The Vanguard U.S. Total Market Shares Index ETF (ASX: VTS) and the iShares S&P 500 ETF (ASX: IVV) are the two largest, and most popular, US equities ETFs. Which is better?

Unpacking the VTS and IVV ETFs

Most of the time when investors or journalists are talking about the US share market, they’re referring to the S&P 500 Index. This is an index which includes the 500 largest listed US companies, weighted by market capitalisation – much like our very own S&P/ASX 200 (INDEXASX: XJO).

While the total US market has far more than 500 listed companies, the S&P 500 is a fairly accurate representation of the total market because the total value of these 500 companies typically accounts for 75-80% of the total market value.

IVV includes just over 500 companies, while VTS holds more than 3,500. However, the top 10 companies of each ETF are virtually the same and include all the tech giants like Microsoft Corporation

(NASDAQ: MSFT), Apple Inc. (NASDAQ: AAPL) and Amazon.com Inc. (NASDAQ: AMZN).

In IVV, the more concentrated of the two ETFs, these top 10 companies account for around 27% of the total ETF value, compared to about 23% for VTS.

Compare the pair

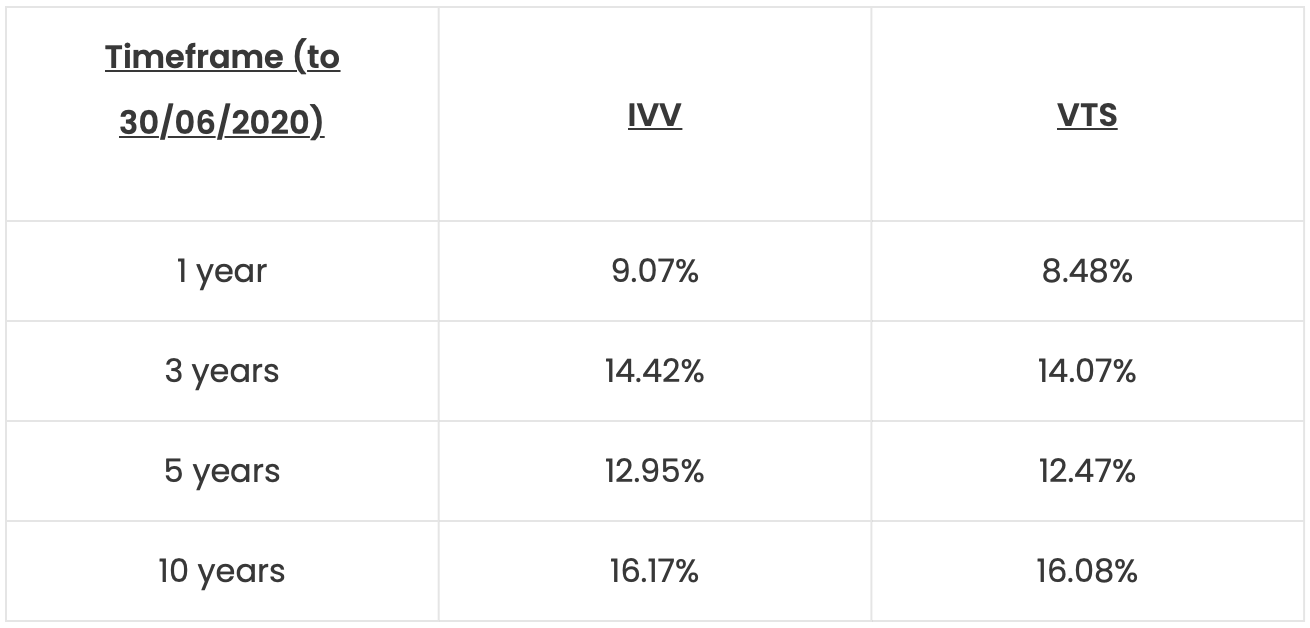

So, what does this mean long-term? It means very similar performance.

Over a 10-year time horizon, IVV starts to pull ahead thanks to its slightly heavier weighting towards the tech giants, which have all experienced phenomenal growth over this time period. However, the difference is negligible.

While VTS may appear to be more diversified, the heavy weighting towards the top 500 companies means the portfolios are largely similar.

My take

I currently own shares in IVV but I would just as happily own VTS shares. They both have extremely low management fees (0.04% and 0.03% respectively), long track records and comparable performance. Therefore, I think either ETF is a good choice for the core of a long-term ETF portfolio.

This story first appeared on Best ETFs Australia.