You won’t be heading to packed nightclubs any time soon, but you may be walking around a retail store within the next few months – Forager’s Steve Johnson.

From equanimity to outright panic in the space of a month, investors experienced the full gamut of emotions during March. We’re trying our best to take advantage of it.

This quarterly report is one I will read again in old age. It has been the most extraordinary three-month period of my life.

In the middle of February, the Australian sharemarket was trading at or near record highs, with the All Ordinaries Index (ASX: XAO) above 7,000 points. COVID-19, the latest deadly coronavirus, had already erupted in China and started to recede.

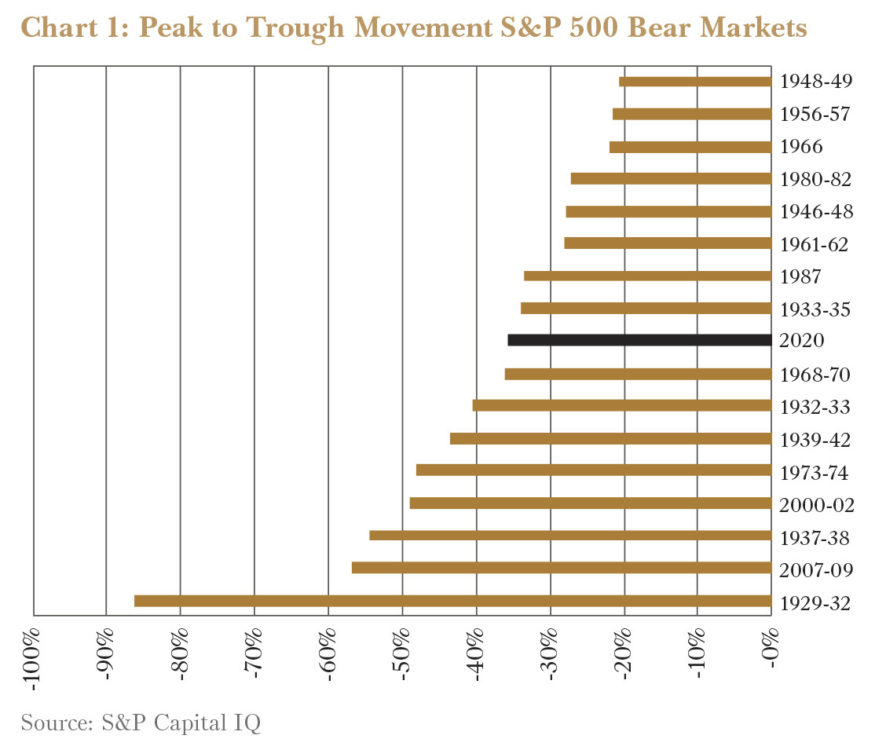

By Monday 23 March, Gareth Brown and I were running an investor webinar from isolation in our houses. The shutters had been pulled down on the entire retail and hospitality sectors in Australia. The ASX All Ordinaries Index closed that day at 4,564, down 37% from its peak.

In the US, the Dow Jones Industrial Average Index suffered the fastest bear market on record, falling 36% in the month to that same black Monday.

That, as it turned out, was peak panic day.

The Dow Jones’s 21% rally over the next three days constituted the fastest bull market on record (the generally accepted rule for a bull or bear market is a rise or fall of more than 20%).

Much remains unknown. How long until a vaccine is widely available? How long will our economy remain in hibernation? How do you bring the economy out of hibernation without suffering a resurgence in infections?

Lockdown working

But there are more pieces of the puzzle in place than just a few weeks ago. And, for the most part, the signs are positive.

