The Qantas Airways Ltd (ASX: QAN

) share price was trading 8% higher today following news of another round of support for domestic airlines, including Virgin Australia Ltd (ASX: VAH).

For comparison, the S&P/ASX 200 (ASX: XJO) was trading at 5541.7, up 2.32%, just efore midday Friday.

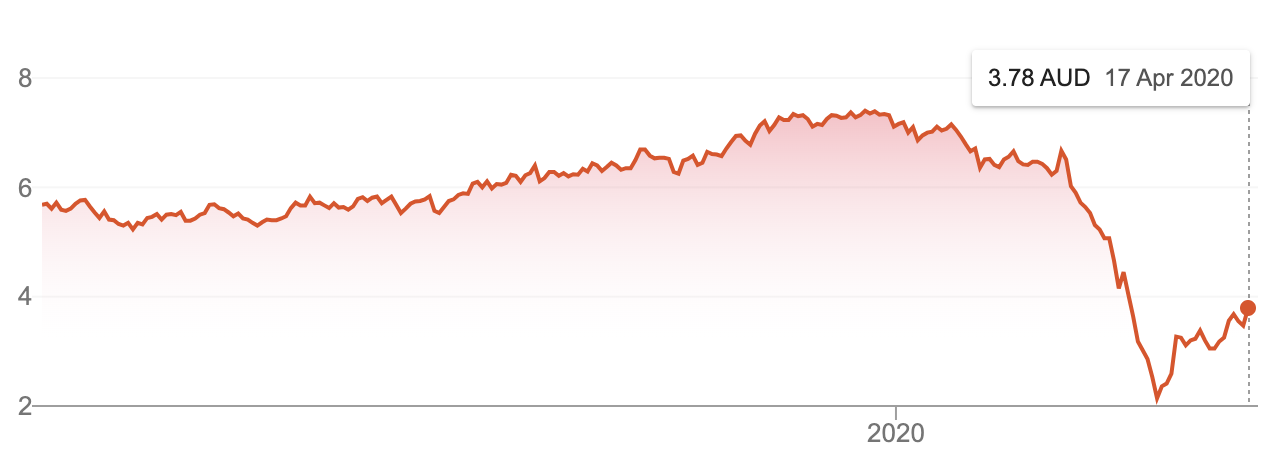

QAN share price – 1 year

Source: Google Finance.

Qantas is Australia’s leading airline. It was founded in the Queensland outback in 1920, the Qantas name was originally Queensland and Northern Territory Aerial Services.

The company operates two main airlines – Qantas and Jetstar – and subsidiary businesses including other airlines, businesses in specialist markets such as Q Catering, Qantas Freight Enterprises and the popular Qantas Frequent Flyer program. It employs some 30,000 people with around 93 per cent of them based within Australia.

As is suggested in its name, Virgin Australia Holdings Limited is a holding company for Virgin Australia International Airlines, Virgin Australia Domestic Airlines and also Tigerair Australia. Tigerair was acquired by Virgin in 2015.

What’s happened today?

The aviation sector has already received $1 billion in relief from the Government but Qantas and Virgin have asked again for bailouts which would see them through the COVID-19 crisis. There are some fears for both businesses on the stock market, but especially Virgin.

Virgin Australia’s shares are currently suspended from trading on the ASX while it seeks a $1.4 billion rescue package from the Australian Government. Debt/bond market investors — and share market investors — are feeling the effects of the cancellation of travel.

Last month, credit rating agencies Standard & Poor’s and Fitch Ratings downgraded the rating on Virgin’s debt given the tough outlook for the sector.

Some good news finally came today for both airlines in the form of a guarantee by the Government to underwrite the costs of $165 million of domestic flights between cities and regional hubs.

“We know that a strong domestic aviation network is critical to Australia’s success and today’s announcement demonstrates our commitment, yet again, to maintaining connectivity during this pandemic,” Deputy Prime Minister Michael McCormack said on Thursday night.

Qantas and Virgin have been providing minimal operations for cargo and freight. Virgin is providing repatriation of travellers to Los Angeles and Hong Kong.

Buy, Hold or Sell?

For stock market investors, the airline industry is tough at the best of times. The industry is plagued by high costs, lots of debt and financing risk, intense competition from global corporates and state-backed airlines, and it’s heavily regulated.

While some investors might like to take a short-term gamble on airline stocks, as an intensely long-term (10+ year) high-quality focused investor, Qantas and Virgin are businesses I’d likely never touch with my family’s capital.

While I think it’s unlikely either airliner will fail — the Government needs airlines — there are no guarantees for equity/share investors especially. If you forced me to choose I’d probably rather own the debt than the shares of Virgin. That said, there are more than 10,000 shares listed on global stock markets, you don’t have to choose between just two.

I’d much rather buy the shares in the free investment report found below.

[ls_content_block id=”14948″ para=”paragraphs”]

Disclosure: Owen likes to fly Virgin and Qantas (if someone else pays for it), but he definitely does not have a financial or commercial interest in any of the companies mentioned in this article.