Panic and distress hit global stock markets hard in March. While the Fund’s holdings weren’t immune, it is a well-balanced portfolio and the impact was muted by a weak Australian dollar.

The Forager International Shares Fund saw its unit price fall 15.5% in March and 17.8% during the quarter. While the falls were widespread, the underlying share price movements varied significantly depending on company balance sheets and the respective degree of exposure to the economic impacts of COVID-19 around the world.

With only a few exceptions, which you will read about below, the portfolio is a collection of well-capitalised businesses with strong market positions. That doesn’t save them from the immediate impacts of an economic meltdown, but it does mean most come out the other side with even stronger hands.

The portfolio impact of share price falls was muted by a significant fall in the Australian dollar (AUDUSD). It traded at an intraday low of $0.55 to the US dollar in March, a level not seen since the 2001 bubble in technology stocks, before rebounding alongside stock markets to end the month at $0.61.

With a plethora of news to report, we have kept this report mostly about stocks. Below you can read an update about the most affected, our largest investments and the new additions to the portfolio.

Retail and airports grounded indefinitely

Consumer confidence suffers in times of uncertainty. Add forced store closures and you have a bleak environment for discretionary retailers. Ulta Beauty (NASDAQ:ULTA) and Hallenstein Glasson Holdings (NZE: HLG) are not exceptions.

Ulta released its fourth-quarter results earlier this month. Sales were up 8.5% for the quarter to 1 February, with comparable-store sales up 4%. Profit margins declined slightly due to investments in growth and marketing. At the time of release all stores were still open and management had only just made the decision to stop providing makeup services. All Ulta stores have since been closed indefinitely. Distribution centres have been granted essential status in the US, so the online channel remains open for now.

Revenue for the current year will take a significant hit. Management is trying to balance cost reductions with supporting staff—a workforce will be needed when it’s time to reopen stores. All capital investments have been put on hold. Ulta has the resources to withstand an extended period of store closures. The company had $1.3bn cash on hand in the middle of March. The next year or two is likely to be tough. Beyond that, consumers should continue spending more on skincare and makeup. Ulta has done a great job of taking share from competitors and will likely continue to do so. The Fund topped up its position mid-month.

Hallenstein also reported a strong first half result to 1 February 2020. Sales were up 5.7% overall, and 10.9% at Glassons Australia. COVID-19-related restrictions in New Zealand have closed all stores (including the online store) since 26 March. Stores in Australia are also closed, although online remains open at the time of writing.

Hallenstein isn’t heavily indebted, but it does not have enough cash to cover operating costs in the current sales environment for long. That’s where government subsidies and flexible landlords come in. Both the Australian and New Zealand governments are assisting with staff costs. And landlords want their retail tenants to survive this crisis, if only so they can be bled for rent further down the track. This will be a difficult period. But Hallenstein has been a well-run, profitable business for a long time, it remains debt free and it will be profitable again.

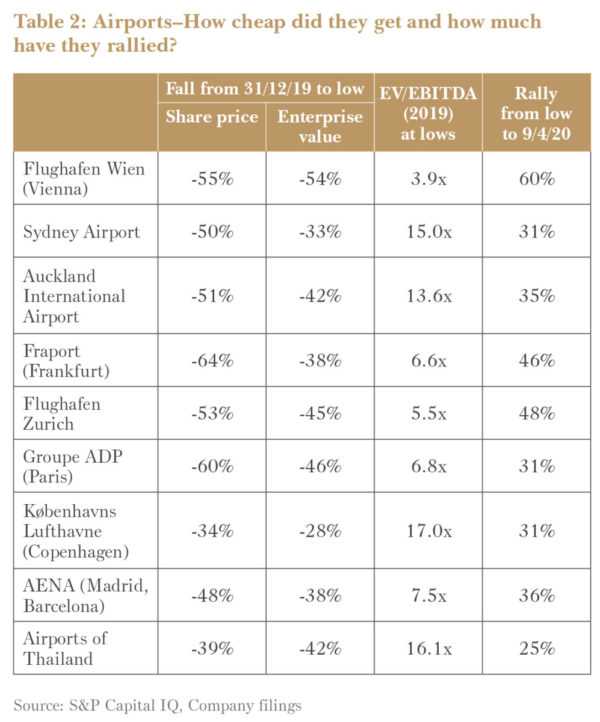

Revenue may fall more than 90% for Flughafen Wien (WBAG: FLU) for the period of this shut down. That’s an astounding thing to write about a piece of essential infrastructure—Vienna Airport. But these are astounding times. Few peers globally are as well placed, with zero net debt and enough cash in the bank to cover costs at normal run rate for at least six months. Those costs are falling sharply, aided by an Austrian government package for furloughed staff. With the European Central Bank flooding the system with cash, bankers are again knocking on the company’s door offering loans, should it ever be wanted.