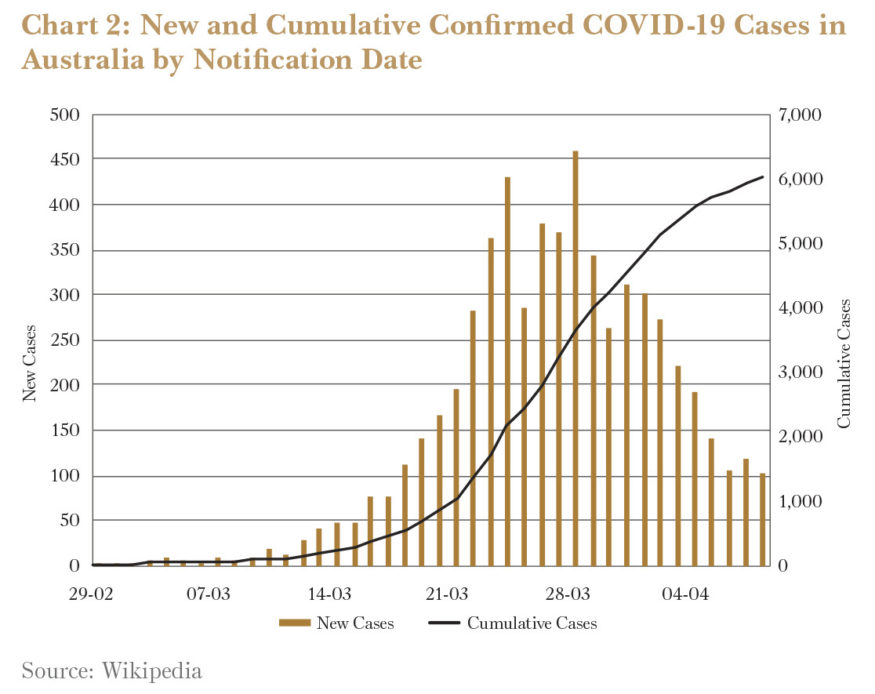

From Wuhan to Bergamo and Sydney, lockdowns are working in every city in which they have been implemented. Within a few weeks, the number of infections starts to decline. Within a few months, restrictions can start to be lifted. In China that has (apparently) been managed successfully. Denmark and Austria have both recently announced plans for a phased reduction in restrictions. Australia won’t be far behind given the lower starting point and rapid drop in the number of new COVID-19 infections.

You won’t be heading to packed nightclubs any time soon, but you may be walking around a retail store within the next few months.

Most importantly, there is going to be a retail store for you to head back to. That wasn’t a certainty a few weeks ago.

The Multiplier Effect

Economies are fragile, interconnected systems. If one person loses their job, they stop spending money. That means someone else loses their job too, and so does the person making a living off the second person’s expenditure. Economists’ rough rule of thumb for this economic “multiplier effect” is five. For every one dollar of exogenous shock to the system, the economic impact is five dollars.

Australia has shut down most of its discretionary retail and hospitality industries. This is not a recessionary slowdown. They are dead. And they are a significant percentage of the economy. Apply a multiplier to that and the impacts are not worth thinking about.

YOU WON’T BE HEADING TO PACKED NIGHTCLUBS ANY TIME SOON, BUT YOU MAY BE WALKING AROUND A RETAIL STORE WITHIN THE NEXT FEW MONTHS.

Thankfully, the response from the government has been appropriately immense. The Federal Government has underwritten the living costs of most Australians while the lockdown is in place. Importantly, they have tried to do it through employers where possible. Broker Shaw and Partners estimates the $1,500 per fortnight Jobkeeper allowance will result in some one million Australians being paid more than they were when they were working. When the shops open again, they will have a job to go to and money to spend.

State governments have added significant payroll tax relief and other small business assistance in an attempt to keep as many small businesses alive as possible.

The Reserve Bank of Australia has provided substantial backstops to the banking sector. And equity markets have provided fresh capital to viable businesses with short-term funding issues. Flight Centre Travel Ltd (ASX: FLT) and Webjet Limited (ASX: WEB) have raised more than $1 billion between them.

While the economy is clearly going to take a massive hit over the coming months, the combined impact of these actions is that the core infrastructure of the economy is being maintained. We should be able to return to full production as quickly and efficiently as possible.

The government can’t fund everyone’s salaries forever but, especially given Australia’s low starting levels of government debt, it is able to do so for a meaningful amount of time.

Necessary and appropriate government response

There has been plenty of criticism of the response. Some seem to see this as another government bailout of the irresponsible and reckless.

I disagree. This is not like the financial crisis, where the problem was caused by private-sector excess. It’s an exogenous shock. One that caused the government to (rightly) close the economy down. And one where the government should do everything it can to mitigate the damage.

Some businesses were carrying too much debt, sure. But their shareholders have largely borne the brunt. And expecting any company to carry its full cost base for a year without revenue is absurd. A business that operates at 5% profit margins has 95 cents of expenses for every one dollar of revenue, meaning its expenses are 19 times the profits. One would need 19 years’ worth of profits as cash in the bank to fund the full expense base for a year.

It is easy to nitpick. But from the health authorities to the government, central banks and CEOs, Australia’s response so far has been speedy, meaningful and effective.

While much remains to be done—recent outbreaks of COVID-19 in Singapore and Japan show that returning to normal won’t be easy—Australia is well placed.

Financial markets recover first

A more optimistic outlook is certainly reflected in share prices. Here in Australia, the All Ordinaries Index is almost 20% higher than its lows*. The US market is up even more, despite a COVID-19 crisis in that country that is yet to hit its peak.

Whether the rally is justified remains to be seen. For now, at least, the forced selling has abated.

I’m sure we will look back and think we could have done better. Some of our stocks have more than doubled from their lows already, and hindsight will probably say we should have been more aggressive.

But, overall, I’m extremely happy with how the team and investors have reacted. We’ve added new stocks to both portfolios. We’ve been fully invested at the market low point (too early in both too, of course). And we haven’t had to deal with investor redemptions, thanks to a loyal and long-term client base.

The listed Forager Australian Shares Fund has traded at a discount to its underlying net asset value (NTA) for some time. But the volume of units traded was healthy through the market crash. There were more than 350,000 units traded on that peak-panic Monday and some Forager faithful picked up exposure to some heavily discounted shares at a further heavily discounted price. The Fund recently announced a buyback in case similar opportunities arise.

Irrespective of how this plays out over the coming months, we have a huge amount of work to do. The performance of the Australian Fund has been extremely disappointing over the past few years and we need to deliver you high returns out of a market like this.

But we have prepared for dysfunctional markets and you have given us every chance. Thanks, and I look forward to reporting the fruits of our labour over the coming months.

To hear more from Steve & Forager, click here to read the latest research.