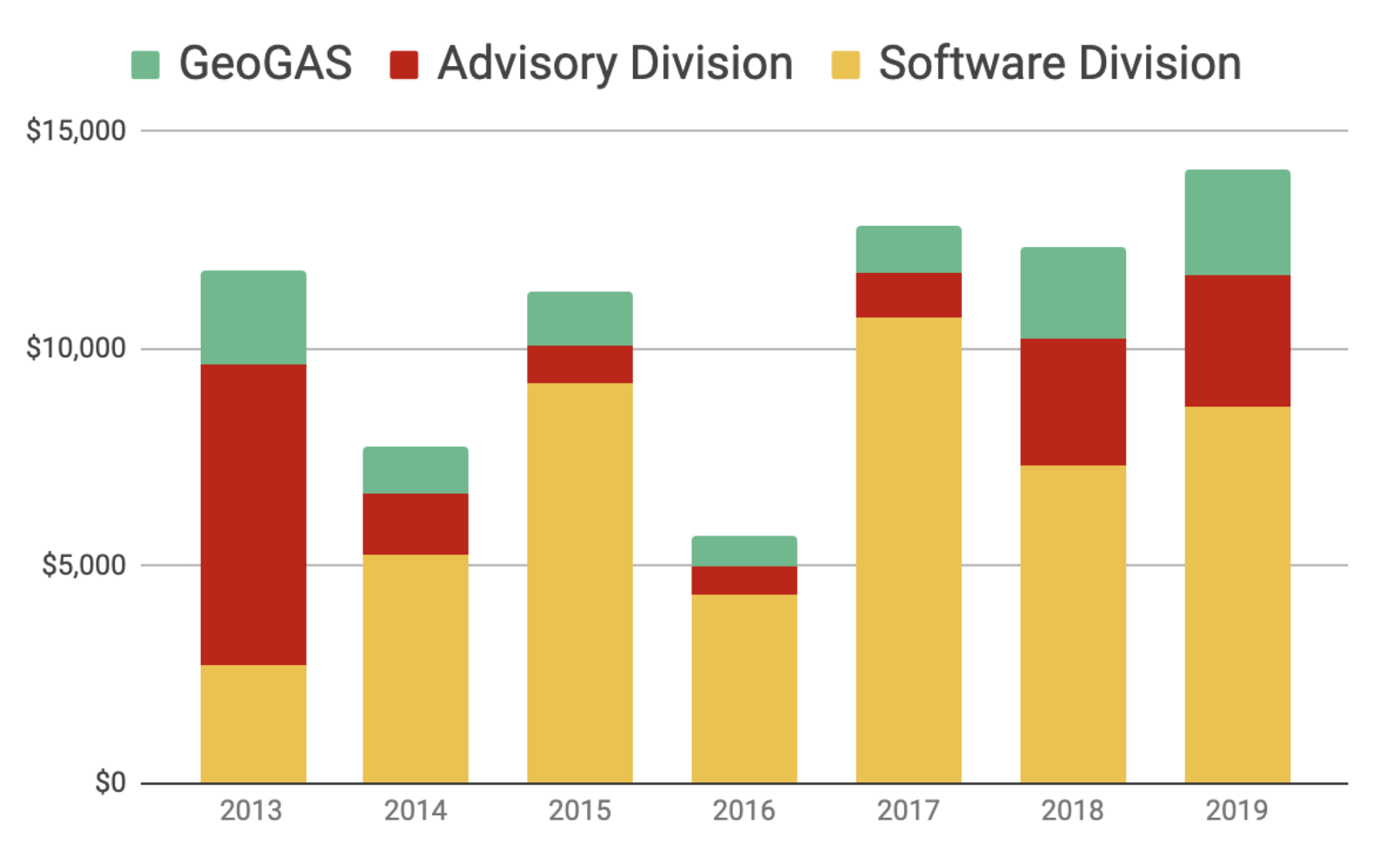

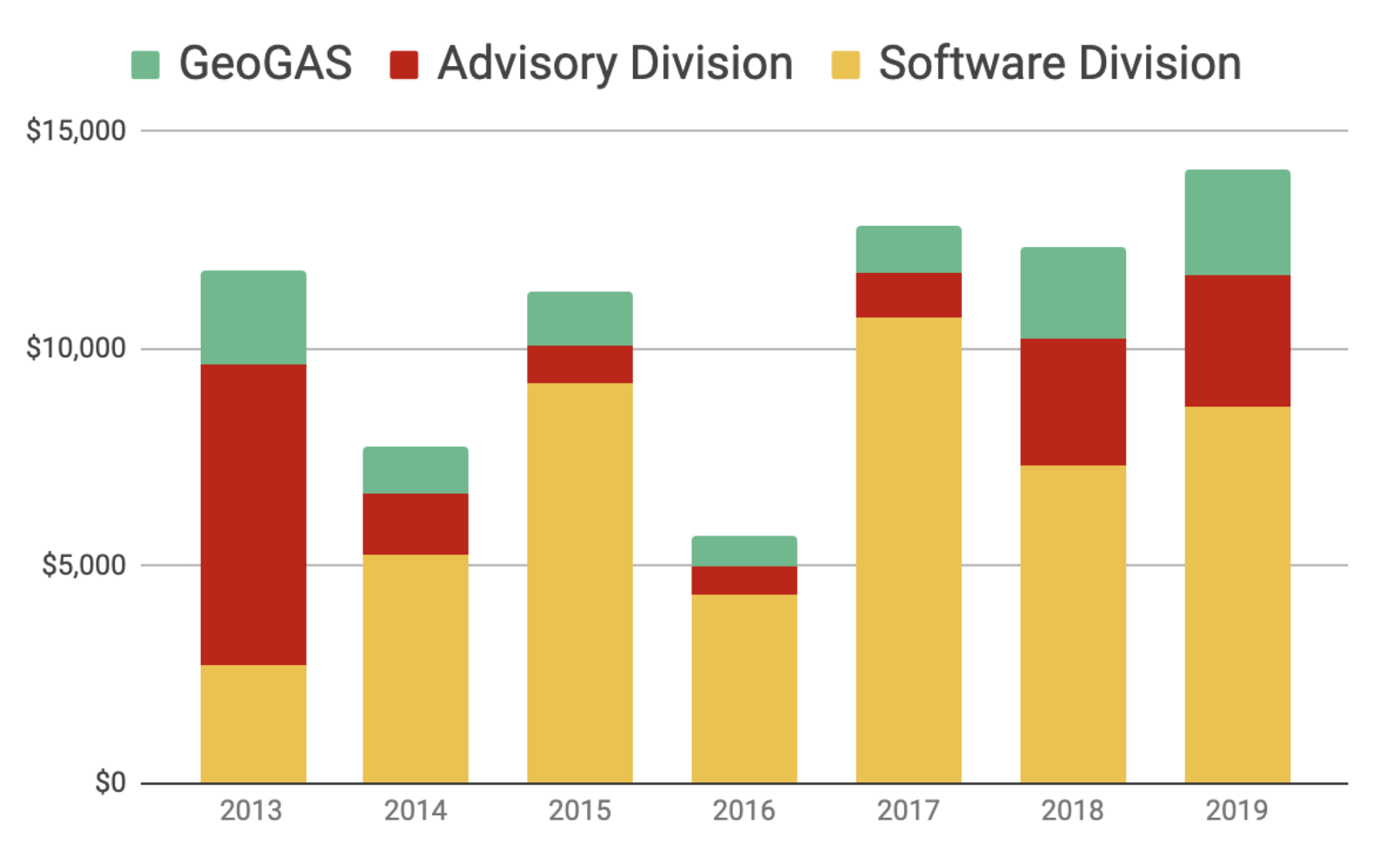

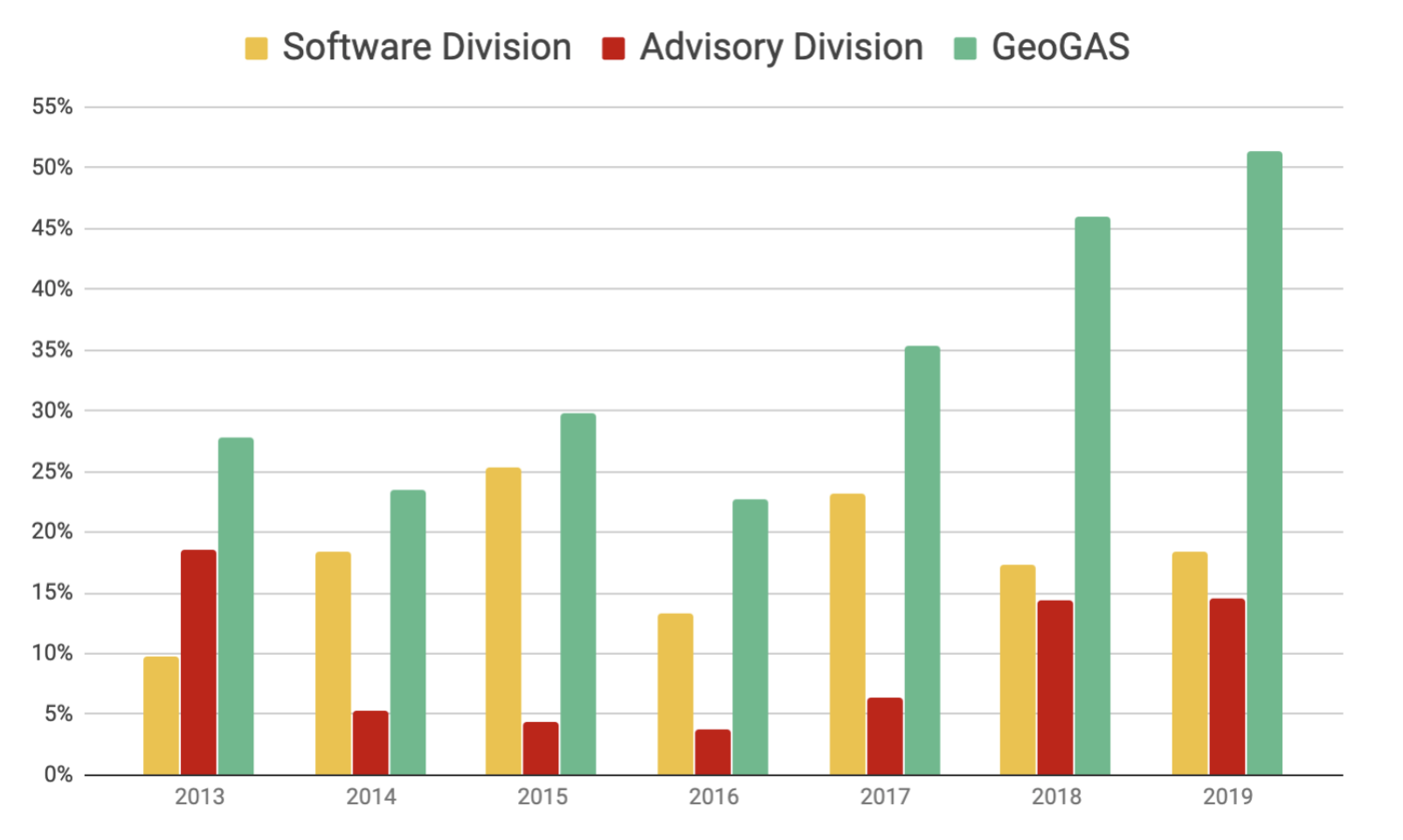

This chart (also shown below) shows the divisional or segment-level profitability.

If we turn to the cash flow statement, RPM Global is free cash flow positive. It makes cash despite growing quickly and rolling out new products.

The dichotomy between a lack of reported profits and positive free cash flow means that many investors who scan stocks for P/E ratios or profitability won’t see RPMGlobal’s potential until its too late. What’s more, investors who don’t know the true measure of profitability for tech businesses is indeed free cash flow will fail to appropriately value this business.

Speaking of cash, RPM has enough. At December 31 2019, the company had $24.5 million of cash and no debt. The company also has a focus on costs despite spending more than 10% of its revenue on research and development.

In the next one to two years, I expect RPM Global to be very volatile and results to appear patchy. That said, I think we’re slowly coming to the back-end of this patchiness, with a relatively modest impact from COVID-19.

You see, RPM Global has come through the final stages of its tech development pipeline and now has experience with its new sales model. That is, selling local and cloud-based software Subscriptions to miners. Right now, subscriptions are less than 10% of software sales.

While the subscription sales are quite small relative to total sales they are growing far quicker than the rest of the business. I think they will be highly recurring and very high margin in a few years.

To be clear, subscriptions can be a harder sell to mining customers. And keep in mind that a subscription business model means you do not take as much cash upfront. What you typically get in return is a very predictable cash flow stream which can last many years.

RPMGlobal updated the market in March 2020 to say its software subscriptions are now running at $11.4 million per year and it has a total contracted value of $25.4 million from subscriptions. Not bad for a company with an enterprise valuation of just ~$150 million.

Under the hood…

The following three charts show what’s going on under the hood of RPMGlobal.

The first chart shows revenue and the second chart shows profits at the divisional level (i.e. before head office costs and taxes).

