Here’s today’s The Match Out report from Market Matters’ James Gerrish. Key point: the S&P/ASX 200 (INDEXASX: XJO) finished up +0.85% to 6838.30.

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

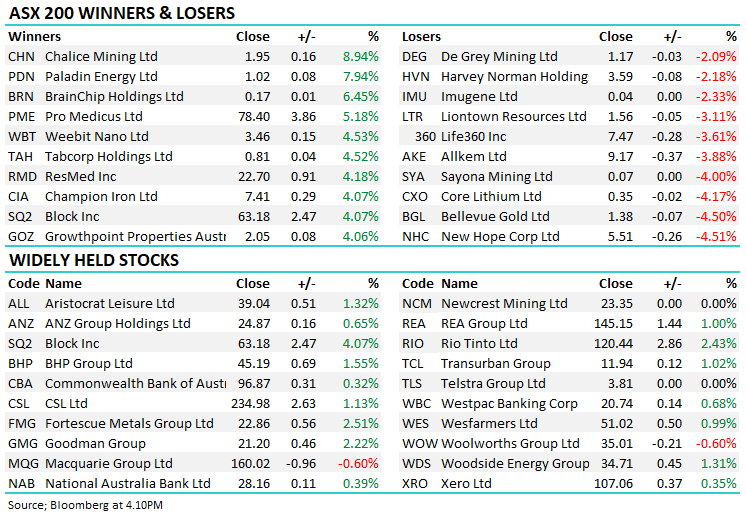

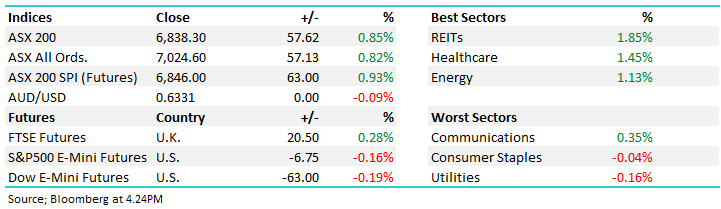

Some reprieve from recent weakness across the ASX today with stocks holding onto morning gains to finish at session highs, up 0.85%, after a weak October saw the market down 3.8%, underperforming global peers.

- The ASX 200 finished up +57pts/+0.85% at 6838.

- The Property sector was best on ground (+1.85%) while Healthcare (+1.45%) & Energy (+1.13%) outpaced the market’s gain.

- Utilities (-0.16%) and Staples (-0.04%) the weakest links and the only two sectors to finish lower.

- ABS building approvals data today showed a dip in September (-4.6%) vs. an expected gain (+1.3%). Private sector house credit to blame.

- Interest rates remain a key focus with the US Fed taking centre stage tonight, no change is expected while the local RBA steps up on Melbourne Cup day, and while there is lots of talk around another rate hike markets are only pricing a 53% chance of a move.

- BHP Group Ltd (ASX: BHP) (+1.55%) held its AGM with a focus on Potash expansion, CEO Mike Henry sees “significant growth” in potash in Canada.

- Regal Partners Ltd (ASX: RPL) +7.71% rallied after buying a 50% stake in Taurus Funds for $28m, taking Regal’s funds under management to $8bn.

- Packaging company Amcor CDI (ASX: AMC) +1.73% reaffirmed earnings guidance of 67-71c a share and free cash flow of $850-$950m for FY24, although it’s only Q1 so that was expected + they are coming off a very low base.

- Aussie Broadband Ltd (ASX: ABB) was in a trading halt as Goldmans prepare a $120m equity raising to buy Symbio Holdings Ltd (ASX: SYM) for $262m.

- Shopping Centre landlord Vicinity Centres (ASX: VCX) +1.47% talked to a cautious outlook at their AGM, given the potential further interest rate rises and lag to softening retail sales.

- Paladin Energy Ltd (ASX: PDN) +7.41% rallied after Cameco Corp (NYSE: CCJ) reported quarterly earnings that were ahead of expectations overnight and talked to a strong backdrop for ongoing strength in the global Uranium market. We remain long & bullish on both.

- While the Uranium market remains hot, the Coal sector has struggled recently, Coal Futures out of Newcastle down at $US131.10 – Whitehaven Coal Ltd (ASX: WHC) -1.62% and New Hope Corporation Ltd (ASX: NHC) -4.51% fell – both stocks we own across separate portfolios.

- Adore Beauty Group Ltd (ASX: ABY) -0.96% fell despite a Citigroup Inc (NYSE: C) upgrade to buy, are we being too cynical thinking a founder sell down is coming through the desks of Citi?

- Iron Ore was higher in Asia, sitting $US126

- Gold edged lower trading at US$1978 at our close.

- Asian stocks were up, Hong Kong +0.07%, Japan +2.16% while China inched 0.25% higher.

- US Futures are down, but only mildly

S&P/ASX 200 (INDEXASX: XJO) Index

S&P/ASX 200 (INDEXASX: XJO) Index

Regal Partners (RPL) $1.89

RPL +7.71%: shares in the Fund Manager had their best session in 18 months today following a Funds Under Management (FUM) update alongside an acquisition.

Regal is taking a 50% stake in Taurus Funds, a financing company managing $2.3b invested in junior to mid-tier mining companies. The deal adds to Regal’s alternative strategy offering in a way that doesn’t cannibalize their current stable of funds, and costing $28m upfront the deal is expected to be EPS accretive pre-synergies, in 2024.

Alongside the deal announcement, Regal revealed FUM fell ~2.5% in the September quarter to $5.76b with 2 large accounts that were inherited in the CGI Partners acquisition accounting for the bulk of the outflows.

Regal Partners (RPL)

Broker Moves

- Adore Beauty Rated New Buy at Citi; PT A$1.25

- Cedar Woods Properties Limited (ASX: CWP) Raised to Buy at Bell Potter; PT A$5.30

- Dicker Data Ltd (ASX: DDR) Cut to Neutral at Barrenjoey; PT A$10.60

- Inghams Group Ltd (ASX: ING) Cut to Hold at Bell Potter; PT A$3.95

- Kogan.com Ltd (ASX: KGN) Rated New Sell at Citi; PT A$4

- Mader Group Ltd (ASX: MAD) Raised to Overweight at Barrenjoey; PT A$7

- Nanosonics Ltd. (ASX: NAN) Raised to Neutral at JPMorgan Chase & Co (NYSE: JPM); PT A$3.65

- Nickel Industries Ltd (ASX: NIC) Raised to Buy at Citi; PT 95 Australian cents

- St Barbara Ltd (ASX: SBM) Cut to Neutral at Macquarie Group Ltd (ASX: MQG); PT 20 Australian cents

- Temple & Webster Group Ltd (ASX: TPW) Rated New Buy at Citi; PT A$6.5075

Major Movers Today