The rest of the year looks tough. A rebound will take time. But come 2025, more travellers than ever will pass through its terminals. Despite being better placed than peers, the stock got sold off more aggressively. Most airports stocks approximately halved in market capitalisation over the first three weeks of March, but fell much less in enterprise value terms (due to the high debt levels of most airport companies, the combined value of debt and equity is less influenced by falls in the equity value). Flughafen Wien, being debt free, halved in both market capitalisation and enterprise value. At one stage it traded at an enterprise value to 2019 earnings before interest, tax, depreciation and amortisation (EV/EBITDA) ratio of less than four times. We’d taken some off the table at full prices in December 2019, and bought them back in mid March at bargain prices. It’s since rebounded strongly and outperformed global peers.

The collapse of air travel hit SkyWest (NYSE:SKYW) even harder. The stock has fallen more than 60%. It was down more than 80% at its lows. A sigh of relief emerged with the US government’s US$2 trillion stimulus plan, which earmarked US$58bn in loans and guarantees for passenger airlines and cargo carriers.

SkyWest is different from other airlines. Most of its revenue comes from mainline carriers such as Delta (NYSE:DAL) and United Airlines (NASDAQ:UAL) rather than direct ticket sales. Long term contractual minimum payments more than cover SkyWest’s operating costs and interest expense, leaving a baseline level of profit.

So why the fall? Mainline airlines are suffering mightily and their survival is not assured. Some contracts might need reworking. How this all shakes out remains to be seen. But there will also be opportunities for survivors. Two smaller regional competitors have already filed for Chapter 11 (bankruptcy) in recent weeks. When restrictions are lifted and air travel returns, domestic routes will recover the fastest, as they did after the September 11 terrorist attacks. US infrastructure is poor and air travel is more critical than in many other countries.

Blancco holds the fort

Restrictions on travel will make new clients harder to find. And the rate of recycling of electronic devices will slow at some point. But Blancco Technology Group (AIM: ALTG) is one of the least affected companies in the portfolio. The data erasure software company’s own small workforce is already spread out around the world and used to working from home. Much of its revenue is repeat deals with existing customers and demand remains healthy.

With institutional investors becoming more interested in the Blancco story after its good recent results, demand for the shares had been strong and the stock held up well at the beginning of the March rout. We took the opportunity to sell a meaningful chunk of our investment in the early weeks of the selloff above £2 per share and deploy that capital elsewhere (see New Investments below). It remains the Fund’s largest investment and we remain excited about its prospects, but today’s weighting of 7.8% is about right given the relative value on offer elsewhere.

WE THINK MOTORPOINT IS BETTER PLACED THAN ANYONE ELSE IN THE UK DEALERSHIP INDUSTRY, AND THE RECOVERY PERIOD WILL BE AN EXCELLENT TIME TO TAKE SHARE FROM STRUGGLING RIVALS.

Motorpoint (LSE: MOTR), like Blancco, held up very well over the first weeks of March and then promptly fell more than 30% like everything else. We sold a little before the fall. The economic realities of used car dealerships can’t be escaped —it is a low margin business selling a big ticket, largely discretionary item. So even once the company’s 13 dealerships are able to reopen doors, sales will likely be poor for a period. But the company is well placed to deal with the period of closure, aided by the UK’s very generous support for furloughed staff. Motorpoint currently plans no layoffs. Much of its other cash costs, like marketing, will melt down quickly. Bigger picture, we think Motorpoint is better placed than anyone else in the UK dealership industry, and the recovery period will be an excellent time to take share from struggling rivals.

Yum China (NYSE:YUMC) provided an encouraging update recently, perhaps showing the rest of the world the path to COVID-19 recovery. The operator of KFC in China is seeing early signs of a recovery with 95% of their stores open for business, well up from more than a third of their stores closed in February. Many now have reopened to only provide takeaway and delivery services, providing a cushion to subdued store traffic. Not surprisingly, sales are still down by around 20% compared to a year ago, but have improved from being

down 40-50% at the peak of the outbreak. Steered by a savvy management team and supported by its cash rich balance sheet, its KFC and Pizza Hut stores are likely to be even more dominant in a recovery scenario. It was one of the Fund’s best performers in the quarter, an unlikely scenario at the start of January.

New investments

Three new US investments made it into our portfolio this month.

CDW (NASDAQ:CDW) is the market-leading provider of IT hardware, solutions and services in the United States. It has a lot of the characteristics that we like to see in an investment.

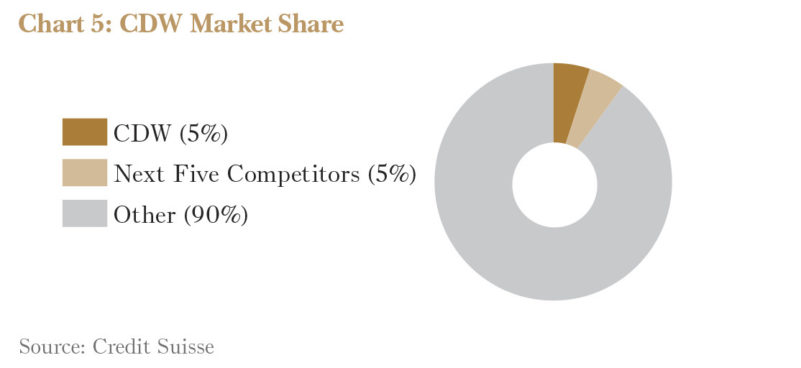

CDW is the largest player in a highly fragmented market, where it continues to gain market share.