RPM revenue

RPM divisional operating profit

What these charts really show is that the Advisory business had been the largest revenue contributor to RPM’s business but that business is tough going at the profit line. Advisory is labour intensive, low margin and new work is often subject to the whims of commodity prices or the mining cycle — something which is outside management’s control.

However, what you can also see is the software business is very profitable and getting more profitable over time. This was despite them spending larger and larger amounts of money on new development projects which impacted the software division’s profits considerably.

Indeed, the software business is very profitable (at the operating level) even though the overall company is not turning out a net profit. What’s why we believe investors are being offered such good prices on RPM shares right now.

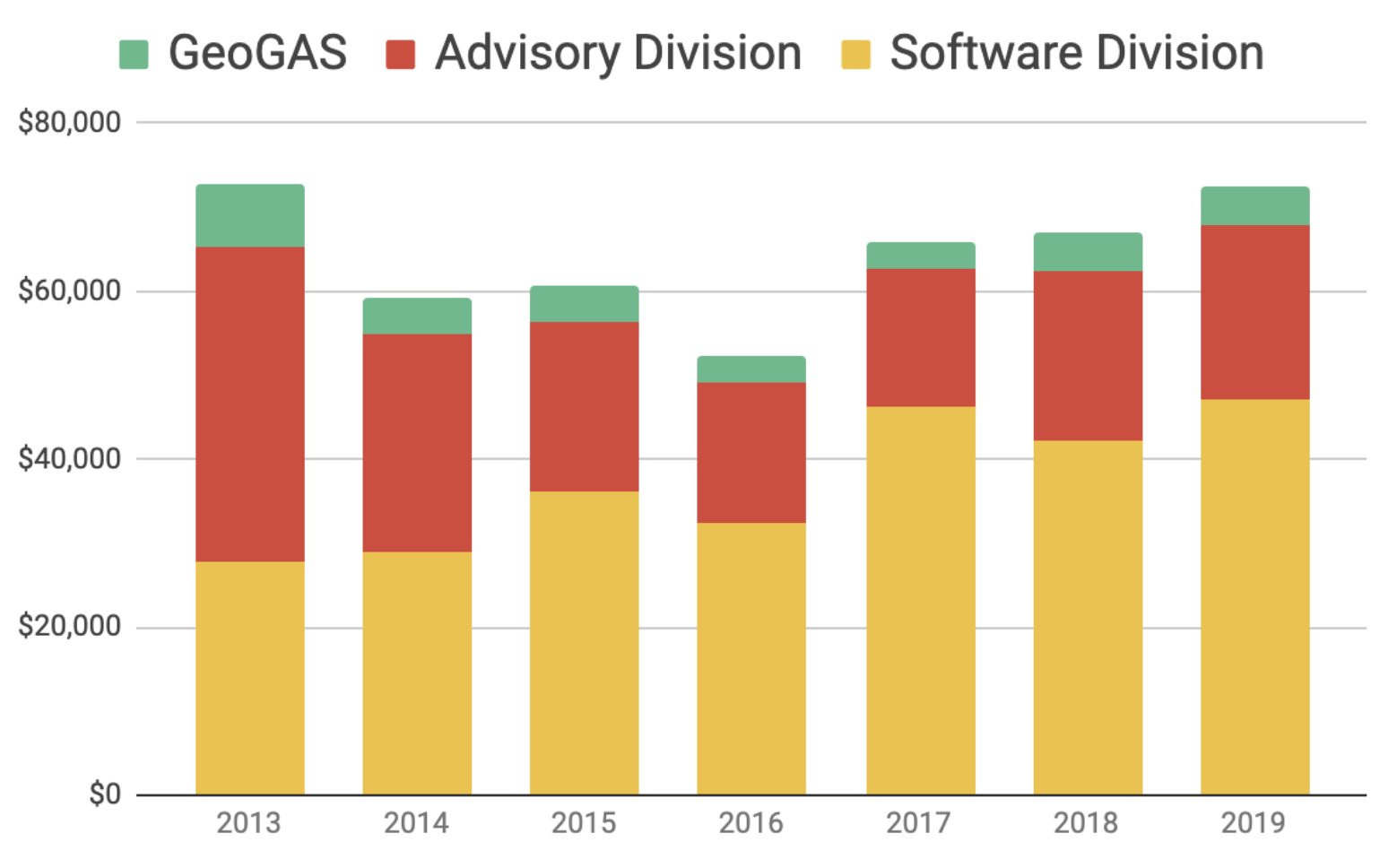

Profit margins

Above, you can see the benefits of RPM’s Advisory business (red columns) going through the recent cycle, the profit margins have tracked back towards 15%. Still, over the years we can also see the company’s software division (yellow columns) being consistently more profitable.

