The Australian and global share market can’t make its mind up. We’re in a bear market (down 20% from the peak) but we’re also in a new bull market (up 20% from the low).

For some investors, it probably feels like trying to make heads from tails when they are the same thing.

1 strategy that works

At Rask Invest, we do not try to time the market because there’s solid evidence which proves such an approach is not worth it.

Our investment research service is quickly proving that our time is far better spent looking for the highest conviction small-caps, technology companies and industrial businesses to buy. Rather than timing the market.

For example, earlier this month we released a brand-new ASX Buy idea to our members, not because the market was down — but because the company is at the beginning of a long-term growth runway and looks undervalued to me.

We believe our strategy of buying high-quality companies and ETFs works in all market environments. For myself and Rask Invest, I aim to make one new investment on average every six weeks.

It’s a dollar-cost averaging strategy and we consider it to be the best way for everyone to invest — whether you invest in shares, ETFs, property, managed funds, Super… everything. Accumulating assets works.

But don’t take my word for it…

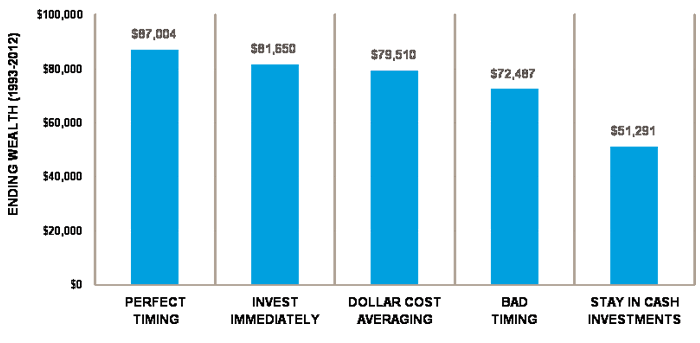

Here are the results of a study by US investment firm Schwab which compared 5 strategies over a 20-year period between 1993 and 2012, using the S&P 500.

In the study, every strategy was given $2,000 at the start of the year to invest at different intervals.

For example, one strategy put all of its $2,000 (each year, for 20 years) in cash. Keep in mind, this was when interest rates were far higher than they are today. This strategy ended up with $51,291. Not a great return considering $40,000 was invested all up.

If you had perfect timing — meaning, you invested your $2,000 on the exact lowest month for the stock market that year — you would have ended up with $87,004. I reckon it’s impossible to have perfect timing — even for the big events like the GFC — but it makes sense to include this scenario.

While that’s interesting, here are the really important takeaways of the study as I see them:

- If you simply invested the money on January 1st (or immediately after you got the $2,000) you would have been nearly as well as off as if you had perfect timing ($81,650), or

- If you had dollar-cost averaged your money ($2,000 split evenly over 12 months) you would have had $79,510 after 20 years.

Heck, even the worst possible timing (column four in the image) resulted in $72,487 from a total invested amount of $40,000.

The moral of this story is crucially simple for everyone:

Do not try to time your investments, just invest.

It’s not about timing the market, it’s about time in the market.

Don’t buy low to sell high. Buy low then buy again.

Last fortnight, I provided a free write-up, together with a 45-minute podcast on one of my previous number-one share ideas from inside Rask Invest. The company was RPMGlobal Holdings Ltd (ASX: RUL).

Guess what: RPMGlobal’s shares have risen from $0.62 on March 23rd 2020 to end trading on Friday (17 April 2020) at $0.98 — meaning RPMGlobal shares have bounced back 58% in less than a month.

Imagine if you missed that because you tried to time the market!

In case you’re wondering, the company is still a Buy inside Rask Invest AND it has been included in my special “3 stocks to buy right now” report — issued this morning.

Meaning, we have more undervalued technology shares like RPMGlobal inside Rask Invest right now.

Plus, we have research on 10 carefully selected ETFs. Plus, exclusive access to podcasts and videos. Plus, members-only question & answers. Plus, ongoing coverage. Plus, lots more.

Not bad considering the $399 membership fee might be tax-deductible…

If you want to take up my offer to join Rask Invest and start investing with our research, simply click here and log in to your Free Rask account (if you have one), or click here to become a premium Rask Invest member.

Cheers to not timing the market and investing well for the long run.

Stay safe.

Owen Raszkiewicz

Lead Investment Analyst, Rask Invest

Founder, Rask Australia

[ls_content_block id=”14945″ para=”paragraphs”]

Disclosure: Owen Raszkiewicz owns shares of RPMGlobal, but this could change.

Figures and returns cited here are believed to be accurate but are hypothetical only because returns are based on past results which do not include fees or costs. Nothing in this email should be considered a guarantee because The Rask Group Pty Ltd does not guarantee the performance of any investment. Investing in shares and ETFs is high risk and involves the potential for capital loss.