At the weekend I was lucky enough to go live on Sky News’ Business Weekend with Ticky Fullerton to chat about Commonwealth Bank’s (ASX: CBA) third-quarter report and Westpac Banking Group’s (ASX: WBC) theoretical multi-trillion-dollar AUSTRAC fine, among other things.

As is usually the case, before I sit down to record an interview, podcast or report, I go back over the source material just to make sure I’ve got my facts straight — and don’t make a fool of myself on live telly!

Long-story-short, for at least five years I’ve been pretty bearish/negative on the prospects of bank shares. However, I think, maybe for a small position in a diversified income-focused portfolio, the stars might finally be aligning for bank investors, specifically CBA shares.

(For the record, I’d still take a dividend ETF like Vanguard’s VHY ETF, a market-cap index ETF like the BetaShares A200 ETF or even Washington H. Soul Pattinson (ASX: SOL) shares… before a bank.)

Here are three reasons to have CBA on your 2020 watchlist…

3 reasons 2020 could be a good year to scoop up CBA shares

1. Uncertainty abounds.

Reading through Rask Media or AFR investment news headlines over the weekend didn’t paint a rosy picture of the economy. There’s talk of negative interest rates in the US, falling dividends, rising provisions for an expected spike in bank bad debts, dilutive capital raisings, how bad hybrids are hitting retiree portfolios where it hurts and, of course, the increased likelihood of falling house prices.

However, there’s a price and a valuation for everything. They are two different things, as this video from our Rask Education website explains.

Most often, if you’re a long-term focused investor (e.g. you would genuinely buy shares with a five to 10-year holding period) it’s typically only during times of high market uncertainty that you will find a ‘bargain’ in the blue-chip bin.

I reckon there’s still a lot of pain left for our economy to endure and I don’t know when it will end — or exactly how it ends for bank shareholders — but by the time the market catches on to the positive news, it will reprice the shares.

For example, if CBA can offer prospective investors a 4% fully franked dividend yield over the next 12 months, with Australian interest rates near 0% and term deposits not much higher, some investors might choose to take the added risk of holding shares. Even I’m tempted for yields over 4% — and I’m not a “dividend investor”.

2. Knowing the economic downside.

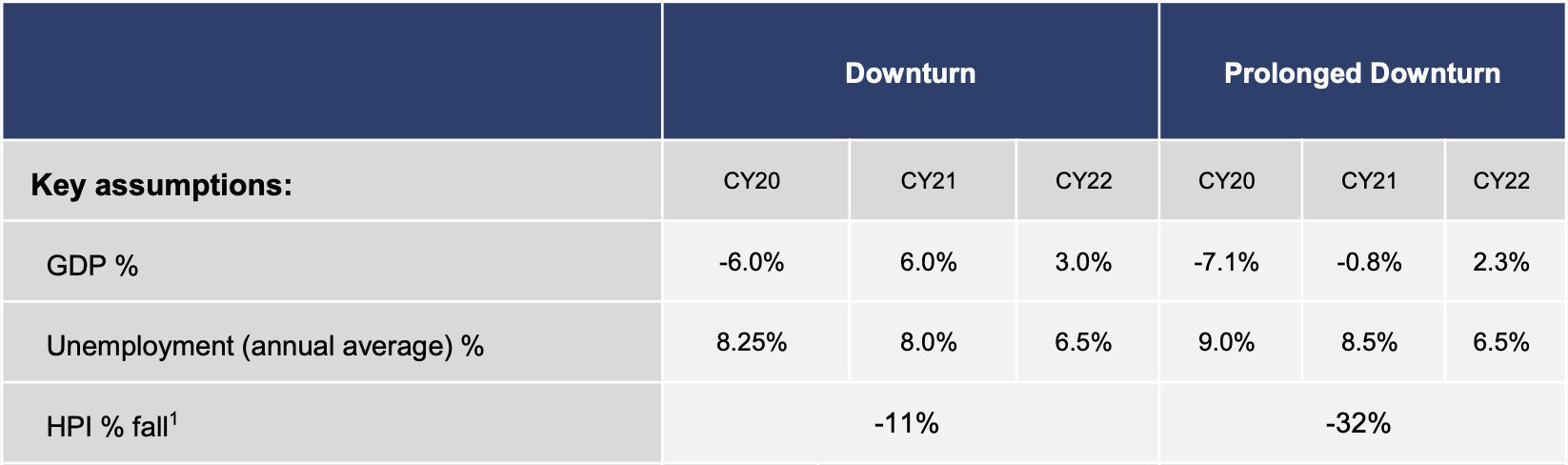

According to CBA and RBA modelling and data, respectively, CBA estimates a “prolonged recovery” from COVID-19 could see Australian house prices fall 30%. This was CBA’s worst-case modelling from its recent third-quarter report (see below). Obviously, such a fall would have quite a devastating impact on credit losses (reducing profit and dividends) and it would hit lots of Australian households and investors.

You can see the basics of CBA’s economic modelling above. It shows the HPI or House Price Index potentially falling between 11%, in the case of an economic “downturn” then prompt recovery, and 32%, in the case of a “prolonged downturn” with a slower return to growth.

In the worst-case modelling above, I believe it’s highly likely CBA would be forced to cut its dividend, at least temporarily and probably by 100%. However, in the less extreme “downturn” scenario, it may be able to get through with modest dividend cuts.

