If you’re looking for the top ASX dividend income shares you’re probably looking at the dividend yield of Washington H. Soul Pattinson & Co. Ltd (ASX: SOL) shares and licking your chops.

Alongside the likes of BHP Group Ltd (ASX: BHP), CSL Limited (ASX: CSL) and Commonwealth Bank of Australia (ASX: CBA), “WHSP” or “SOL” has established itself among the best ASX-listed shares for income. Even now, during COVID-19 isolation, SOL shares are moving forward as a leading dividend share for many investors because of a few important factors, discussed below.

Are ASX dividend income shares worth the risk?

One of the best things about investing on the Australian share market is the ability to generate long-term dividend income. Sometimes, these companies pay their dividends half-yearly or every six months (known as the interim and final dividends), or just one per year.

What makes Australian dividends so special is that Aussie companies often pay dividends with something called ‘franking credits’. Franking credits are like tax credits stored at the tax office (ATO) until you file your tax returns and claim them. The following Rask Education video explains franking credits in more detail. To subscribe to our YouTube channel click here.

SOL pays fully franked dividends to shareholders. As of its 2019 annual report the company had over $554 million of franking credits available to pay with dividends to shareholders. That’s a lot! If you’re due to receive a dividend with franking, click here to use our free franking credits calculator (hint: bookmark the page).

Who is SOL?

SOL or WHSP is an investment company that has been on the ASX for over a century. Its history is in owning and operating Australian pharmacies, which is where the Soul Pattinson chemist chain comes from. You might have seen these chemists around Sydney, for example.

The Soul Pattinson Chemist business is now owned by Australian Pharmaceutical Industries Ltd (ASX: API), of which WHSP owns 19%. WHSP invests in a large number of companies across a variety of industries such as construction, finance, resources and telecommunications.

