Knowing my luck the Challenger Ltd (ASX: CGF) share price will bounce or rally higher from here. Murphy’s Law tells me that if I say something negative, when CGF shares come out of their trading halt they could jump and ‘prove’ me wrong.

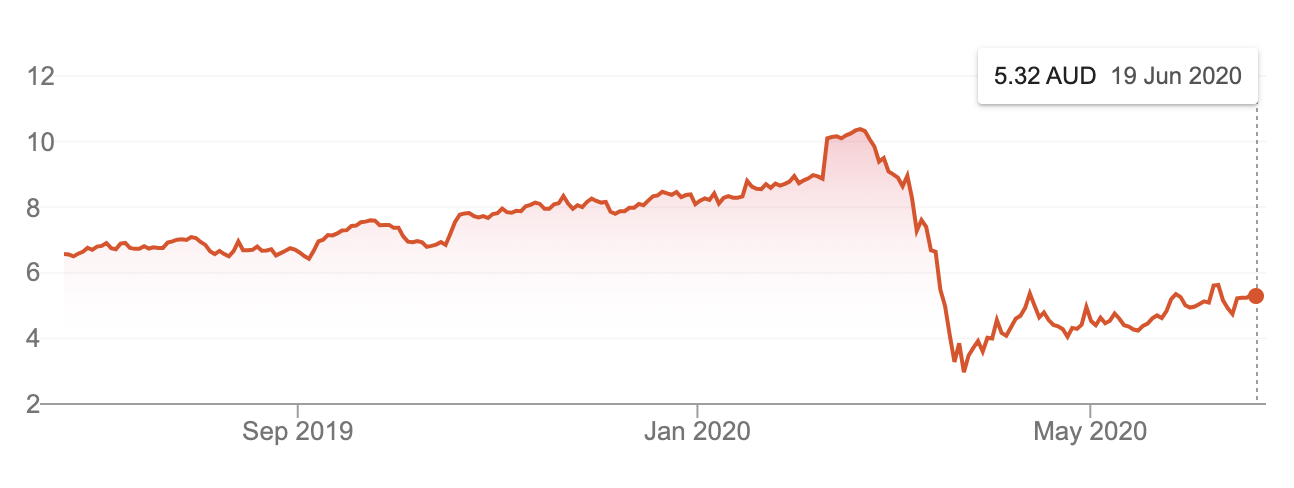

Challenger share price – 12 months

The chart above shows Challenger’s share price over 12 months. Clearly, the market volatility in March spooked investors.

Capital raising

This morning, Challenger released an announcement informing investors about its upcoming capital raising. The brilliant Jaz Harrison covered the details of the raising in this article on Rask Media: Challenger (ASX:CGF) is doing a capital raising, should you take part?

In short, the raising is being done at $4.89 with the vast majority (90%) of new shares being sold to institutions only (sorry small shareholders!).

While the discount seems good, here are three reasons I’d think twice before putting more money into Challenger shares:

- While the business model sounds good in theory, it’s a model most day-to-day investors don’t understand enough about to appreciate the risk. Owning an annuity is different from owning shares in an annuity provider. For example, the board of Challenger does not currently intend to pay a final dividend.

- The company is issuing capital at one of the worst possible times. Three years ago Challenger shares were trading over $14. At these prices, Challenger is getting less bang for its buck.

- I reckon there better alternatives for dividend income. If an investor is buying Challenger shares for the fully franked dividends, I think a low-cost and diversified Australian shares ETF would be my preferred option. A low-cost Australian shares ETF diversifies the dividend stream away from one share.

Food for thought.

[ls_content_block id=”14947″ para=”paragraphs”]