CDW is the largest player in a highly fragmented market, where it continues to gain market share. The company’s 5% share is larger than the five next largest competitors combined, and it continues to outgrow the industry by 3-5% every year. It has a strong track record of growth, with ample runway ahead of it. With returns on equity of around 50% and strong cash flow generation, it doesn’t need much capital to grow. And its market implied valuation recently approached just 10 times earnings.

Keysight Technologies (NASDAQ:KEYS), too, is a wonderful business. Keysight is the world’s leading communications and electronics testing company, with a strong foothold in new technologies such as 5G and new WiFi standards. It was separated from Agilent Technologies (NYSE:A) five years ago and currently holds 25% of the US$16bn testing equipment market.

Keysight offers the broadest electronics testing portfolio, enabling customers to design, simulate, prototype and manufacture next generation electronic products, components and networks. Its customers are all seeing accelerating secular growth over the coming years—5G infrastructure build-outs are likely to span a decade, while new use cases such as connected cars, Advanced Driver-Assisted Systems and the Internet of Things all result in the company’s addressable market expanding from here.

These trends increase the need for software-based test and measurement tools, which Keysight offers. This is an industry with huge barriers to entry—the company spends over $650m in research and development every year (which is much higher than most of its competitors) and has the largest installed base in the industry, combined with longstanding key customer relationships. The company is still not very well covered by larger equity research houses, despite management having done a tremendous job at growing market share, structurally improving profit margins and revitalising its product portfolio since it became independent. People tend to underestimate just how much a business can evolve and improve when one removes the “shackles” of being a smaller division of a larger conglomerate.

Finally in the US, we added a stock that will surprise many, ridesharing company Uber Technologies (NYSE: UBER). This one needs a full write up to address the widely held bear views of the stock, but the much maligned business has undergone a significant transformation in recent years.

At its core Uber is a highly profitable technology company that benefits from network effects and scale. Those benefits have been squandered seeking new markets to conquer and new products, such as driverless cars. Founder Travis Kalanick was a necessary evil to gain Uber’s initial leg up, but his replacement Dara Khosrowshahi is the reason our interest was piqued. His focus on core markets, cash flow and profitability have led to rapidly improving performance in recent years. As the world recovers from COVID-19, we expect that improvement to continue. A recent share price fall of more than 60% was enough for an initial investment.

In the UK we’ve added GAN plc (AIM: GAN) to the portfolio. Listed in the UK but with an increasingly US focused business, GAN is an orphan stock. That’s being rectified soon with a relisting on the Nasdaq. GAN provides mission critical software to online casino and sportsbook operators, including player account management systems and many services essential to this heavily regulated industry. GAN’s revenue has been growing fast, since the overturning of a decades old federal ban. Online gambling is now legal in New Jersey, Pennsylvania and Indiana. Much of GAN’s revenue is directly linked to its customers’ online revenue, thus it shares in the upside (and downside). With many states on the cusp of legalisation, the tailwind has been strong.

WITH THE BENEFIT OF HINDSIGHT, THOUGH, WE WISH WE HADN’T INVESTED JUST WEEKS BEFORE EVERY MAJOR SPORTING LEAGUE IN THE US SHUT DOWN.

Management long claimed profitability would rise rapidly as revenue increased. The half year to 31 December 2019 proved the concept. With the benefit of hindsight, though, we wish we hadn’t invested just weeks before every major sporting league in the US shut down. The stock more than halved on our average purchase price but it has since doubled off the lows. Investors increasingly recognise sports betting will come roaring back after life returns to normal, and in the meantime higher margin online gaming should be going gangbusters as an alternative. Casinos around the country are quickly recognising the benefits of a strong online presence, and GAN has been signing up new customers rapidly.

Over in Asia the Fund made two new investments.

Listed in Hong Kong, VTech (HKSE: 303) is a manufacturer and owner of brands such as VTech and LeapFrog in the electronic learning toy category. Headline growth in recent years had been held back due to its legacy business in fixed-line telephones, which has been in decline but is now a very small component of its revenue. With the strong push into contract manufacturing services in recent years, the company is back on a path to overall growth. Shareholders are also rewarded by its commitment (and ability) to maintain a near 100% dividend payout in the meantime.

Dominant power tool and floor care company Techtronic (HKSE: 669) was another addition to the Fund. The owner of brands such as Ryobi and Hoover is the market leader in a consolidated market. Its success to date has been underpinned by continued innovation and highly efficient manufacturing. We have had the stock on the wishlist for years, and the recent selloff gave us the opportunity we were waiting for.

To hear more from Steve & Forager, click here to read the latest research.