3 reasons to like SOL shares for dividends

1. Diversification

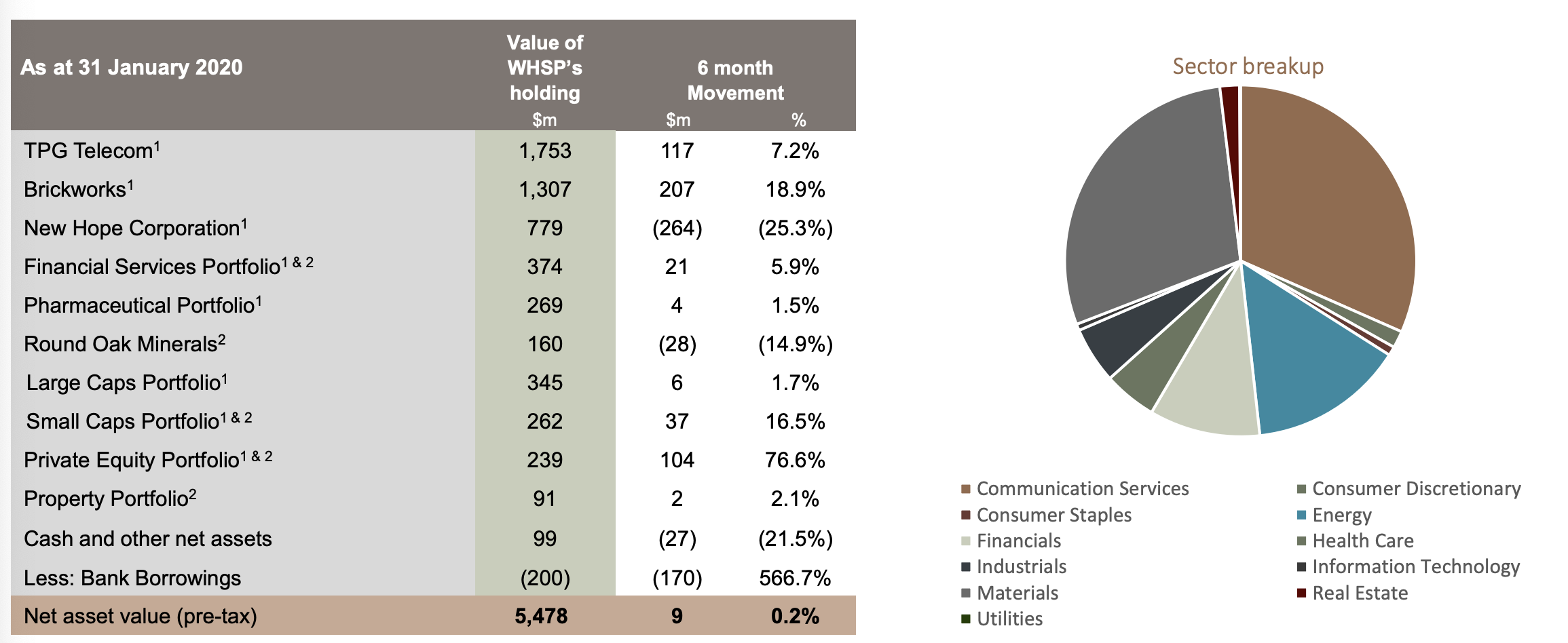

As the following chart demonstrates, SOL is one of the most diversified ‘holding’ companies on the ASX, with over $5.5 billion invested in various companies in different sectors, whether they are listed on the ASX or privately held companies.

This type of diversification or ‘non-correlated’ investing means a more stable income-generating portfolio for SOL which in turn means more stable dividends for investors.

As long-running Chairman Rob Millner put it last month, “We are pleased that the diversification of the portfolio and focus on resilient businesses which can perform well even in difficult conditions has placed WHSP in a good position to weather the storm we are seeing in financial markets.”

