The Webjet Limited (ASX: WEB) share price traded 9% higher today following news it had raised too much capital.

About Webjet Limited

Webjet is a digital travel business spanning both global consumer markets (‘B2C’) and wholesale markets (‘B2B’). It was established in 1998 and now claims to be the leading online travel agency (OTA) in Australia and New Zealand. Webjet says it was the world’s first to use ‘Travel Services Aggregator’ technology and is now leading the industry in blockchain innovation.

Webjet’s capital raising

While the sky seems to be in the most part ‘aeroplane free’ due to travel restrictions put in place across Australia and the world due to Coronavirus (COVID-19), Webjet has been busy.

Webjet seems to have overdone its recent capital raising expectations as it now needs to scale back applications for approximately 27.5 million additional shares applied for under the top-up facility. It will now need to give back $14.5 million in refunds.

“It has been necessary to scale back applications for approximately 27.5 million additional shares applied for under the top-up facility,” Webjet explained.

“All eligible applications for additional new shares will be scaled back by approximately 31 per cent.”

“The scale back will be done on a pro-rata basis across all applications. Refunds totalling approximately $14.5 million in respect of scaled back applications under the top-up facility will be dispatched to retail shareholders as soon as practicable.”

The Rask Education video above explains capital raisings, including institutional capital raisings and share purchase plans (SPP). It also tells you what you can expect to happen next. Click here to subscribe for FREE for the latest stock videos, investment news and commentary.

Is it takeoff for Webjet’s share price?

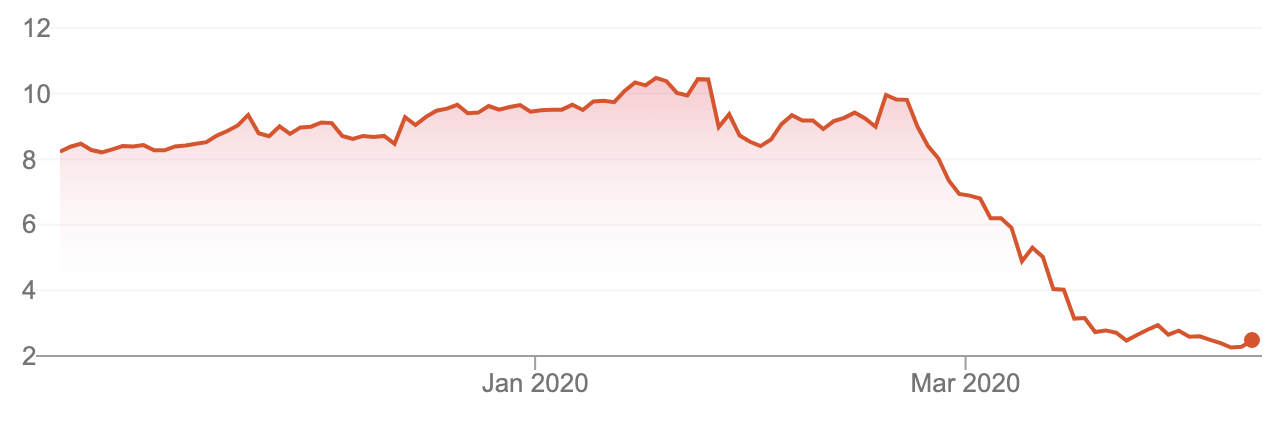

Webjet Limited shares were last seen trading at $2.46, giving the company a market capitalisation more than $500 million. As previously explained, Webjet shares were trading 9% higher Friday, but they could still be well-priced stock for some investors.

For context, only 2 months ago Webjet shares were trading at $9, they’re now below $2. While this is a stock to watch, with all things considered I’m not sure I’d be throwing my chips on Webjet just yet given what’s still to play out with COVID-19. I’d prefer to watch these 3 stocks.

[ls_content_block id=”14947″ para=”paragraphs”]