I normally wouldn’t emphasise dividends. But they are really important because in my opinion dividends are the best way to value bank shares like CBA. That said, there are a lot of variables which go between house price forecasts and dividend payments. Basically, as reliable as dividends may be, it’s impossible to predict them with any certainty.

3. A focus on quality

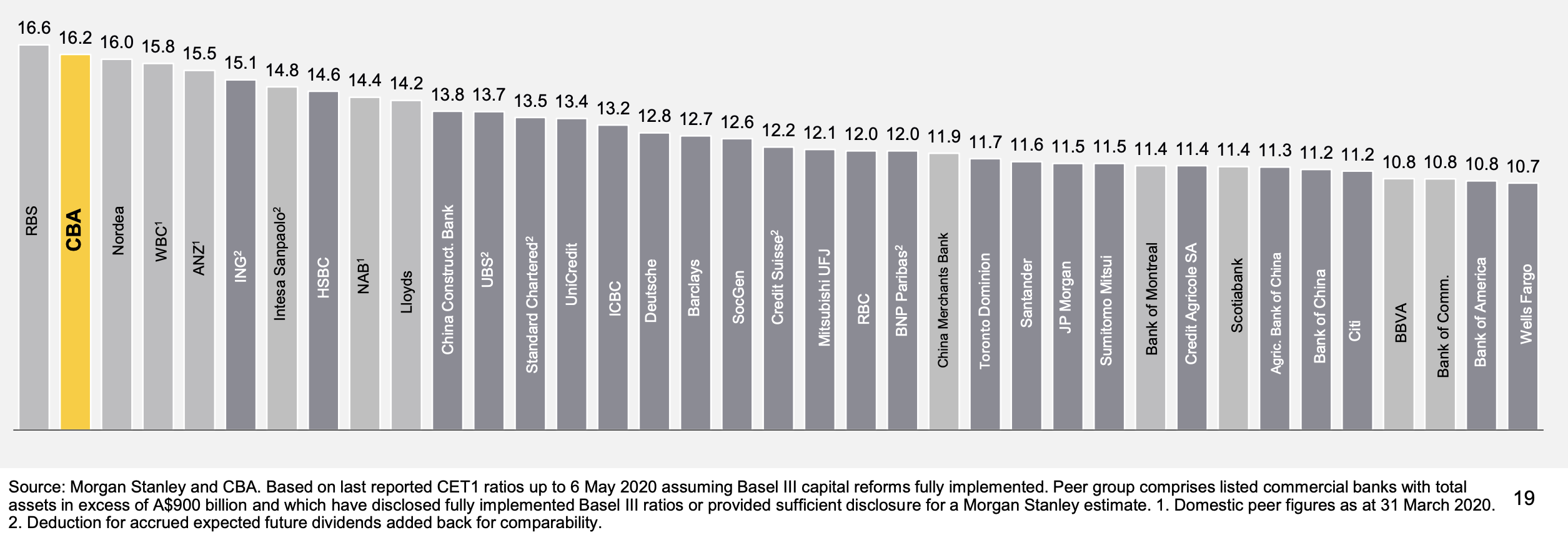

If I were ever going to buy or recommend a bank share to our Rask Invest members it would be during a proper economic downturn and I would seek to buy shares in only the highest quality, well-managed banks. As you can see in the following chart, CBA is, by international standards, amongst the highest-rated banks in terms of its protective capital buffer (known as CET1).

Of course, this does not guarantee payments of dividends, nor the safeguarding of share investors’ capital. For example, NAB has also ranked highly in the CET1 chart above yet it recently cut its dividend and diluted shareholders with a massive capital raising. What the chart above does offer us, however, is an insight into the bank’s strategy and stance on capital preservation.

Other things which jumped out to me in the third-quarter report are the increase in customer term deposit funding of loans, which stood at 70% of loans as of March 2020 versus 55% during the GFC; and the longer-dated maturity of its wholesale funding, which was an average 5.3 years in March 2020 versus just 3.5 years during the GFC.

Wholesale funding is money that comes from overseas markets and is used to fund bank loans to customers. Typically, term deposit funding is considered a better source of loan funding because it’s often more ‘sticky’ and therefore a more reliable form of funding for the bank during a crisis. For example, a reputable bank is often seen as the most secure place to put your money during an economic downturn.

Summary

The market is in a state of flux and if you asked me for my best guess right now, I’d say bank shares will likely continue to take a beating over coming months. Keep in mind, short-term predictions are just guesswork. Having said that, with over 12,000 shares on the ASX and global markets combined, we’re not rushing out to buy shares of CBA, Westpac, NAB, ANZ or any of the regional banks.

However, what I will say is, if CBA can pay a decent dividend in the next 12 months and the economy gradually returns to normal, dividend investors who are not currently exposed to bank shares or investment property might end up kicking themselves for not doing a bit more research.

Again, I’ll remind readers that we don’t own or recommend any bank shares inside Rask Invest at this time. And we probably won’t be putting a ‘buy’ rating on them anytime soon because we invest for total returns (capital growth plus dividend income) and right now, there are some shares offering far more long-term risk-adjusted upside potential than the banks, in my opinion.

Three of these growth shares can be found in the free investment report below.

[ls_content_block id=”18457″ para=”paragraphs”]

Disclosure: at the time of publishing, Owen does not have a financial interest in any of the companies mentioned.