Looking ahead, consider that the software division’s margins are reported after research and development (R&D) spending — and management has signalled their intention to slow extra R&D spending going forward.

That’s why we can see RPM’s software margins growing from their current level around 15-20% to 25% plus… and likely much higher in five years from today. We believe this will make the business appear very profitable in time.

Valuation

I still find RPM Global a tough company to value because my assumptions and the associated inputs make it a very sensitive model. Plus, the transition to subscriptions and potential demand-side effects from Coronavirus make forecasting cash flow for the next 1-2 years quite different.

All that said, if we take the market capitalisation, which is around $170 million and subtract the cash at 31 December 2019 we’re left with an enterprise valuation of ~$150 million. For a company operating successfully in an under-served industry with customers that have extremely deep pockets and are now catching up with other industries in terms of tech development, I could see RPM Global being a $200 – $300 million company in five years from today.

Management

RPM’s management is of high quality and well-aligned with investors in my view.

If you watch some of the videos on the RPMGlobal YouTube channel, it doesn’t take long to realise that CEO Richard Mathews has an almost infectious personality when it comes to technology innovation.

When you’re out there trying to hire the best software engineers and developers to come and work on your (sometimes boring) mining projects, it’s vital that the person who these developers answer to is engaged and excited about the projects.

If Mathews left, I’d be concerned and likely revisit my position. Fortunately, given that he owned 8 million of shares as at December 31, 2019 — $6.5 million worth — I doubt he’s planning to leave anytime soon.

Other executives, many of whom followed Mathews to Runge Limited, hold sufficient chunks of stock (and/or options), so I’m confident their interests are aligned.

There are some blemishes. For me, one is the skew in incentives between short term (too much) and long term (not enough). However, that’s mitigated by management’s shareholdings.

Risks

There are plenty of risks. In no particular order, here are some of the known risks I’ve considered relevant:

- Competition. If RPM Global was unable to keep winning new clients I would be concerned. The company has emphasised its ‘learnings’ in the sale of its subscription services and the longer lead and onboarding processes for large miners adopting this sales model.

- Volatility. RPM is barely profitable and may not be truly cashflow breakeven for a little while yet. It’s also a very small company, so shares are thinly traded and the range of outcomes is wide enough to land a plane. This is a high-risk investment. That said management has stated they will begin to ease their spending on R&D (widening profit margins) and they now have a sales team with experience selling subscriptions.

- Commodity prices. In the last major commodity price rout between 2011 and 2013 RPM downsized its workforce considerably. I expect that the impacts of the next big commodity price fall will be less impactful given the company’s focus on software and recurring revenue. However, a sustained fall in commodity prices or COVID-19 impacts on new projects could squeeze the sales pipeline and all types of procurement initiatives at mining companies, including software.

- Culture. I haven’t worked for RPM nor been inside their offices, but like many consulting and tech firms RPM could be a high-performance environment. This doesn’t suit all employees. The limited Glassdoor reviews on RPM, which go back quite a few years, are pretty good. But remember culture is vital to attracting new tech talent.

- Expectations V Reality. I expect a lot from RPM in the next 2-3 years but it’s going to be a bumpy ride as they transition to more of a SaaS-style business and commodity prices ebb-and-flow. I could be wrong.

Bottom Line

RPM has all the hallmarks of what ‘could be’ an innovative and profitable small Australian SaaS business, uniquely placed to capitalise on what is arguably the most important industry to the Australian economy. It’s also well-managed, cashed-up, well-resourced and has handy overseas exposure.

That’s why I bought RPM global shares twice. It’s why I continue to hold them.

What now?

I encourage you to go ahead and research RPM for yourself. Or if you want to know more you can follow me on Twitter, message me on LinkedIn or, put simply, join our Rask Invest investment research service.

We have more write-ups on RPM and videos explaining the RPM thesis and the numbers. We also have a portfolio of shares similar to RPM.

But that’s enough of that. Finally, be sure to subscribe to The Australian Investors Podcast to get more stock ideas from professional investors.

Stay safe, and invest well.

Owen Raszkiewicz

Lead Investment Adviser, Rask Invest

Founder, Rask Australia