Kate and I often field questions on The Australian Finance Podcast and one recent question in particular caught our attention. Loosely, it was about the difference between trading shares and investing:

- What’s the difference between trading and investing?

- Does trading stocks work?

- How do you buy stocks in Australia?

- Are CFDs risky?

These are very important questions.

Unfortunately, some financial commentators and spruikers will see you, the beginner, coming. They prey on fear and greed — the two most powerful behavioural triggers in finance.

These “experts” have “education” tabs on their websites that masquerade as marketing designed to bamboozle you and convince you (read up-sell) on a brokerage platform, better charting software or trading strategy.

Oh, and by the way, the strategy isn’t audited and cannot be replicated but you will need “courage” and “willpower” to “see the trade”.

This is a very controversial topic. And for what it’s worth, I won’t deny that some people who trade full-time and have many years of experience could make money. But I am yet to see an audited track record.

Why it’s time to call this BS for what it is…

The real reason we chose to talk about the merits of trading now is that Australia is, unfortunately, witnessing a massive spike in huge trading losses and I believe thousands of Australian families are facing financial ruin because beginner investors are being misled into thinking that they can make money trading shares and/or CFDs (contracts for difference).

As we reveal in the podcast, a recent sample of the top CFD trading providers in Australia found that Aussies lost over $230 million in one week of trading CFDs on the ASX! We’re talking about investors facing a complete loss of their capital, plus some (CFDs use leverage). These are not just shares going up and down — remember, you still own shares in a company if the stock price falls 20%, for example. With CFDs, the money will actually vanish before your eyes.

And when you combine disastrous outcomes for ordinary and often beginner investors who are desperate to make money in a COVID-19 lockdown, plus big marketing budgets from unscrupulous departments at cashed-up financial firms, it’s a bloody nightmare that comes true for too many Aussie families.