2. Track record

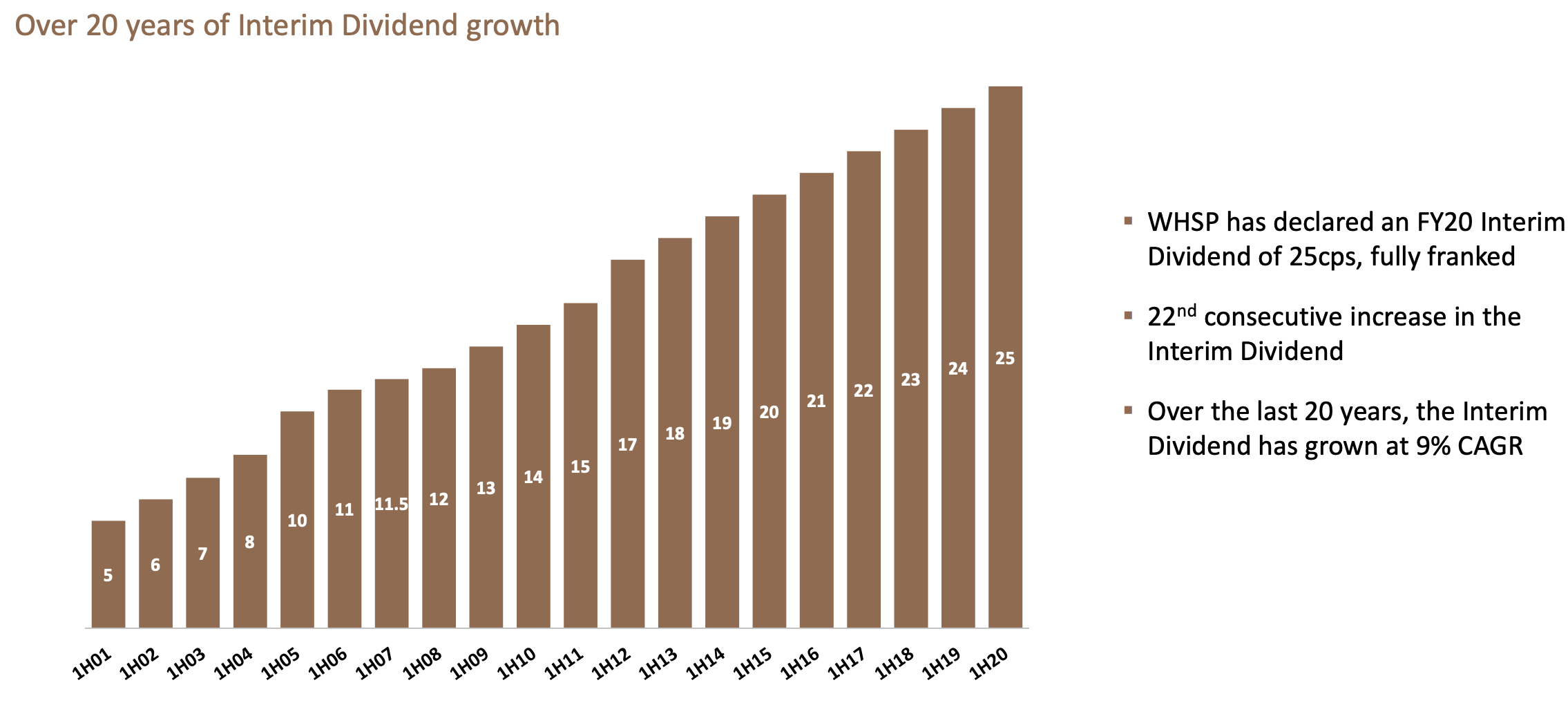

Amongst CBA, Westpac Banking Group (ASX: WBC), CSL and BHP, SOL shares have produced one of the most reliable dividend track records in ASX history. Of course, dividends are not guaranteed… but I think you’ll agree the following chart looks pretty consistent!

“Over the last 20 years to 31 January 2020, an investment in WHSP with dividends reinvested has increased by 11.1 times while the Index has increased just 4.2 times,” WHSP’s CEO Todd Barlow said in a March 2020 ASX update.

3. Optionality

SOL is able to generate a defensive dividend income stream for shareholders at a time when most other investment businesses are panicking because they have to meet client withdrawals or, frankly, they’ve never experienced a proper market decline. Since SOL is a company and not a trust or managed fund it does not have to enable redemptions or withdrawals of shareholder money — the money is already inside the company.

If you are indeed a long-term income investor — with a five, 10 or 20-year view — a holding company structure is preferable to a trust structure because the investors steering the investments don’t have to bother with ‘flows’ of money coming in-and-out. They can deploy capital confidently knowing the money is available to invest. In addition, the target investment companies (e.g. TPG, API, etc.) also prefer an investor like SOL on their register because they know SOL is likely to support them for the long run.

For example, SOL was topping up on shares of TPG Telecom at around 14 cents per share over 10 years ago during the GFC. It’s now trading around $7.70 per share and SOL owns over 20% of the company.

“We believe that the recent events will provide WHSP with opportunities to make new investments and we are actively looking for opportunities where our long-term, patient and disciplined investment approach can deliver outperformance for shareholders,” Barlow added.

Buy, Hold Or Sell?

I’m watching Soul Patts closely because I think it’s run by very high-quality investors, has a diverse portfolio of good industrial businesses and combines them to produce a consistent stream of dividend income.

I don’t think Soul Patts shares are dirt cheap. For example, based on a yearly dividend payment of $0.59 (before franking) and growing at 3% per annum, my dividend valuation model puts the value of SOL shares between $12 and $15. If I include franking, the valuation edges higher to between $15 and $20 per share — but that’s a little bit of a stretch.

I’m doing more work on SOL this week for our Rask Invest community — Australian investors who pay to access our expert stock research. In the meantime, you should know that I own all three of the stocks in the free investment report below. You can grab a free copy when you join as a free Rask account holder.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: At the time of publishing, Owen does not have a financial interest in any of the companies mentioned.