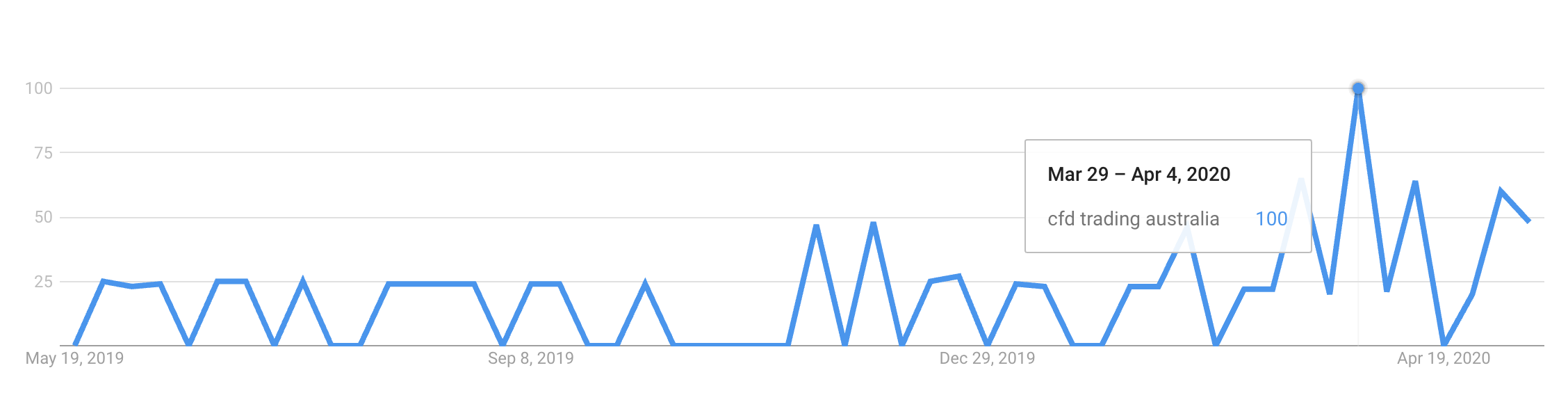

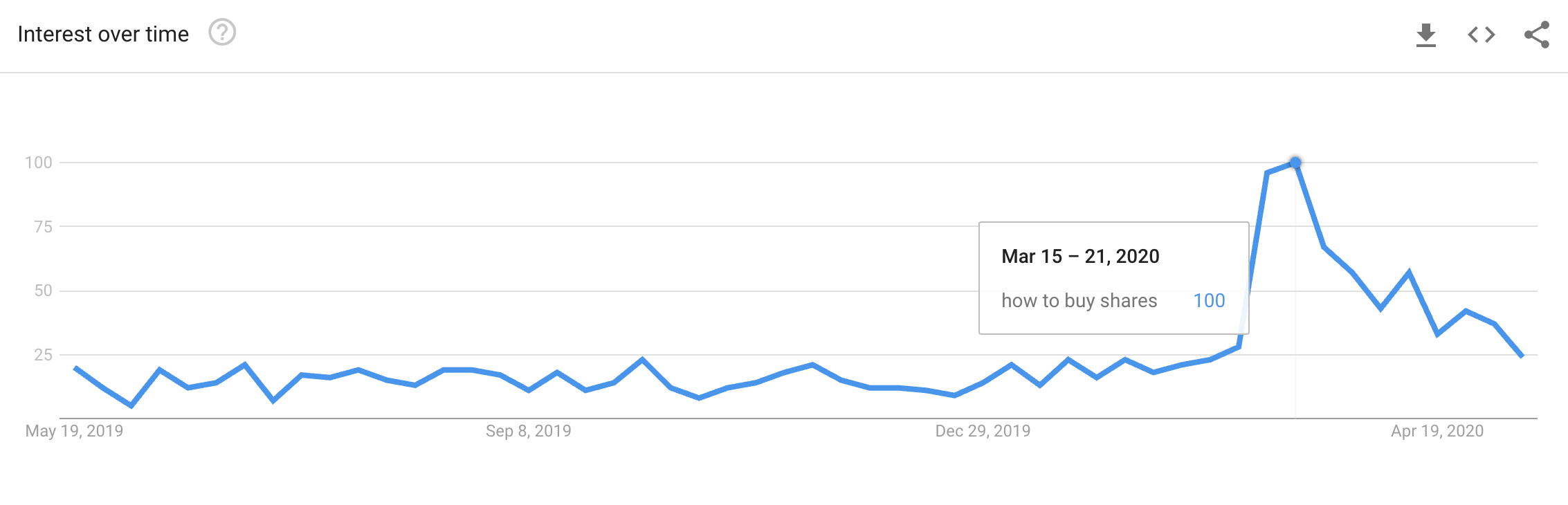

Don’t believe me? The following chart from Google Trends shows just how many beginner Australian investors were turning to the stock market during its most volatile period.

People searching: “CFD trading Australia”

People searching: “how to buy shares” in Australia

The chart above shows that Australians searched for “how to buy shares” three times as much in March versus, say, December 2019. And here’s what ASIC said:

“In the week of 16-22 March 2020, for example, retail clients’ net losses from trading CFDs were $234 million for a sample of 12 CFD providers.”

Here’s my takeaway: if you’re thinking of learning about the sharemarket please listen to our podcast BEFORE STARTING and even consider one of the 100% free courses on Rask Education. Or speak to a professional.

Listen to the Australian Finance Podcast

Show notes & resources:

- Owens Shares & ETF course – this stuff’s free guys!

- A Guide to Buying Shares in Australia

- Australian share broking accounts

- Technical Analysis Around the World – Academic paper by Massey

- ASIC proposes ban on the sale of binary options to retail clients, and restrictions on the sale of CFDs

- ASIC investigation into Mayfair 101/Mayfair Platinum

- How COVID-19 created a nation of ASX punters

- ASIC: Retail investors at risk in volatile markets

- ASIC warns consumers: Investment advertising is not always ‘true to label’

[ls_content_block id=”18457″ para=”paragraphs”]